2008 Annual report - Sappi

2008 Annual report - Sappi

2008 Annual report - Sappi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the group annual financial statements // continued<br />

for the year ended September <strong>2008</strong><br />

2. Accounting policies (continued)<br />

Refer to note 30.6 of the Group <strong>Annual</strong> Financial Statements<br />

contained elsewhere in this <strong>Annual</strong> Report for details of the fair<br />

value hedging relationships as well as the impact of the hedge<br />

on the pre-tax profit or loss for the period.<br />

Plantations<br />

The fair value of immature timber is the present value of the<br />

expected future cashflows taking into account, unadjusted<br />

current market prices in available markets, estimated projected<br />

growth over the rotation period for the existing immature<br />

timber volumes in metric ton, cost of delivery and estimated<br />

maintenance costs up to the timber becoming usable. The<br />

discount rate used is the applicable pre-tax weighted average<br />

cost of capital of the business unit. Determining the appropriate<br />

discount rate requires significant assumption and judgement<br />

and changes in these assumptions could change the outcomes<br />

of the plantation valuations. The standing value of mature timber<br />

is based on unadjusted current market prices in available<br />

markets and estimated timber volumes in metric tons less cost<br />

of delivery at current market prices.<br />

Management focuses their attention on good husbandry<br />

techniques which include ensuring that the rotation of<br />

plantations is met with adequate planting activities for future<br />

harvesting. The rotation periods vary from eight to eighteen<br />

years in Southern Africa.<br />

Assumptions and estimates are used in the recording of<br />

plantation volumes, maintenance cost per metric ton, and<br />

depletion. Changes in the assumptions or estimates used in<br />

these calculations may affect the group’s results, in particular,<br />

our plantation valuation and depletion costs.<br />

A key assumption and estimation is the projected growth<br />

estimation over a period of eight to eighteen years per rotation.<br />

The inputs to our immature timber growth model are complex<br />

and involve estimations and judgements, all of which are<br />

regularly updated. <strong>Sappi</strong> established a long term sample plot<br />

network which is representative of the species and sites on<br />

which we grow trees and the measured data from these<br />

permanent sample plots are used as input into our growth<br />

estimation. Periodic adjustments are made to existing models<br />

for new genetic material.<br />

<strong>Sappi</strong> manages its plantations on a rotational basis and by<br />

implication, the respective increases by means of growth<br />

are,over the rotation period, negated by depletions for the<br />

group’s own production or sales. Estimated volume changes,<br />

on a rotational basis, amount to approximately five million tons<br />

per annum.<br />

Ruling unadjusted current market prices applied at the <strong>report</strong>ing<br />

date, as well as the assumptions that are used in determining<br />

the extent of biological transformation (growth) can have a<br />

significant effect on the valuation of the plantations, and as a<br />

result, the amount recorded in the income statement arising<br />

from fair value changes and growth. In addition, the discount<br />

rate applied in the valuation of immature timber has an impact<br />

as tabled below.<br />

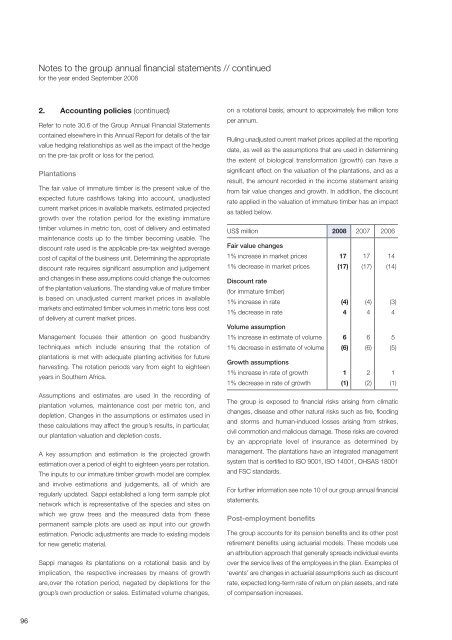

US$ million <strong>2008</strong> 2007 2006<br />

Fair value changes<br />

1% increase in market prices 17 17 14<br />

1% decrease in market prices (17) (17) (14)<br />

Discount rate<br />

(for immature timber)<br />

1% increase in rate (4) (4) (3)<br />

1% decrease in rate 4 4 4<br />

Volume assumption<br />

1% increase in estimate of volume 6 6 5<br />

1% decrease in estimate of volume (6) (6) (5)<br />

Growth assumptions<br />

1% increase in rate of growth 1 2 1<br />

1% decrease in rate of growth (1) (2) (1)<br />

The group is exposed to financial risks arising from climatic<br />

changes, disease and other natural risks such as fire, flooding<br />

and storms and human-induced losses arising from strikes,<br />

civil commotion and malicious damage. These risks are covered<br />

by an appropriate level of insurance as determined by<br />

management. The plantations have an integrated management<br />

system that is certified to ISO 9001, ISO 14001, OHSAS 18001<br />

and FSC standards.<br />

For further information see note 10 of our group annual financial<br />

statements.<br />

Post-employment benefits<br />

The group accounts for its pension benefits and its other post<br />

retirement benefits using actuarial models. These models use<br />

an attribution approach that generally spreads individual events<br />

over the service lives of the employees in the plan. Examples of<br />

‘events’ are changes in actuarial assumptions such as discount<br />

rate, expected long-term rate of return on plan assets, and rate<br />

of compensation increases.<br />

96