2012 Annual Report - Italcementi Group

2012 Annual Report - Italcementi Group

2012 Annual Report - Italcementi Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

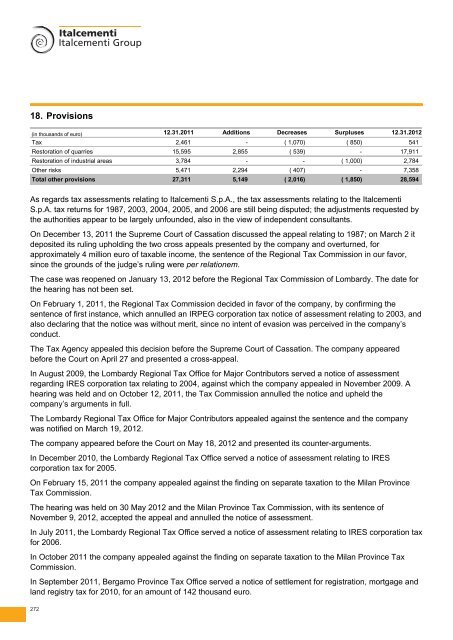

18. Provisions<br />

(in thousands of euro) 12.31.2011 Additions Decreases Surpluses 12.31.<strong>2012</strong><br />

Tax 2,461 - ( 1,070) ( 850) 541<br />

Restoration of quarries 15,595 2,855 ( 539) - 17,911<br />

Restoration of industrial areas 3,784 - - ( 1,000) 2,784<br />

Other risks 5,471 2,294 ( 407) - 7,358<br />

Total other provisions 27,311 5,149 ( 2,016) ( 1,850) 28,594<br />

As regards tax assessments relating to <strong>Italcementi</strong> S.p.A., the tax assessments relating to the <strong>Italcementi</strong><br />

S.p.A. tax returns for 1987, 2003, 2004, 2005, and 2006 are still being disputed; the adjustments requested by<br />

the authorities appear to be largely unfounded, also in the view of independent consultants.<br />

On December 13, 2011 the Supreme Court of Cassation discussed the appeal relating to 1987; on March 2 it<br />

deposited its ruling upholding the two cross appeals presented by the company and overturned, for<br />

approximately 4 million euro of taxable income, the sentence of the Regional Tax Commission in our favor,<br />

since the grounds of the judge’s ruling were per relationem.<br />

The case was reopened on January 13, <strong>2012</strong> before the Regional Tax Commission of Lombardy. The date for<br />

the hearing has not been set.<br />

On February 1, 2011, the Regional Tax Commission decided in favor of the company, by confirming the<br />

sentence of first instance, which annulled an IRPEG corporation tax notice of assessment relating to 2003, and<br />

also declaring that the notice was without merit, since no intent of evasion was perceived in the company’s<br />

conduct.<br />

The Tax Agency appealed this decision before the Supreme Court of Cassation. The company appeared<br />

before the Court on April 27 and presented a cross-appeal.<br />

In August 2009, the Lombardy Regional Tax Office for Major Contributors served a notice of assessment<br />

regarding IRES corporation tax relating to 2004, against which the company appealed in November 2009. A<br />

hearing was held and on October 12, 2011, the Tax Commission annulled the notice and upheld the<br />

company’s arguments in full.<br />

The Lombardy Regional Tax Office for Major Contributors appealed against the sentence and the company<br />

was notified on March 19, <strong>2012</strong>.<br />

The company appeared before the Court on May 18, <strong>2012</strong> and presented its counter-arguments.<br />

In December 2010, the Lombardy Regional Tax Office served a notice of assessment relating to IRES<br />

corporation tax for 2005.<br />

On February 15, 2011 the company appealed against the finding on separate taxation to the Milan Province<br />

Tax Commission.<br />

The hearing was held on 30 May <strong>2012</strong> and the Milan Province Tax Commission, with its sentence of<br />

November 9, <strong>2012</strong>, accepted the appeal and annulled the notice of assessment.<br />

In July 2011, the Lombardy Regional Tax Office served a notice of assessment relating to IRES corporation tax<br />

for 2006.<br />

In October 2011 the company appealed against the finding on separate taxation to the Milan Province Tax<br />

Commission.<br />

In September 2011, Bergamo Province Tax Office served a notice of settlement for registration, mortgage and<br />

land registry tax for 2010, for an amount of 142 thousand euro.<br />

272