2008 Annual report - Sappi

2008 Annual report - Sappi

2008 Annual report - Sappi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

sappi<br />

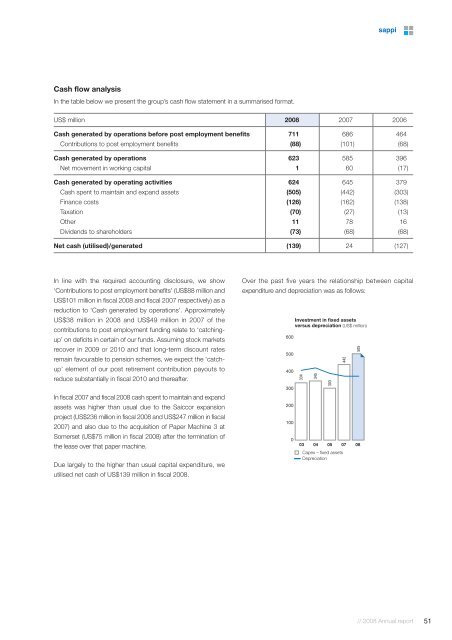

Cash flow analysis<br />

In the table below we present the group’s cash flow statement in a summarised format.<br />

US$ million <strong>2008</strong> 2007 2006<br />

Cash generated by operations before post employment benefits 711 686 464<br />

Contributions to post employment benefits (88) (101) (68)<br />

Cash generated by operations 623 585 396<br />

Net movement in working capital 1 60 (17)<br />

Cash generated by operating activities 624 645 379<br />

Cash spent to maintain and expand assets (505) (442) (303)<br />

Finance costs (126) (162) (138)<br />

Taxation (70) (27) (13)<br />

Other 11 78 16<br />

Dividends to shareholders (73) (68) (68)<br />

Net cash (utilised)/generated (139) 24 (127)<br />

In line with the required accounting disclosure, we show<br />

‘Contributions to post employment benefits’ (US$88 million and<br />

US$101 million in fiscal <strong>2008</strong> and fiscal 2007 respectively) as a<br />

reduction to ‘Cash generated by operations’. Approximately<br />

US$38 million in <strong>2008</strong> and US$49 million in 2007 of the<br />

contributions to post employment funding relate to ‘catchingup’<br />

on deficits in certain of our funds. Assuming stock markets<br />

recover in 2009 or 2010 and that long-term discount rates<br />

remain favourable to pension schemes, we expect the ‘catchup’<br />

element of our post retirement contribution payouts to<br />

reduce substantially in fiscal 2010 and thereafter.<br />

Over the past five years the relationship between capital<br />

expenditure and depreciation was as follows:<br />

In fiscal 2007 and fiscal <strong>2008</strong> cash spent to maintain and expand<br />

assets was higher than usual due to the Saiccor expansion<br />

project (US$236 million in fiscal <strong>2008</strong> and US$247 million in fiscal<br />

2007) and also due to the acquisition of Paper Machine 3 at<br />

Somerset (US$75 million in fiscal <strong>2008</strong>) after the termination of<br />

the lease over that paper machine.<br />

Due largely to the higher than usual capital expenditure, we<br />

utilised net cash of US$139 million in fiscal <strong>2008</strong>.<br />

// <strong>2008</strong> <strong>Annual</strong> <strong>report</strong><br />

51