100th Annual Report 2006-2007 - Tata Steel

100th Annual Report 2006-2007 - Tata Steel

100th Annual Report 2006-2007 - Tata Steel

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

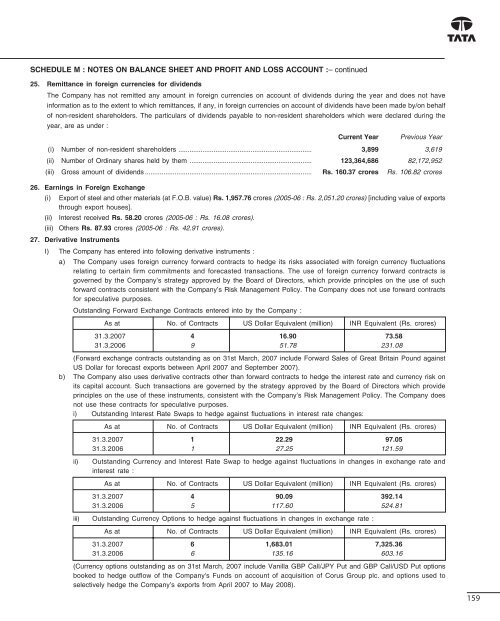

SCHEDULE M : NOTES ON BALANCE SHEET AND PROFIT AND LOSS ACCOUNT :– continued<br />

25. Remittance in foreign currencies for dividends<br />

The Company has not remitted any amount in foreign currencies on account of dividends during the year and does not have<br />

information as to the extent to which remittances, if any, in foreign currencies on account of dividends have been made by/on behalf<br />

of non-resident shareholders. The particulars of dividends payable to non-resident shareholders which were declared during the<br />

year, are as under :<br />

Current Year Previous Year<br />

(i) Number of non-resident shareholders ........................................................................ 3,899 3,619<br />

(ii) Number of Ordinary shares held by them .................................................................. 123,364,686 82,172,952<br />

(iii) Gross amount of dividends .......................................................................................... Rs. 160.37 crores Rs. 106.82 crores<br />

26. Earnings in Foreign Exchange<br />

(i) Export of steel and other materials (at F.O.B. value) Rs. 1,957.76 crores (2005-06 : Rs. 2,051.20 crores) [including value of exports<br />

through export houses].<br />

(ii) Interest received Rs. 58.20 crores (2005-06 : Rs. 16.08 crores).<br />

(iii) Others Rs. 87.93 crores (2005-06 : Rs. 42.91 crores).<br />

27. Derivative Instruments<br />

I) The Company has entered into following derivative instruments :<br />

a) The Company uses foreign currency forward contracts to hedge its risks associated with foreign currency fluctuations<br />

relating to certain firm commitments and forecasted transactions. The use of foreign currency forward contracts is<br />

governed by the Company’s strategy approved by the Board of Directors, which provide principles on the use of such<br />

forward contracts consistent with the Company’s Risk Management Policy. The Company does not use forward contracts<br />

for speculative purposes.<br />

Outstanding Forward Exchange Contracts entered into by the Company :<br />

As at No. of Contracts US Dollar Equivalent (million) INR Equivalent (Rs. crores)<br />

31.3.<strong>2007</strong> 4 16.90 73.58<br />

31.3.<strong>2006</strong> 9 51.78 231.08<br />

(Forward exchange contracts outstanding as on 31st March, <strong>2007</strong> include Forward Sales of Great Britain Pound against<br />

US Dollar for forecast exports between April <strong>2007</strong> and September <strong>2007</strong>).<br />

b) The Company also uses derivative contracts other than forward contracts to hedge the interest rate and currency risk on<br />

its capital account. Such transactions are governed by the strategy approved by the Board of Directors which provide<br />

principles on the use of these instruments, consistent with the Company’s Risk Management Policy. The Company does<br />

not use these contracts for speculative purposes.<br />

i) Outstanding Interest Rate Swaps to hedge against fluctuations in interest rate changes:<br />

As at No. of Contracts US Dollar Equivalent (million) INR Equivalent (Rs. crores)<br />

31.3.<strong>2007</strong> 1 22.29 97.05<br />

31.3.<strong>2006</strong> 1 27.25 121.59<br />

ii)<br />

Outstanding Currency and Interest Rate Swap to hedge against fluctuations in changes in exchange rate and<br />

interest rate :<br />

As at No. of Contracts US Dollar Equivalent (million) INR Equivalent (Rs. crores)<br />

31.3.<strong>2007</strong> 4 90.09 392.14<br />

31.3.<strong>2006</strong> 5 117.60 524.81<br />

iii) Outstanding Currency Options to hedge against fluctuations in changes in exchange rate :<br />

As at No. of Contracts US Dollar Equivalent (million) INR Equivalent (Rs. crores)<br />

31.3.<strong>2007</strong> 6 1,683.01 7,325.36<br />

31.3.<strong>2006</strong> 6 135.16 603.16<br />

(Currency options outstanding as on 31st March, <strong>2007</strong> include Vanilla GBP Call/JPY Put and GBP Call/USD Put options<br />

booked to hedge outflow of the Company's Funds on account of acquisition of Corus Group plc. and options used to<br />

selectively hedge the Company’s exports from April <strong>2007</strong> to May 2008).<br />

159