100th Annual Report 2006-2007 - Tata Steel

100th Annual Report 2006-2007 - Tata Steel

100th Annual Report 2006-2007 - Tata Steel

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management Discussion and Analysis<br />

controlling inflationary pressures may be a challenge for the<br />

Indian Government.<br />

The International Iron and <strong>Steel</strong> Institute (IISI) forecasts global<br />

steel consumption to grow by 5.9% in <strong>2007</strong> and 6.1% in 2008,<br />

driven by strong demand from Asia, Africa and South America.<br />

The apparent steel demand is likely to increase by 65 million<br />

tonnes in <strong>2007</strong> and 72 million tonnes in 2008 to reach a level<br />

of 1,250 million tonnes in 2008. China is expected to remain<br />

the largest market with steel demand likely to increase by 13%<br />

(46 million tonnes) in <strong>2007</strong>, which represents 71% of global<br />

steel consumption growth in <strong>2007</strong>.<br />

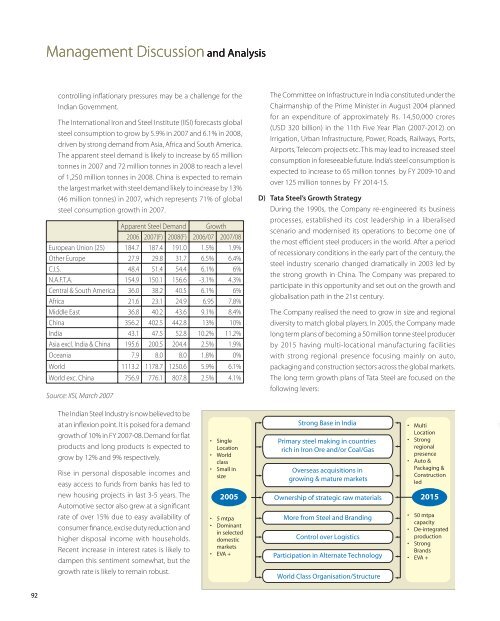

Apparent <strong>Steel</strong> Demand Growth<br />

<strong>2006</strong> <strong>2007</strong>(F) 2008(F) <strong>2006</strong>/07 <strong>2007</strong>/08<br />

European Union (25) 184.7 187.4 191.0 1.5% 1.9%<br />

Other Europe 27.9 29.8 31.7 6.5% 6.4%<br />

C.I.S. 48.4 51.4 54.4 6.1% 6%<br />

N.A.F.T.A. 154.9 150.1 156.6 -3.1% 4.3%<br />

Central & South America 36.0 38.2 40.5 6.1% 6%<br />

Africa 21.6 23.1 24.9 6.95 7.8%<br />

Middle East 36.8 40.2 43.6 9.1% 8.4%<br />

China 356.2 402.5 442.8 13% 10%<br />

India 43.1 47.5 52.8 10.2% 11.2%<br />

Asia excl. India & China 195.6 200.5 204.4 2.5% 1.9%<br />

Oceania 7.9 8.0 8.0 1.8% 0%<br />

World 1113.2 1178.7 1250.6 5.9% 6.1%<br />

World exc. China 756.9 776.1 807.8 2.5% 4.1%<br />

Source: IISI, March <strong>2007</strong><br />

The Committee on Infrastructure in India constituted under the<br />

Chairmanship of the Prime Minister in August 2004 planned<br />

for an expenditure of approximately Rs. 14,50,000 crores<br />

(USD 320 billion) in the 11th Five Year Plan (<strong>2007</strong>-2012) on<br />

Irrigation, Urban Infrastructure, Power, Roads, Railways, Ports,<br />

Airports, Telecom projects etc. This may lead to increased steel<br />

consumption in foreseeable future. India’s steel consumption is<br />

expected to increase to 65 million tonnes by FY 2009-10 and<br />

over 125 million tonnes by FY 2014-15.<br />

D) <strong>Tata</strong> <strong>Steel</strong>’s Growth Strategy<br />

During the 1990s, the Company re-engineered its business<br />

processes, established its cost leadership in a liberalised<br />

scenario and modernised its operations to become one of<br />

the most efficient steel producers in the world. After a period<br />

of recessionary conditions in the early part of the century, the<br />

steel industry scenario changed dramatically in 2003 led by<br />

the strong growth in China. The Company was prepared to<br />

participate in this opportunity and set out on the growth and<br />

globalisation path in the 21st century.<br />

The Company realised the need to grow in size and regional<br />

diversity to match global players. In 2005, the Company made<br />

long term plans of becoming a 50 million tonne steel producer<br />

by 2015 having multi-locational manufacturing facilities<br />

with strong regional presence focusing mainly on auto,<br />

packaging and construction sectors across the global markets.<br />

The long term growth plans of <strong>Tata</strong> <strong>Steel</strong> are focused on the<br />

following levers:<br />

The Indian <strong>Steel</strong> Industry is now believed to be<br />

at an inflexion point. It is poised for a demand<br />

growth of 10% in FY <strong>2007</strong>-08. Demand for flat<br />

products and long products is expected to<br />

grow by 12% and 9% respectively.<br />

Rise in personal disposable incomes and<br />

easy access to funds from banks has led to<br />

new housing projects in last 3-5 years. The<br />

Automotive sector also grew at a significant<br />

rate of over 15% due to easy availability of<br />

consumer finance, excise duty reduction and<br />

higher disposal income with households.<br />

Recent increase in interest rates is likely to<br />

dampen this sentiment somewhat, but the<br />

growth rate is likely to remain robust.<br />

• Single<br />

Location<br />

• World<br />

class<br />

• Small in<br />

size<br />

2005<br />

• 5 mtpa<br />

• Dominant<br />

in selected<br />

domestic<br />

markets<br />

• EVA +<br />

Strong Base in India<br />

Primary steel making in countries<br />

rich in Iron Ore and/or Coal/Gas<br />

Overseas acquisitions in<br />

growing & mature markets<br />

Ownership of strategic raw materials<br />

More from <strong>Steel</strong> and Branding<br />

Control over Logistics<br />

Participation in Alternate Technology<br />

World Class Organisation/Structure<br />

• Multi<br />

Location<br />

• Strong<br />

regional<br />

presence<br />

• Auto &<br />

Packaging &<br />

Construction<br />

led<br />

2015<br />

• 50 mtpa<br />

capacity<br />

• De-integrated<br />

production<br />

• Strong<br />

Brands<br />

• EVA +<br />

92