2008 Annual report - Sappi

2008 Annual report - Sappi

2008 Annual report - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the group annual financial statements // continued<br />

for the year ended September <strong>2008</strong><br />

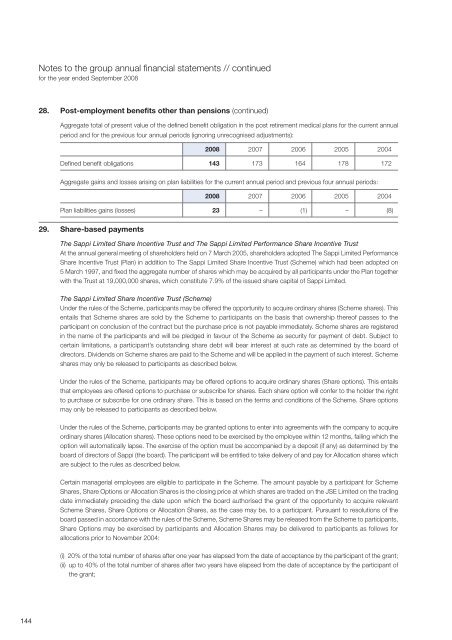

28. Post-employment benefits other than pensions (continued)<br />

Aggregate total of present value of the defined benefit obligation in the post retirement medical plans for the current annual<br />

period and for the previous four annual periods (ignoring unrecognised adjustments):<br />

<strong>2008</strong> 2007 2006 2005 2004<br />

Defined benefit obligations 143 173 164 178 172<br />

Aggregate gains and losses arising on plan liabilities for the current annual period and previous four annual periods:<br />

<strong>2008</strong> 2007 2006 2005 2004<br />

Plan liabilities gains (losses) 23 – (1) – (8)<br />

29. Share-based payments<br />

The <strong>Sappi</strong> Limited Share Incentive Trust and The <strong>Sappi</strong> Limited Performance Share Incentive Trust<br />

At the annual general meeting of shareholders held on 7 March 2005, shareholders adopted The <strong>Sappi</strong> Limited Performance<br />

Share Incentive Trust (Plan) in addition to The <strong>Sappi</strong> Limited Share Incentive Trust (Scheme) which had been adopted on<br />

5 March 1997, and fixed the aggregate number of shares which may be acquired by all participants under the Plan together<br />

with the Trust at 19,000,000 shares, which constitute 7.9% of the issued share capital of <strong>Sappi</strong> Limited.<br />

The <strong>Sappi</strong> Limited Share Incentive Trust (Scheme)<br />

Under the rules of the Scheme, participants may be offered the opportunity to acquire ordinary shares (Scheme shares). This<br />

entails that Scheme shares are sold by the Scheme to participants on the basis that ownership thereof passes to the<br />

participant on conclusion of the contract but the purchase price is not payable immediately. Scheme shares are registered<br />

in the name of the participants and will be pledged in favour of the Scheme as security for payment of debt. Subject to<br />

certain limitations, a participant’s outstanding share debt will bear interest at such rate as determined by the board of<br />

directors. Dividends on Scheme shares are paid to the Scheme and will be applied in the payment of such interest. Scheme<br />

shares may only be released to participants as described below.<br />

Under the rules of the Scheme, participants may be offered options to acquire ordinary shares (Share options). This entails<br />

that employees are offered options to purchase or subscribe for shares. Each share option will confer to the holder the right<br />

to purchase or subscribe for one ordinary share. This is based on the terms and conditions of the Scheme. Share options<br />

may only be released to participants as described below.<br />

Under the rules of the Scheme, participants may be granted options to enter into agreements with the company to acquire<br />

ordinary shares (Allocation shares). These options need to be exercised by the employee within 12 months, failing which the<br />

option will automatically lapse. The exercise of the option must be accompanied by a deposit (if any) as determined by the<br />

board of directors of <strong>Sappi</strong> (the board). The participant will be entitled to take delivery of and pay for Allocation shares which<br />

are subject to the rules as described below.<br />

Certain managerial employees are eligible to participate in the Scheme. The amount payable by a participant for Scheme<br />

Shares, Share Options or Allocation Shares is the closing price at which shares are traded on the JSE Limited on the trading<br />

date immediately preceding the date upon which the board authorised the grant of the opportunity to acquire relevant<br />

Scheme Shares, Share Options or Allocation Shares, as the case may be, to a participant. Pursuant to resolutions of the<br />

board passed in accordance with the rules of the Scheme, Scheme Shares may be released from the Scheme to participants,<br />

Share Options may be exercised by participants and Allocation Shares may be delivered to participants as follows for<br />

allocations prior to November 2004:<br />

(i) 20% of the total number of shares after one year has elapsed from the date of acceptance by the participant of the grant;<br />

(ii) up to 40% of the total number of shares after two years have elapsed from the date of acceptance by the participant of<br />

the grant;<br />

144