2008 Annual report - Sappi

2008 Annual report - Sappi

2008 Annual report - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

sappi<br />

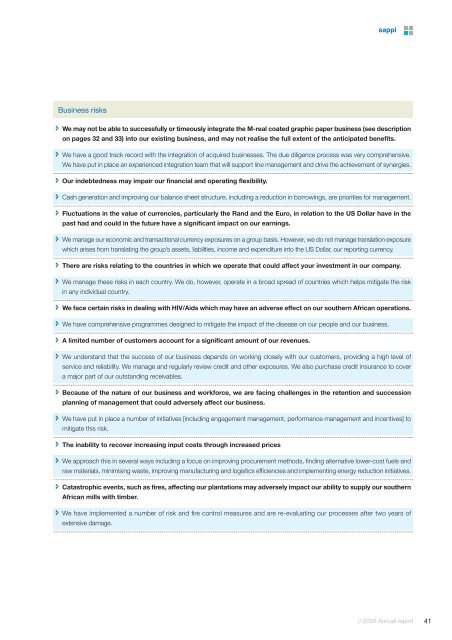

Business risks<br />

We may not be able to successfully or timeously integrate the M-real coated graphic paper business (see description<br />

on pages 32 and 33) into our existing business, and may not realise the full extent of the anticipated benefits.<br />

We have a good track record with the integration of acquired businesses. The due diligence process was very comprehensive.<br />

We have put in place an experienced integration team that will support line management and drive the achievement of synergies.<br />

Our indebtedness may impair our financial and operating flexibility.<br />

Cash generation and improving our balance sheet structure, including a reduction in borrowings, are priorities for management.<br />

Fluctuations in the value of currencies, particularly the Rand and the Euro, in relation to the US Dollar have in the<br />

past had and could in the future have a significant impact on our earnings.<br />

We manage our economic and transactional currency exposures on a group basis. However, we do not manage translation exposure<br />

which arises from translating the group’s assets, liabilities, income and expenditure into the US Dollar, our <strong>report</strong>ing currency.<br />

There are risks relating to the countries in which we operate that could affect your investment in our company.<br />

We manage these risks in each country. We do, however, operate in a broad spread of countries which helps mitigate the risk<br />

in any individual country.<br />

We face certain risks in dealing with HIV/Aids which may have an adverse effect on our southern African operations.<br />

We have comprehensive programmes designed to mitigate the impact of the disease on our people and our business.<br />

A limited number of customers account for a significant amount of our revenues.<br />

We understand that the success of our business depends on working closely with our customers, providing a high level of<br />

service and reliability. We manage and regularly review credit and other exposures. We also purchase credit insurance to cover<br />

a major part of our outstanding receivables.<br />

Because of the nature of our business and workforce, we are facing challenges in the retention and succession<br />

planning of management that could adversely affect our business.<br />

We have put in place a number of initiatives [including engagement management, performance management and incentives] to<br />

mitigate this risk.<br />

The inability to recover increasing input costs through increased prices<br />

We approach this in several ways including a focus on improving procurement methods, finding alternative lower-cost fuels and<br />

raw materials, minimising waste, improving manufacturing and logistics efficiencies and implementing energy reduction initiatives.<br />

Catastrophic events, such as fires, affecting our plantations may adversely impact our ability to supply our southern<br />

African mills with timber.<br />

We have implemented a number of risk and fire control measures and are re-evaluating our processes after two years of<br />

extensive damage.<br />

// <strong>2008</strong> <strong>Annual</strong> <strong>report</strong><br />

41