2012 Annual Report - Italcementi Group

2012 Annual Report - Italcementi Group

2012 Annual Report - Italcementi Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>2012</strong> <strong>Annual</strong> <strong>Report</strong><br />

Presentation 4<br />

General information 14<br />

<strong>Annual</strong> <strong>Report</strong> Consolidated <strong>Annual</strong> <strong>Report</strong> Directors’ report 146<br />

Sustainability disclosure <strong>Italcementi</strong> S.p.A. <strong>Annual</strong> <strong>Report</strong> Separate financial statements 241<br />

Extraordinary session 351<br />

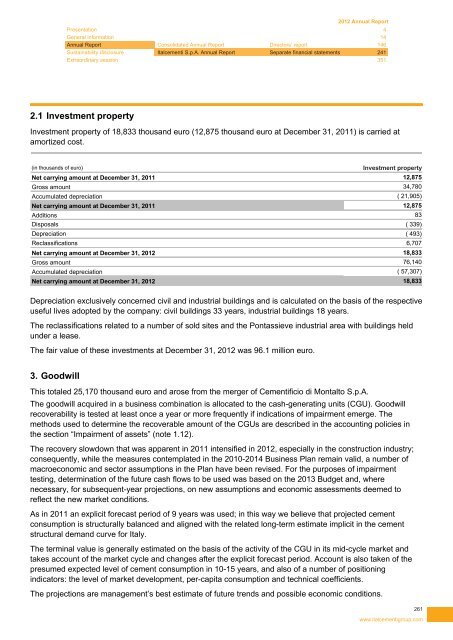

2.1 Investment property<br />

Investment property of 18,833 thousand euro (12,875 thousand euro at December 31, 2011) is carried at<br />

amortized cost.<br />

(in thousands of euro)<br />

Investment property<br />

Net carrying amount at December 31, 2011 12,875<br />

Gross amount 34,780<br />

Accumulated depreciation ( 21,905)<br />

Net carrying amount at December 31, 2011 12,875<br />

Additions 83<br />

Disposals ( 339)<br />

Depreciation ( 493)<br />

Reclassifications 6,707<br />

Net carrying amount at December 31, <strong>2012</strong> 18,833<br />

Gross amount 76,140<br />

Accumulated depreciation ( 57,307)<br />

Net carrying amount at December 31, <strong>2012</strong> 18,833<br />

Depreciation exclusively concerned civil and industrial buildings and is calculated on the basis of the respective<br />

useful lives adopted by the company: civil buildings 33 years, industrial buildings 18 years.<br />

The reclassifications related to a number of sold sites and the Pontassieve industrial area with buildings held<br />

under a lease.<br />

The fair value of these investments at December 31, <strong>2012</strong> was 96.1 million euro.<br />

3. Goodwill<br />

This totaled 25,170 thousand euro and arose from the merger of Cementificio di Montalto S.p.A.<br />

The goodwill acquired in a business combination is allocated to the cash-generating units (CGU). Goodwill<br />

recoverability is tested at least once a year or more frequently if indications of impairment emerge. The<br />

methods used to determine the recoverable amount of the CGUs are described in the accounting policies in<br />

the section “Impairment of assets” (note 1.12).<br />

The recovery slowdown that was apparent in 2011 intensified in <strong>2012</strong>, especially in the construction industry;<br />

consequently, while the measures contemplated in the 2010-2014 Business Plan remain valid, a number of<br />

macroeconomic and sector assumptions in the Plan have been revised. For the purposes of impairment<br />

testing, determination of the future cash flows to be used was based on the 2013 Budget and, where<br />

necessary, for subsequent-year projections, on new assumptions and economic assessments deemed to<br />

reflect the new market conditions.<br />

As in 2011 an explicit forecast period of 9 years was used; in this way we believe that projected cement<br />

consumption is structurally balanced and aligned with the related long-term estimate implicit in the cement<br />

structural demand curve for Italy.<br />

The terminal value is generally estimated on the basis of the activity of the CGU in its mid-cycle market and<br />

takes account of the market cycle and changes after the explicit forecast period. Account is also taken of the<br />

presumed expected level of cement consumption in 10-15 years, and also of a number of positioning<br />

indicators: the level of market development, per-capita consumption and technical coefficients.<br />

The projections are management’s best estimate of future trends and possible economic conditions.<br />

261<br />

www.italcementigroup.com