- Page 1:

2012 Annual Report

- Page 4 and 5:

Contents PRESENTATION Letter to the

- Page 6 and 7:

Letter to the stakeholders Consolid

- Page 8 and 9:

Italcementi Group in the world (as

- Page 10 and 11:

Highlights Contribution to consolid

- Page 12 and 13:

Share prices and market capitalizat

- Page 14 and 15:

E) Share prices and market capitali

- Page 16 and 17:

Italcementi S.p.A. Directors, Offic

- Page 18 and 19:

Lorenzo Renato Guerini (Director si

- Page 20 and 21:

Alberto Clô (Director since May 4,

- Page 22 and 23:

Yves René Nanot (Director since Ju

- Page 24 and 25:

Board of Statutory Auditors Maria M

- Page 26 and 27:

Notice of Call Those who are entitl

- Page 28 and 29:

Appointment of the Board of Directo

- Page 31 and 32:

Annual Report Consolidated Annual R

- Page 33 and 34:

2012 Annual Report Presentation 4 G

- Page 35 and 36:

2012 Annual Report Presentation 4 G

- Page 37 and 38:

2012 Annual Report Presentation 4 G

- Page 39 and 40:

2012 Annual Report Presentation 4 G

- Page 41 and 42:

2012 Annual Report Presentation 4 G

- Page 43 and 44:

2012 Annual Report Presentation 4 G

- Page 45 and 46:

2012 Annual Report Presentation 4 G

- Page 47 and 48:

2012 Annual Report Presentation 4 G

- Page 49 and 50:

2012 Annual Report Presentation 4 G

- Page 51 and 52:

2012 Annual Report Presentation 4 G

- Page 53 and 54:

2012 Annual Report Presentation 4 G

- Page 55 and 56:

2012 Annual Report Presentation 4 G

- Page 57 and 58:

2012 Annual Report Presentation 4 G

- Page 59 and 60:

2012 Annual Report Presentation 4 G

- Page 61 and 62:

2012 Annual Report Presentation 4 G

- Page 63:

2012 Annual Report Presentation 4 G

- Page 66 and 67:

Financial statements Statement of f

- Page 68 and 69:

Statement of comprehensive income N

- Page 70 and 71:

Statement of cash flows Notes 2012

- Page 72 and 73:

21. Deferred tax assets and Deferre

- Page 74 and 75:

Amendments to IAS 12 “Income taxe

- Page 76 and 77:

1.3. Basis of consolidation The con

- Page 78 and 79:

Changes in equity interests in subs

- Page 80 and 81:

Operating lease payments are recogn

- Page 82 and 83:

1.15. Cash and cash equivalents Cas

- Page 84 and 85:

1.18. Share-based payments The Grou

- Page 86 and 87:

1.24. Government grants Government

- Page 88 and 89:

4. Operating segment disclosure The

- Page 90 and 91:

The table below sets out segment re

- Page 92 and 93:

The table below sets out other segm

- Page 94 and 95:

The useful life adopted by the Grou

- Page 96 and 97:

Assumptions used for the computatio

- Page 98 and 99: 7. Intangible assets in thousands o

- Page 100 and 101: 10. Other non-current assets This c

- Page 102 and 103: 15. Reserves Translation reserve Th

- Page 104 and 105: Net liabilities determined on the b

- Page 106 and 107: The table below sets out key data f

- Page 108 and 109: appeal and by the regional court of

- Page 110 and 111: 22.1 Financial liabilities Financia

- Page 112 and 113: Bond loans f) The Italcementi Group

- Page 114 and 115: The bond was assigned a Ba2 Moody

- Page 116 and 117: At December 31, 2012 lines of credi

- Page 118 and 119: 22.3.1 Fair value of derivatives Th

- Page 120 and 121: 22.4 Interest-rate risk management

- Page 122 and 123: The Group companies operate chiefly

- Page 124 and 125: From 2008 to 2012, the Group transa

- Page 126 and 127: 26. Services Services amounted to 1

- Page 128 and 129: 29. Non-recurring income (expense)

- Page 130 and 131: The income statement and the statem

- Page 132 and 133: Diluted earnings per share Diluted

- Page 134 and 135: 36. Joint ventures The Group’s mo

- Page 136 and 137: Net debt (in thousands of euro) amo

- Page 138 and 139: Annex 1 The following table shows i

- Page 140 and 141: Company Registered office Share cap

- Page 142 and 143: Company Registered office Share cap

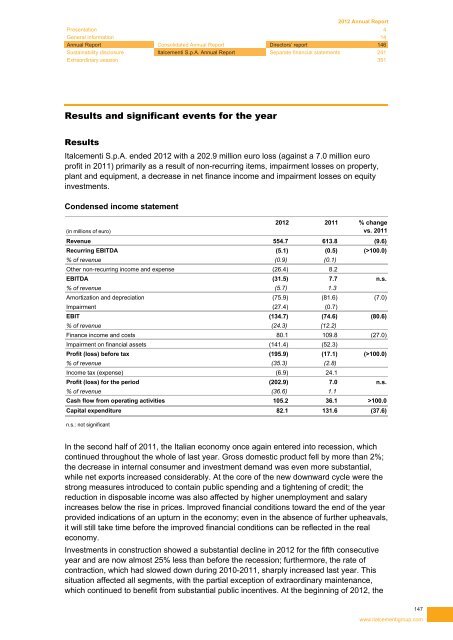

- Page 147: Italcementi S.p.A. Annual Report 14

- Page 151 and 152: 2012 Annual Report Presentation 4 G

- Page 153 and 154: 2012 Annual Report Presentation 4 G

- Page 155 and 156: 2012 Annual Report Presentation 4 G

- Page 157 and 158: 2012 Annual Report Presentation 4 G

- Page 159 and 160: 2012 Annual Report Presentation 4 G

- Page 161 and 162: 2012 Annual Report Presentation 4 G

- Page 163 and 164: 2012 Annual Report Presentation 4 G

- Page 165 and 166: 2012 Annual Report Presentation 4 G

- Page 167 and 168: 2012 Annual Report Presentation 4 G

- Page 169 and 170: 2012 Annual Report Presentation 4 G

- Page 171 and 172: 2012 Annual Report Presentation 4 G

- Page 173 and 174: 2012 Annual Report Presentation 4 G

- Page 175 and 176: 2012 Annual Report Presentation 4 G

- Page 177 and 178: 2012 Annual Report Presentation 4 G

- Page 179 and 180: 2012 Annual Report Presentation 4 G

- Page 181 and 182: 2012 Annual Report Presentation 4 G

- Page 183 and 184: 2012 Annual Report Presentation 4 G

- Page 185 and 186: 2012 Annual Report Presentation 4 G

- Page 187 and 188: 2012 Annual Report Presentation 4 G

- Page 189 and 190: 2012 Annual Report Presentation 4 G

- Page 191 and 192: 2012 Annual Report Presentation 4 G

- Page 193 and 194: 2012 Annual Report Presentation 4 G

- Page 195 and 196: 2012 Annual Report Presentation 4 G

- Page 197 and 198: 2012 Annual Report Presentation 4 G

- Page 199 and 200:

2012 Annual Report Presentation 4 G

- Page 201 and 202:

2012 Annual Report Presentation 4 G

- Page 203 and 204:

2012 Annual Report Presentation 4 G

- Page 205 and 206:

2012 Annual Report Presentation 4 G

- Page 207 and 208:

2012 Annual Report Presentation 4 G

- Page 209 and 210:

2012 Annual Report Presentation 4 G

- Page 211 and 212:

2012 Annual Report Presentation 4 G

- Page 213 and 214:

2012 Annual Report Presentation 4 G

- Page 215 and 216:

2012 Annual Report Presentation 4 G

- Page 217 and 218:

2012 Annual Report Presentation 4 G

- Page 219 and 220:

2012 Annual Report Presentation 4 G

- Page 221 and 222:

2012 Annual Report Presentation 4 G

- Page 223 and 224:

2012 Annual Report Presentation 4 G

- Page 225 and 226:

2012 Annual Report Presentation 4 G

- Page 227 and 228:

2012 Annual Report Presentation 4 G

- Page 229 and 230:

2012 Annual Report Presentation 4 G

- Page 231 and 232:

2012 Annual Report Presentation 4 G

- Page 233 and 234:

2012 Annual Report Presentation 4 G

- Page 235 and 236:

2012 Annual Report Presentation 4 G

- Page 237 and 238:

2012 Annual Report Presentation 4 G

- Page 239 and 240:

2012 Annual Report Presentation 4 G

- Page 241 and 242:

2012 Annual Report Presentation 4 G

- Page 243 and 244:

Separated financial statements 241

- Page 245 and 246:

2012 Annual Report Presentation 4 G

- Page 247 and 248:

2012 Annual Report Presentation 4 G

- Page 249 and 250:

2012 Annual Report Presentation 4 G

- Page 251 and 252:

2012 Annual Report Presentation 4 G

- Page 253 and 254:

2012 Annual Report Presentation 4 G

- Page 255 and 256:

2012 Annual Report Presentation 4 G

- Page 257 and 258:

2012 Annual Report Presentation 4 G

- Page 259 and 260:

2012 Annual Report Presentation 4 G

- Page 261 and 262:

2012 Annual Report Presentation 4 G

- Page 263 and 264:

2012 Annual Report Presentation 4 G

- Page 265 and 266:

2012 Annual Report Presentation 4 G

- Page 267 and 268:

2012 Annual Report Presentation 4 G

- Page 269 and 270:

2012 Annual Report Presentation 4 G

- Page 271 and 272:

2012 Annual Report Presentation 4 G

- Page 273 and 274:

2012 Annual Report Presentation 4 G

- Page 275 and 276:

2012 Annual Report Presentation 4 G

- Page 277 and 278:

2012 Annual Report Presentation 4 G

- Page 279 and 280:

2012 Annual Report Presentation 4 G

- Page 281 and 282:

2012 Annual Report Presentation 4 G

- Page 283 and 284:

2012 Annual Report Presentation 4 G

- Page 285 and 286:

2012 Annual Report Presentation 4 G

- Page 287 and 288:

2012 Annual Report Presentation 4 G

- Page 289 and 290:

2012 Annual Report Presentation 4 G

- Page 291 and 292:

2012 Annual Report Presentation 4 G

- Page 293 and 294:

2012 Annual Report Presentation 4 G

- Page 295 and 296:

2012 Annual Report Presentation 4 G

- Page 297 and 298:

2012 Annual Report Presentation 4 G

- Page 299 and 300:

2012 Annual Report Presentation 4 G

- Page 301 and 302:

2012 Annual Report Presentation 4 G

- Page 303 and 304:

2012 Annual Report Presentation 4 G

- Page 305 and 306:

Annexes 303 www.italcementigroup.co

- Page 308 and 309:

ITALCEMENTI S.P.A. REPORT OF THE BO

- Page 310 and 311:

We ascertained that the Remuneratio

- Page 314 and 315:

312

- Page 316 and 317:

Sustainability disclosure Italcemen

- Page 318 and 319:

In 2010, the Group reinforced its a

- Page 320 and 321:

2 Looking forward 2.1 Targets 2015

- Page 322 and 323:

3 Social responsibility 3.1 Valuing

- Page 324 and 325:

2012 2011 2010 2012 2011 2010 Italy

- Page 326 and 327:

Trainees (%) 2012 2011 2010 Manager

- Page 328 and 329:

3.3 Health and product responsibili

- Page 330 and 331:

The Social Initiatives Policy reinf

- Page 332 and 333:

In 2012, Energy Efficiency Certific

- Page 334 and 335:

Power consumption, concrete 2012 20

- Page 336 and 337:

4.3 Air emissions At the end of 201

- Page 338 and 339:

Water consumption, cement 2012 2011

- Page 340 and 341:

Quarry management, cement (*) Matur

- Page 342 and 343:

5.2 Quality The Group is committed

- Page 344 and 345:

5.4 Sustainable construction Italce

- Page 346 and 347:

6 Reporting and additional informat

- Page 349 and 350:

6.4 Boundaries and reporting method

- Page 351 and 352:

Training management system Hours of

- Page 353 and 354:

Extraordinary session 351 www.italc

- Page 355 and 356:

2012 Annual Report Presentation 4 G

- Page 357 and 358:

Summary of resolutions The Annual G

- Page 359 and 360:

at an extraordinary session: to ren

- Page 362:

April 2013 Project by LSVmultimedia