100th Annual Report 2006-2007 - Tata Steel

100th Annual Report 2006-2007 - Tata Steel

100th Annual Report 2006-2007 - Tata Steel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

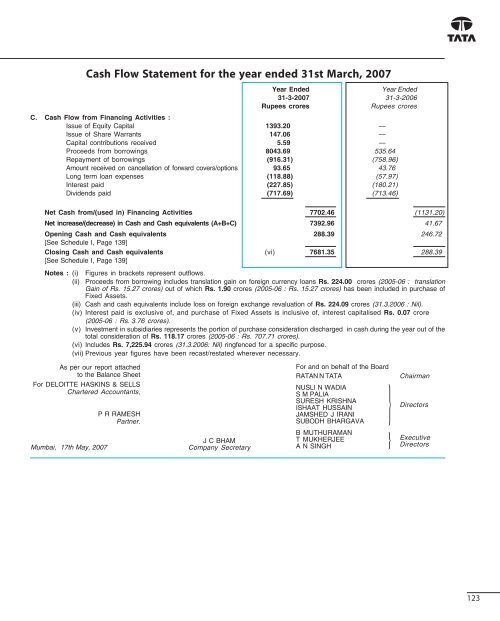

Cash Flow Statement for the year ended 31st March, <strong>2007</strong><br />

Year Ended<br />

Year Ended<br />

31-3-<strong>2007</strong> 31-3-<strong>2006</strong><br />

Rupees crores<br />

Rupees crores<br />

C. Cash Flow from Financing Activities :<br />

Issue of Equity Capital 1393.20 —<br />

Issue of Share Warrants 147.06 —<br />

Capital contributions received 5.59 —<br />

Proceeds from borrowings 8043.69 535.64<br />

Repayment of borrowings (916.31) (758.96)<br />

Amount received on cancellation of forward covers/options 93.65 43.76<br />

Long term loan expenses (118.88) (57.97)<br />

Interest paid (227.85) (180.21)<br />

Dividends paid (717.69) (713.46)<br />

Net Cash from/(used in) Financing Activities 7702.46 (1131.20)<br />

Net increase/(decrease) in Cash and Cash equivalents (A+B+C) 7392.96 41.67<br />

Opening Cash and Cash equivalents 288.39 246.72<br />

[See Schedule I, Page 139]<br />

Closing Cash and Cash equivalents (vi) 7681.35 288.39<br />

[See Schedule I, Page 139]<br />

Notes : (i) Figures in brackets represent outflows.<br />

(ii) Proceeds from borrowing includes translation gain on foreign currency loans Rs. 224.00 crores (2005-06 : translation<br />

Gain of Rs. 15.27 crores) out of which Rs. 1.90 crores (2005-06 : Rs. 15.27 crores) has been included in purchase of<br />

Fixed Assets.<br />

(iii) Cash and cash equivalents include loss on foreign exchange revaluation of Rs. 224.09 crores (31.3.<strong>2006</strong> : Nil).<br />

(iv) Interest paid is exclusive of, and purchase of Fixed Assets is inclusive of, interest capitalised Rs. 0.07 crore<br />

(2005-06 : Rs. 3.76 crores).<br />

(v) Investment in subsidiaries represents the portion of purchase consideration discharged in cash during the year out of the<br />

total consideration of Rs. 118.17 crores (2005-06 : Rs. 707.71 crores).<br />

(vi) Includes Rs. 7,225.94 crores (31.3.<strong>2006</strong>: Nil) ringfenced for a specific purpose.<br />

(vii) Previous year figures have been recast/restated wherever necessary.<br />

As per our report attached<br />

to the Balance Sheet<br />

For DELOITTE HASKINS & SELLS<br />

Chartered Accountants,<br />

Mumbai, 17th May, <strong>2007</strong><br />

P R RAMESH<br />

Partner.<br />

J C BHAM<br />

Company Secretary<br />

For and on behalf of the Board<br />

RATAN N TATA<br />

NUSLI N WADIA<br />

S M PALIA<br />

SURESH KRISHNA<br />

ISHAAT HUSSAIN<br />

JAMSHED J IRANI<br />

SUBODH BHARGAVA<br />

B MUTHURAMAN<br />

T MUKHERJEE<br />

A N SINGH<br />

}<br />

}<br />

Chairman<br />

Directors<br />

Executive<br />

Directors<br />

123