2008 Annual report - Sappi

2008 Annual report - Sappi

2008 Annual report - Sappi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

sappi<br />

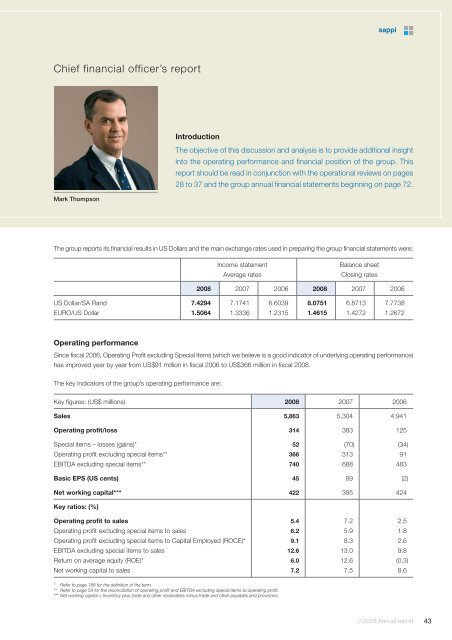

Chief financial officer’s <strong>report</strong><br />

Introduction<br />

The objective of this discussion and analysis is to provide additional insight<br />

into the operating performance and financial position of the group. This<br />

<strong>report</strong> should be read in conjunction with the operational reviews on pages<br />

28 to 37 and the group annual financial statements beginning on page 72.<br />

Mark Thompson<br />

The group <strong>report</strong>s its financial results in US Dollars and the main exchange rates used in preparing the group financial statements were:<br />

Income statement<br />

Average rates<br />

Balance sheet<br />

Closing rates<br />

<strong>2008</strong> 2007 2006 <strong>2008</strong> 2007 2006<br />

US Dollar/SA Rand 7.4294 7.1741 6.6039 8.0751 6.8713 7.7738<br />

EURO/US Dollar 1.5064 1.3336 1.2315 1.4615 1.4272 1.2672<br />

Operating performance<br />

Since fiscal 2006, Operating Profit excluding Special Items (which we believe is a good indicator of underlying operating performance)<br />

has improved year by year from US$91 million in fiscal 2006 to US$366 million in fiscal <strong>2008</strong>.<br />

The key indicators of the group’s operating performance are:<br />

Key figures: (US$ millions) <strong>2008</strong> 2007 2006<br />

Sales 5,863 5,304 4,941<br />

Operating profit/loss 314 383 125<br />

Special items – losses (gains)* 52 (70) (34)<br />

Operating profit excluding special items** 366 313 91<br />

EBITDA excluding special items** 740 688 483<br />

Basic EPS (US cents) 45 89 (2)<br />

Net working capital*** 422 395 424<br />

Key ratios: (%)<br />

Operating profit to sales 5.4 7.2 2.5<br />

Operating profit excluding special items to sales 6.2 5.9 1.8<br />

Operating profit excluding special items to Capital Employed (ROCE)* 9.1 8.3 2.6<br />

EBITDA excluding special items to sales 12.6 13.0 9.8<br />

Return on average equity (ROE)* 6.0 12.6 (0.3)<br />

Net working capital to sales 7.2 7.5 8.6<br />

* Refer to page 188 for the definition of the term.<br />

** Refer to page 59 for the reconciliation of operating profit and EBITDA excluding special items to operating profit.<br />

*** Net working capital = Inventory plus trade and other receivables minus trade and other payables and provisions.<br />

// <strong>2008</strong> <strong>Annual</strong> <strong>report</strong><br />

43