2008 Annual report - Sappi

2008 Annual report - Sappi

2008 Annual report - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the group annual financial statements // continued<br />

for the year ended September <strong>2008</strong><br />

16. Trade and other receivables (continued)<br />

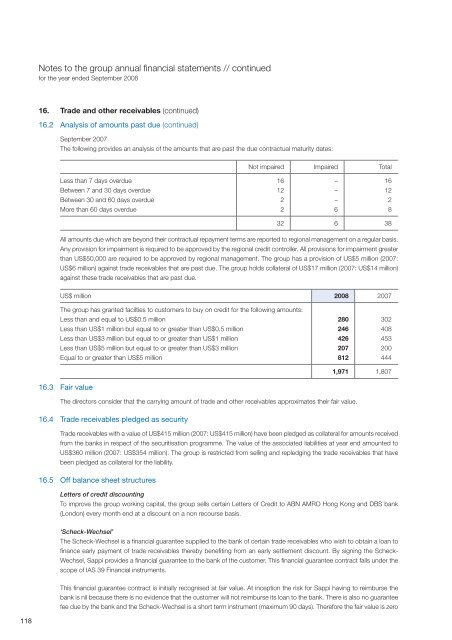

16.2 Analysis of amounts past due (continued)<br />

September 2007<br />

The following provides an analysis of the amounts that are past the due contractual maturity dates:<br />

Not impaired Impaired Total<br />

Less than 7 days overdue 16 – 16<br />

Between 7 and 30 days overdue 12 – 12<br />

Between 30 and 60 days overdue 2 – 2<br />

More than 60 days overdue 2 6 8<br />

32 6 38<br />

All amounts due which are beyond their contractual repayment terms are <strong>report</strong>ed to regional management on a regular basis.<br />

Any provision for impairment is required to be approved by the regional credit controller. All provisions for impairment greater<br />

than US$50,000 are required to be approved by regional management. The group has a provision of US$5 million (2007:<br />

US$6 million) against trade receivables that are past due. The group holds collateral of US$17 million (2007: US$14 million)<br />

against these trade receivables that are past due.<br />

US$ million <strong>2008</strong> 2007<br />

The group has granted facilties to customers to buy on credit for the following amounts:<br />

Less than and equal to US$0.5 million 280 302<br />

Less than US$1 million but equal to or greater than US$0.5 million 246 408<br />

Less than US$3 million but equal to or greater than US$1 million 426 453<br />

Less than US$5 million but equal to or greater than US$3 million 207 200<br />

Equal to or greater than US$5 million 812 444<br />

1,971 1,807<br />

16.3 Fair value<br />

The directors consider that the carrying amount of trade and other receivables approximates their fair value.<br />

16.4 Trade receivables pledged as security<br />

Trade receivables with a value of US$415 million (2007: US$415 million) have been pledged as collateral for amounts received<br />

from the banks in respect of the securitisation programme. The value of the associated liabilities at year end amounted to<br />

US$360 million (2007: US$354 million). The group is restricted from selling and repledging the trade receivables that have<br />

been pledged as collateral for the liability.<br />

16.5 Off balance sheet structures<br />

Letters of credit discounting<br />

To improve the group working capital, the group sells certain Letters of Credit to ABN AMRO Hong Kong and DBS bank<br />

(London) every month end at a discount on a non recourse basis.<br />

‘Scheck-Wechsel’<br />

The Scheck-Wechsel is a financial guarantee supplied to the bank of certain trade receivables who wish to obtain a loan to<br />

finance early payment of trade receivables thereby benefiting from an early settlement discount. By signing the Scheck-<br />

Wechsel, <strong>Sappi</strong> provides a financial guarantee to the bank of the customer. This financial guarantee contract falls under the<br />

scope of IAS 39 Financial instruments.<br />

This financial guarantee contract is initially recognised at fair value. At inception the risk for <strong>Sappi</strong> having to reimburse the<br />

bank is nil because there is no evidence that the customer will not reimburse its loan to the bank. There is also no guarantee<br />

fee due by the bank and the Scheck-Wechsel is a short term instrument (maximum 90 days). Therefore the fair value is zero<br />

118