2008 Annual report - Sappi

2008 Annual report - Sappi

2008 Annual report - Sappi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

sappi //<br />

US$ million <strong>2008</strong> 2007<br />

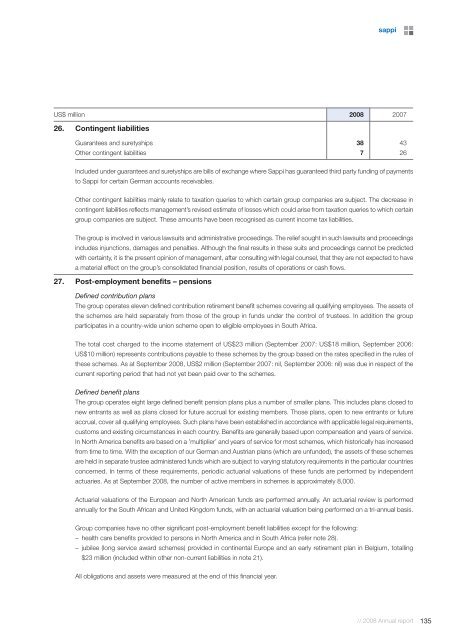

26. Contingent liabilities<br />

Guarantees and suretyships 38 43<br />

Other contingent liabilities 7 26<br />

Included under guarantees and suretyships are bills of exchange where <strong>Sappi</strong> has guaranteed third party funding of payments<br />

to <strong>Sappi</strong> for certain German accounts receivables.<br />

Other contingent liabilities mainly relate to taxation queries to which certain group companies are subject. The decrease in<br />

contingent liabilities reflects management’s revised estimate of losses which could arise from taxation queries to which certain<br />

group companies are subject. These amounts have been recognised as current income tax liabilities.<br />

The group is involved in various lawsuits and administrative proceedings. The relief sought in such lawsuits and proceedings<br />

includes injunctions, damages and penalties. Although the final results in these suits and proceedings cannot be predicted<br />

with certainty, it is the present opinion of management, after consulting with legal counsel, that they are not expected to have<br />

a material effect on the group’s consolidated financial position, results of operations or cash flows.<br />

27. Post-employment benefits – pensions<br />

Defined contribution plans<br />

The group operates eleven defined contribution retirement benefit schemes covering all qualifying employees. The assets of<br />

the schemes are held separately from those of the group in funds under the control of trustees. In addition the group<br />

participates in a country-wide union scheme open to eligible employees in South Africa.<br />

The total cost charged to the income statement of US$23 million (September 2007: US$18 million, September 2006:<br />

US$10 million) represents contributions payable to these schemes by the group based on the rates specified in the rules of<br />

these schemes. As at September <strong>2008</strong>, US$2 million (September 2007: nil, September 2006: nil) was due in respect of the<br />

current <strong>report</strong>ing period that had not yet been paid over to the schemes.<br />

Defined benefit plans<br />

The group operates eight large defined benefit pension plans plus a number of smaller plans. This includes plans closed to<br />

new entrants as well as plans closed for future accrual for existing members. Those plans, open to new entrants or future<br />

accrual, cover all qualifying employees. Such plans have been established in accordance with applicable legal requirements,<br />

customs and existing circumstances in each country. Benefits are generally based upon compensation and years of service.<br />

In North America benefits are based on a ’multiplier’ and years of service for most schemes, which historically has increased<br />

from time to time. With the exception of our German and Austrian plans (which are unfunded), the assets of these schemes<br />

are held in separate trustee administered funds which are subject to varying statutory requirements in the particular countries<br />

concerned. In terms of these requirements, periodic actuarial valuations of these funds are performed by independent<br />

actuaries. As at September <strong>2008</strong>, the number of active members in schemes is approximately 8,000.<br />

Actuarial valuations of the European and North American funds are performed annually. An actuarial review is performed<br />

annually for the South African and United Kingdom funds, with an actuarial valuation being performed on a tri-annual basis.<br />

Group companies have no other significant post-employment benefit liabilities except for the following:<br />

– health care benefits provided to persons in North America and in South Africa (refer note 28).<br />

– jubilee (long service award schemes) provided in continental Europe and an early retirement plan in Belgium, totalling<br />

$23 million (included within other non-current liabilities in note 21).<br />

All obligations and assets were measured at the end of this financial year.<br />

// <strong>2008</strong> <strong>Annual</strong> <strong>report</strong><br />

135