2012 Annual Report - Italcementi Group

2012 Annual Report - Italcementi Group

2012 Annual Report - Italcementi Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>2012</strong> <strong>Annual</strong> <strong>Report</strong><br />

Presentation 4<br />

General information 14<br />

<strong>Annual</strong> <strong>Report</strong> Consolidated <strong>Annual</strong> <strong>Report</strong> Directors’ report 146<br />

Sustainability disclosure <strong>Italcementi</strong> S.p.A. <strong>Annual</strong> <strong>Report</strong> Separate financial statements 241<br />

Extraordinary session 351<br />

conference provided an analysis and a discussion on the European economic crisis and<br />

the resulting possible impact on the development of EC institutions.<br />

The above initiatives and a variety of other recurring projects, such as support for the<br />

“Bergamo Scienza” exhibitions and for the activities of the Bergamo foundation in history,<br />

involved an overall financial commitment of 563,000 euro in <strong>2012</strong> (852,000 euro in<br />

2011).<br />

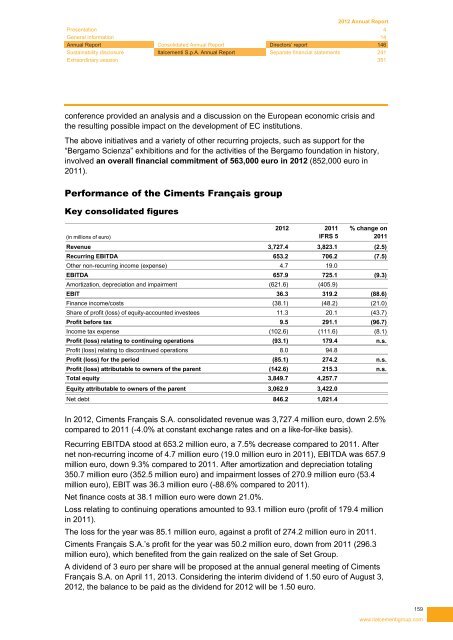

Performance of the Ciments Français group<br />

Key consolidated figures<br />

<strong>2012</strong> 2011 % change on<br />

(in millions of euro)<br />

IFRS 5<br />

2011<br />

Revenue 3,727.4 3,823.1 (2.5)<br />

Recurring EBITDA 653.2 706.2 (7.5)<br />

Other non-recurring income (expense) 4.7 19.0<br />

EBITDA 657.9 725.1 (9.3)<br />

Amortization, depreciation and impairment (621.6) (405.9)<br />

EBIT 36.3 319.2 (88.6)<br />

Finance income/costs (38.1) (48.2) (21.0)<br />

Share of profit (loss) of equity-accounted investees 11.3 20.1 (43.7)<br />

Profit before tax 9.5 291.1 (96.7)<br />

Income tax expense (102.6) (111.6) (8.1)<br />

Profit (loss) relating to continuing operations (93.1) 179.4 n.s.<br />

Profit (loss) relating to discontinued operations 8.0 94.8<br />

Profit (loss) for the period (85.1) 274.2 n.s.<br />

Profit (loss) attributable to owners of the parent (142.6) 215.3 n.s.<br />

Total equity 3,849.7 4,257.7<br />

Equity attributable to owners of the parent 3,062.9 3,422.0<br />

Net debt 846.2 1,021.4<br />

In <strong>2012</strong>, Ciments Français S.A. consolidated revenue was 3,727.4 million euro, down 2.5%<br />

compared to 2011 (-4.0% at constant exchange rates and on a like-for-like basis).<br />

Recurring EBITDA stood at 653.2 million euro, a 7.5% decrease compared to 2011. After<br />

net non-recurring income of 4.7 million euro (19.0 million euro in 2011), EBITDA was 657.9<br />

million euro, down 9.3% compared to 2011. After amortization and depreciation totaling<br />

350.7 million euro (352.5 million euro) and impairment losses of 270.9 million euro (53.4<br />

million euro), EBIT was 36.3 million euro (-88.6% compared to 2011).<br />

Net finance costs at 38.1 million euro were down 21.0%.<br />

Loss relating to continuing operations amounted to 93.1 million euro (profit of 179.4 million<br />

in 2011).<br />

The loss for the year was 85.1 million euro, against a profit of 274.2 million euro in 2011.<br />

Ciments Français S.A.’s profit for the year was 50.2 million euro, down from 2011 (296.3<br />

million euro), which benefited from the gain realized on the sale of Set <strong>Group</strong>.<br />

A dividend of 3 euro per share will be proposed at the annual general meeting of Ciments<br />

Français S.A. on April 11, 2013. Considering the interim dividend of 1.50 euro of August 3,<br />

<strong>2012</strong>, the balance to be paid as the dividend for <strong>2012</strong> will be 1.50 euro.<br />

159<br />

www.italcementigroup.com