Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements<br />

Notes to the consolidated financial statements<br />

continued<br />

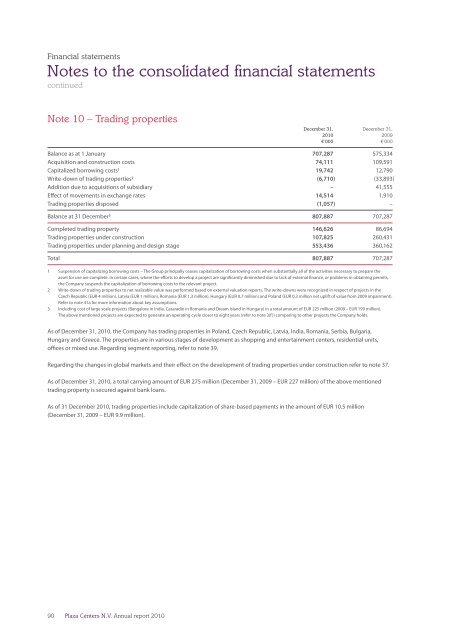

Note 10 – Trading properties<br />

December 31, December 31,<br />

<strong>2010</strong> 2009<br />

€’000 €’000<br />

Balance as at 1 January 707,287 575,334<br />

Acquisition and construction costs 74,111 109,591<br />

Capitalized borrowing costs1 19,742 12,790<br />

Write-down of trading properties2 (6,710) (33,893)<br />

Addition due to acquisitions of subsidiary – 41,555<br />

Effect of movements in exchange rates 14,514 1,910<br />

Trading properties disposed (1,057) –<br />

Balance at 31 December3 807,887 707,287<br />

Completed trading property 146,626 86,694<br />

Trading properties under construction 107,825 260,431<br />

Trading properties under planning and design stage 553,436 360,162<br />

Total 807,887 707,287<br />

1 Suspension of capitalizing borrowing costs – The Group principally ceases capitalization of borrowing costs when substantially all of the activities necessary to prepare the<br />

asset for use are complete. In certain cases, where the efforts to develop a project are significantly diminished due to lack of external finance, or problems in obtaining permits,<br />

the Company suspends the capitalization of borrowing costs to the relevant project.<br />

2 Write-down of trading properties to net realizable value was performed based on external valuation <strong>report</strong>s. The write-downs were recognized in respect of projects in the<br />

Czech Republic (EUR 4 million), Latvia (EUR 1 million), Romania (EUR 1.3 million), Hungary (EUR 0.7 million) and Poland (EUR 0.3 million net uplift of value from 2009 impairment).<br />

Refer to note 41a for more information about key assumptions.<br />

3 Including cost of large scale projects (Bangalore in India, Casaradio in Romania and Dream Island in Hungary) in a total amount of EUR 225 million (2009 – EUR 199 million).<br />

The above mentioned projects are expected to generate an operating cycle closer to eight years (refer to note 3(f)) comparing to other projects the Company holds.<br />

As of December 31, <strong>2010</strong>, the Company has trading properties in Poland, Czech Republic, Latvia, India, Romania, Serbia, Bulgaria,<br />

Hungary and Greece. The properties are in various stages of development as shopping and entertainment centers, residential units,<br />

offices or mixed use. Regarding segment <strong>report</strong>ing, refer to note 39.<br />

Regarding the changes in global markets and their effect on the development of trading properties under construction refer to note 37.<br />

As of December 31, <strong>2010</strong>, a total carrying amount of EUR 275 million (December 31, 2009 – EUR 227 million) of the above mentioned<br />

trading property is secured against bank loans.<br />

As of 31 December <strong>2010</strong>, trading properties include capitalization of share-based payments in the amount of EUR 10.5 million<br />

(December 31, 2009 – EUR 9.9 million).<br />

90<br />

Plaza Centers N.V. <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>