2008 Annual report - Sappi

2008 Annual report - Sappi

2008 Annual report - Sappi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

sappi<br />

The movement in net debt over the past three years is<br />

explained below.<br />

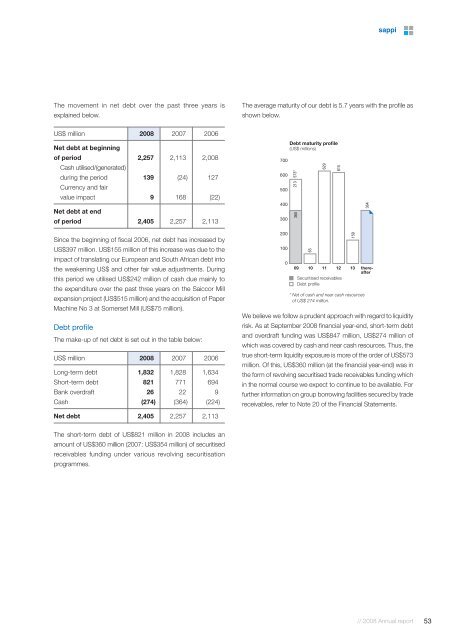

The average maturity of our debt is 5.7 years with the profile as<br />

shown below.<br />

US$ million <strong>2008</strong> 2007 2006<br />

Net debt at beginning<br />

of period 2,257 2,113 2,008<br />

Cash utilised/(generated)<br />

during the period 139 (24) 127<br />

Currency and fair<br />

value impact 9 168 (22)<br />

Net debt at end<br />

of period 2,405 2,257 2,113<br />

Since the beginning of fiscal 2006, net debt has increased by<br />

US$397 million. US$155 million of this increase was due to the<br />

impact of translating our European and South African debt into<br />

the weakening US$ and other fair value adjustments. During<br />

this period we utilised US$242 million of cash due mainly to<br />

the expenditure over the past three years on the Saiccor Mill<br />

expansion project (US$515 million) and the acquisition of Paper<br />

Machine No 3 at Somerset Mill (US$75 million).<br />

Debt profile<br />

The make-up of net debt is set out in the table below:<br />

US$ million <strong>2008</strong> 2007 2006<br />

Long-term debt 1,832 1,828 1,634<br />

Short-term debt 821 771 694<br />

Bank overdraft 26 22 9<br />

Cash (274) (364) (224)<br />

Net debt 2,405 2,257 2,113<br />

We believe we follow a prudent approach with regard to liquidity<br />

risk. As at September <strong>2008</strong> financial year-end, short-term debt<br />

and overdraft funding was US$847 million, US$274 million of<br />

which was covered by cash and near cash resources. Thus, the<br />

true short-term liquidity exposure is more of the order of US$573<br />

million. Of this, US$360 million (at the financial year-end) was in<br />

the form of revolving securitised trade receivables funding which<br />

in the normal course we expect to continue to be available. For<br />

further information on group borrowing facilities secured by trade<br />

receivables, refer to Note 20 of the Financial Statements.<br />

The short-term debt of US$821 million in <strong>2008</strong> includes an<br />

amount of US$360 million (2007: US$354 million) of securitised<br />

receivables funding under various revolving securitisation<br />

programmes.<br />

// <strong>2008</strong> <strong>Annual</strong> <strong>report</strong><br />

53