Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements<br />

Notes to the consolidated financial statements<br />

continued<br />

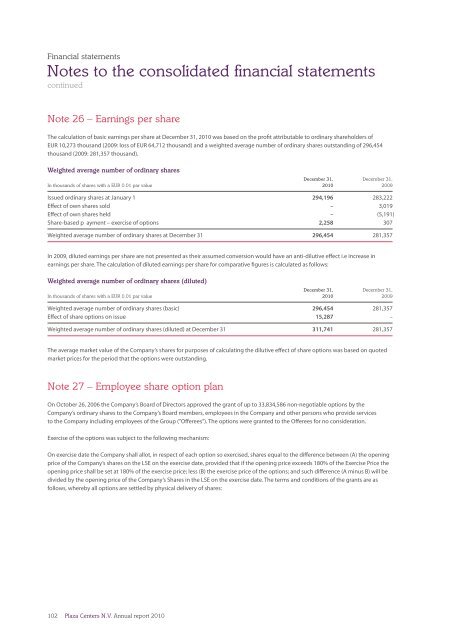

Note 26 – Earnings per share<br />

The calculation of basic earnings per share at December 31, <strong>2010</strong> was based on the profit attributable to ordinary shareholders of<br />

EUR 10,273 thousand (2009: loss of EUR 64,712 thousand) and a weighted average number of ordinary shares outstanding of 296,454<br />

thousand (2009: 281,357 thousand).<br />

Weighted average number of ordinary shares<br />

December 31, December 31,<br />

In thousands of shares with a EUR 0.01 par value <strong>2010</strong> 2009<br />

Issued ordinary shares at January 1 294,196 283,222<br />

Effect of own shares sold – 3,019<br />

Effect of own shares held – (5,191)<br />

Share-based p ayment – exercise of options 2,258 307<br />

Weighted average number of ordinary shares at December 31 296,454 281,357<br />

In 2009, diluted earnings per share are not presented as their assumed conversion would have an anti-dilutive effect i.e increase in<br />

earnings per share. The calculation of diluted earnings per share for comparative figures is calculated as follows:<br />

Weighted average number of ordinary shares (diluted)<br />

December 31, December 31,<br />

In thousands of shares with a EUR 0.01 par value <strong>2010</strong> 2009<br />

Weighted average number of ordinary shares (basic) 296,454 281,357<br />

Effect of share options on issue 15,287 –<br />

Weighted average number of ordinary shares (diluted) at December 31 311,741 281,357<br />

The average market value of the Company’s shares for purposes of calculating the dilutive effect of share options was based on quoted<br />

market prices for the period that the options were outstanding.<br />

Note 27 – Employee share option plan<br />

On October 26, 2006 the Company’s Board of Directors approved the grant of up to 33,834,586 non-negotiable options by the<br />

Company’s ordinary shares to the Company’s Board members, employees in the Company and other persons who provide services<br />

to the Company including employees of the Group (”Offerees”). The options were granted to the Offerees for no consideration.<br />

Exercise of the options was subject to the following mechanism:<br />

On exercise date the Company shall allot, in respect of each option so exercised, shares equal to the difference between (A) the opening<br />

price of the Company’s shares on the LSE on the exercise date, provided that if the opening price exceeds 180% of the Exercise Price the<br />

opening price shall be set at 180% of the exercise price; less (B) the exercise price of the options; and such difference (A minus B) will be<br />

divided by the opening price of the Company’s Shares in the LSE on the exercise date. The terms and conditions of the grants are as<br />

follows, whereby all options are settled by physical delivery of shares:<br />

102<br />

Plaza Centers N.V. <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>