2008 Annual report - Sappi

2008 Annual report - Sappi

2008 Annual report - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the group annual financial statements // continued<br />

for the year ended September <strong>2008</strong><br />

US$ million <strong>2008</strong> 2007<br />

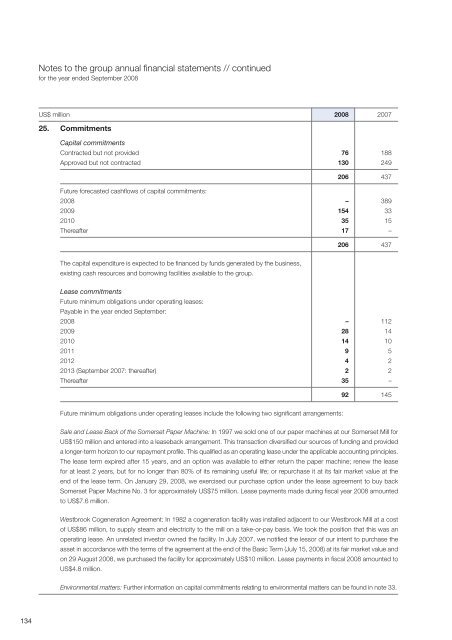

25. Commitments<br />

Capital commitments<br />

Contracted but not provided 76 188<br />

Approved but not contracted 130 249<br />

206 437<br />

Future forecasted cashflows of capital commitments:<br />

<strong>2008</strong> – 389<br />

2009 154 33<br />

2010 35 15<br />

Thereafter 17 –<br />

206 437<br />

The capital expenditure is expected to be financed by funds generated by the business,<br />

existing cash resources and borrowing facilities available to the group.<br />

Lease commitments<br />

Future minimum obligations under operating leases:<br />

Payable in the year ended September:<br />

<strong>2008</strong> – 112<br />

2009 28 14<br />

2010 14 10<br />

2011 9 5<br />

2012 4 2<br />

2013 (September 2007: thereafter) 2 2<br />

Thereafter 35 –<br />

92 145<br />

Future minimum obligations under operating leases include the following two significant arrangements:<br />

Sale and Lease Back of the Somerset Paper Machine: In 1997 we sold one of our paper machines at our Somerset Mill for<br />

US$150 million and entered into a leaseback arrangement. This transaction diversified our sources of funding and provided<br />

a longer-term horizon to our repayment profile. This qualified as an operating lease under the applicable accounting principles.<br />

The lease term expired after 15 years, and an option was available to either return the paper machine; renew the lease<br />

for at least 2 years, but for no longer than 80% of its remaining useful life; or repurchase it at its fair market value at the<br />

end of the lease term. On January 29, <strong>2008</strong>, we exercised our purchase option under the lease agreement to buy back<br />

Somerset Paper Machine No. 3 for approximately US$75 million. Lease payments made during fiscal year <strong>2008</strong> amounted<br />

to US$7.6 million.<br />

Westbrook Cogeneration Agreement: In 1982 a cogeneration facility was installed adjacent to our Westbrook Mill at a cost<br />

of US$86 million, to supply steam and electricity to the mill on a take-or-pay basis. We took the position that this was an<br />

operating lease. An unrelated investor owned the facility. In July 2007, we notified the lessor of our intent to purchase the<br />

asset in accordance with the terms of the agreement at the end of the Basic Term (July 15, <strong>2008</strong>) at its fair market value and<br />

on 29 August <strong>2008</strong>, we purchased the facility for approximately US$10 million. Lease payments in fiscal <strong>2008</strong> amounted to<br />

US$4.8 million.<br />

Environmental matters: Further information on capital commitments relating to environmental matters can be found in note 33.<br />

134