2008 Annual report - Sappi

2008 Annual report - Sappi

2008 Annual report - Sappi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

sappi //<br />

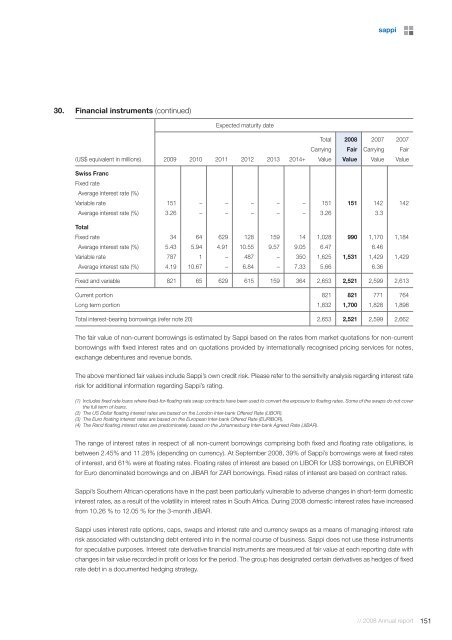

30. Financial instruments (continued)<br />

Expected maturity date<br />

Total <strong>2008</strong> 2007 2007<br />

Carrying Fair Carrying Fair<br />

(US$ equivalent in millions) 2009 2010 2011 2012 2013 2014+ Value Value Value Value<br />

Swiss Franc<br />

Fixed rate<br />

Average interest rate (%)<br />

Variable rate 151 – – – – – 151 151 142 142<br />

Average interest rate (%) 3.26 – – – – – 3.26 3.3<br />

Total<br />

Fixed rate 34 64 629 128 159 14 1,028 990 1,170 1,184<br />

Average interest rate (%) 5.43 5.94 4.91 10.55 9.57 9.05 6.47 6.46<br />

Variable rate 787 1 – 487 – 350 1,625 1,531 1,429 1,429<br />

Average interest rate (%) 4.19 10.67 – 6.84 – 7.33 5.66 6.36<br />

Fixed and variable 821 65 629 615 159 364 2,653 2,521 2,599 2,613<br />

Current portion 821 821 771 764<br />

Long term portion 1,832 1,700 1,828 1,898<br />

Total interest-bearing borrowings (refer note 20) 2,653 2,521 2,599 2,662<br />

The fair value of non-current borrowings is estimated by <strong>Sappi</strong> based on the rates from market quotations for non-current<br />

borrowings with fixed interest rates and on quotations provided by internationally recognised pricing services for notes,<br />

exchange debentures and revenue bonds.<br />

The above mentioned fair values include <strong>Sappi</strong>’s own credit risk. Please refer to the sensitivity analysis regarding interest rate<br />

risk for additional information regarding <strong>Sappi</strong>’s rating.<br />

(1) Includes fixed rate loans where fixed-for-floating rate swap contracts have been used to convert the exposure to floating rates. Some of the swaps do not cover<br />

the full term of loans.<br />

(2) The US Dollar floating interest rates are based on the London Inter-bank Offered Rate (LIBOR).<br />

(3) The Euro floating interest rates are based on the European Inter-bank Offered Rate (EURIBOR).<br />

(4) The Rand floating interest rates are predominately based on the Johannesburg Inter-bank Agreed Rate (JIBAR).<br />

The range of interest rates in respect of all non-current borrowings comprising both fixed and floating rate obligations, is<br />

between 2.45% and 11.28% (depending on currency). At September <strong>2008</strong>, 39% of <strong>Sappi</strong>’s borrowings were at fixed rates<br />

of interest, and 61% were at floating rates. Floating rates of interest are based on LIBOR for US$ borrowings, on EURIBOR<br />

for Euro denominated borrowings and on JIBAR for ZAR borrowings. Fixed rates of interest are based on contract rates.<br />

<strong>Sappi</strong>’s Southern African operations have in the past been particularly vulnerable to adverse changes in short-term domestic<br />

interest rates, as a result of the volatility in interest rates in South Africa. During <strong>2008</strong> domestic interest rates have increased<br />

from 10.26 % to 12.05 % for the 3-month JIBAR.<br />

<strong>Sappi</strong> uses interest rate options, caps, swaps and interest rate and currency swaps as a means of managing interest rate<br />

risk associated with outstanding debt entered into in the normal course of business. <strong>Sappi</strong> does not use these instruments<br />

for speculative purposes. Interest rate derivative financial instruments are measured at fair value at each <strong>report</strong>ing date with<br />

changes in fair value recorded in profit or loss for the period. The group has designated certain derivatives as hedges of fixed<br />

rate debt in a documented hedging strategy.<br />

// <strong>2008</strong> <strong>Annual</strong> <strong>report</strong><br />

151