Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

O<br />

Br<br />

Mg<br />

Fs<br />

Ai<br />

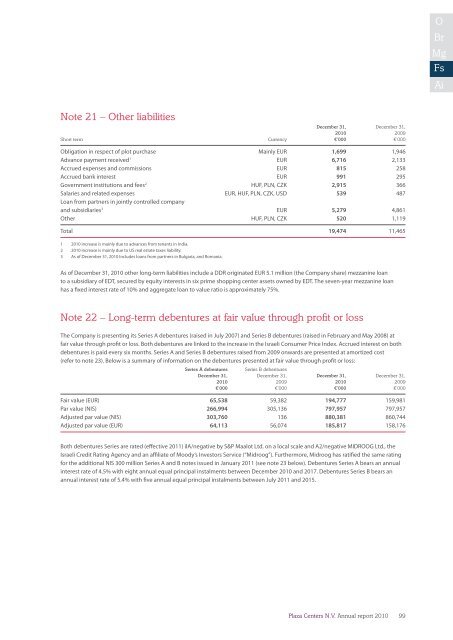

Note 21 – Other liabilities<br />

December 31, December 31,<br />

<strong>2010</strong> 2009<br />

Short term Currency €’000 €’000<br />

Obligation in respect of plot purchase Mainly EUR 1,699 1,946<br />

Advance payment received 1 EUR 6,716 2,133<br />

Accrued expenses and commissions EUR 815 258<br />

Accrued bank interest EUR 991 295<br />

Government institutions and fees 2 HUF, PLN, CZK 2,915 366<br />

Salaries and related expenses EUR, HUF, PLN, CZK, USD 539 487<br />

Loan from partners in jointly controlled company<br />

and subsidiaries 3 EUR 5,279 4,861<br />

Other HUF, PLN, CZK 520 1,119<br />

Total 19,474 11,465<br />

1 <strong>2010</strong> increase is mainly due to advances from tenants in India.<br />

2 <strong>2010</strong> increase is mainly due to US real estate taxes liability.<br />

3 As of December 31, <strong>2010</strong> Includes loans from partners in Bulgaria, and Romania.<br />

As of December 31, <strong>2010</strong> other long-term liabilities include a DDR originated EUR 5.1 million (the Company share) mezzanine loan<br />

to a subsidiary of EDT, secured by equity interests in six prime shopping center assets owned by EDT. The seven-year mezzanine loan<br />

has a fixed interest rate of 10% and aggregate loan to value ratio is approximately 75%.<br />

Note 22 – Long-term debentures at fair value through profit or loss<br />

The Company is presenting its Series A debentures (raised in July 2007) and Series B debentures (raised in February and May 2008) at<br />

fair value through profit or loss. Both debentures are linked to the increase in the Israeli Consumer Price Index. Accrued interest on both<br />

debentures is paid every six months. Series A and Series B debentures raised from 2009 onwards are presented at amortized cost<br />

(refer to note 23). Below is a summary of information on the debentures presented at fair value through profit or loss:<br />

Series A debentures Series B debentures<br />

December 31, December 31, December 31, December 31,<br />

<strong>2010</strong> 2009 <strong>2010</strong> 2009<br />

€’000 €’000 €’000 €’000<br />

Fair value (EUR) 65,538 59,382 194,777 159,981<br />

Par value (NIS) 266,994 305,136 797,957 797,957<br />

Adjusted par value (NIS) 303,760 136 880,381 860,744<br />

Adjusted par value (EUR) 64,113 56,074 185,817 158,176<br />

Both debentures Series are rated (effective 2011) ilA/negative by S&P Maalot Ltd. on a local scale and A2/negative MIDROOG Ltd., the<br />

Israeli Credit Rating Agency and an affiliate of Moody’s Investors Service (“Midroog”). Furthermore, Midroog has ratified the same rating<br />

for the additional NIS 300 million Series A and B notes issued in January 2011 (see note 23 below). Debentures Series A bears an annual<br />

interest rate of 4.5% with eight annual equal principal instalments between December <strong>2010</strong> and 2017. Debentures Series B bears an<br />

annual interest rate of 5.4% with five annual equal principal instalments between July 2011 and 2015.<br />

<br />

Plaza Centers N.V. <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>99