2008 Annual report - Sappi

2008 Annual report - Sappi

2008 Annual report - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

sappi<br />

We have derived these target ratios to meet the group’s weighted average cost of capital after adjusting book assets for inflation.<br />

These key target ratios are closely monitored and benchmarked against peer groups.<br />

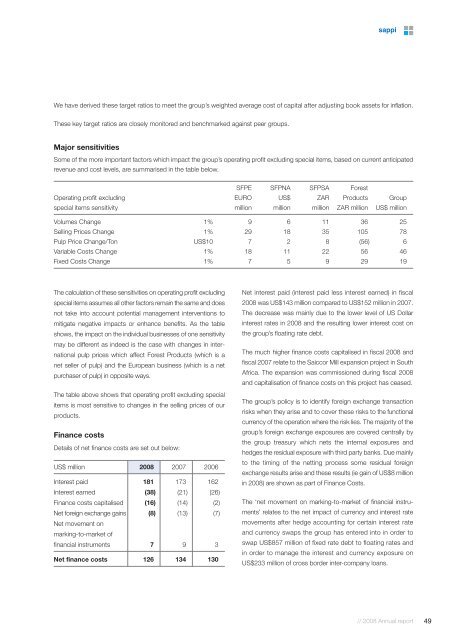

Major sensitivities<br />

Some of the more important factors which impact the group’s operating profit excluding special items, based on current anticipated<br />

revenue and cost levels, are summarised in the table below.<br />

SFPE SFPNA SFPSA Forest<br />

Operating profit excluding EURO US$ ZAR Products Group<br />

special items sensitivity million million million ZAR million US$ million<br />

Volumes Change 1% 9 6 11 36 25<br />

Selling Prices Change 1% 29 18 35 105 78<br />

Pulp Price Change/Ton US$10 7 2 8 (56) 6<br />

Variable Costs Change 1% 18 11 22 56 46<br />

Fixed Costs Change 1% 7 5 9 29 19<br />

The calculation of these sensitivities on operating profit excluding<br />

special items assumes all other factors remain the same and does<br />

not take into account potential management interventions to<br />

mitigate negative impacts or enhance benefits. As the table<br />

shows, the impact on the individual businesses of one sensitivity<br />

may be different as indeed is the case with changes in inter -<br />

national pulp prices which affect Forest Products (which is a<br />

net seller of pulp) and the European business (which is a net<br />

purchaser of pulp) in opposite ways.<br />

The table above shows that operating profit excluding special<br />

items is most sensitive to changes in the selling prices of our<br />

products.<br />

Finance costs<br />

Details of net finance costs are set out below:<br />

US$ million <strong>2008</strong> 2007 2006<br />

Interest paid 181 173 162<br />

Interest earned (38) (21) (26)<br />

Finance costs capitalised (16) (14) (2)<br />

Net foreign exchange gains (8) (13) (7)<br />

Net movement on<br />

marking-to-market of<br />

financial instruments 7 9 3<br />

Net finance costs 126 134 130<br />

Net interest paid (interest paid less interest earned) in fiscal<br />

<strong>2008</strong> was US$143 million compared to US$152 million in 2007.<br />

The decrease was mainly due to the lower level of US Dollar<br />

interest rates in <strong>2008</strong> and the resulting lower interest cost on<br />

the group’s floating rate debt.<br />

The much higher finance costs capitalised in fiscal <strong>2008</strong> and<br />

fiscal 2007 relate to the Saiccor Mill expansion project in South<br />

Africa. The expansion was commissioned during fiscal <strong>2008</strong><br />

and capitalisation of finance costs on this project has ceased.<br />

The group’s policy is to identify foreign exchange transaction<br />

risks when they arise and to cover these risks to the functional<br />

currency of the operation where the risk lies. The majority of the<br />

group’s foreign exchange exposures are covered centrally by<br />

the group treasury which nets the internal exposures and<br />

hedges the residual exposure with third party banks. Due mainly<br />

to the timing of the netting process some residual foreign<br />

exchange results arise and these results (ie gain of US$8 million<br />

in <strong>2008</strong>) are shown as part of Finance Costs.<br />

The ‘net movement on marking-to-market of financial instru -<br />

ments’ relates to the net impact of currency and interest rate<br />

movements after hedge accounting for certain interest rate<br />

and currency swaps the group has entered into in order to<br />

swap US$857 million of fixed rate debt to floating rates and<br />

in order to manage the interest and currency exposure on<br />

US$233 million of cross border inter-company loans.<br />

// <strong>2008</strong> <strong>Annual</strong> <strong>report</strong><br />

49