Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

O<br />

Br<br />

Mg<br />

Fs<br />

Ai<br />

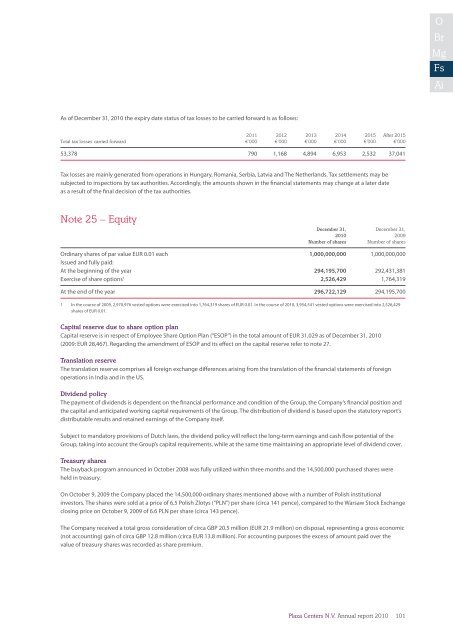

As of December 31, <strong>2010</strong> the expiry date status of tax losses to be carried forward is as follows:<br />

2011 2012 2013 2014 2015 After 2015<br />

Total tax losses carried forward €’000 €’000 €’000 €’000 €’000 €’000<br />

53,378 790 1,168 4,894 6,953 2,532 37,041<br />

Tax losses are mainly generated from operations in Hungary, Romania, Serbia, Latvia and The Netherlands. Tax settlements may be<br />

subjected to inspections by tax authorities. Accordingly, the amounts shown in the financial statements may change at a later date<br />

as a result of the final decision of the tax authorities.<br />

Note 25 – Equity<br />

December 31, December 31,<br />

<strong>2010</strong> 2009<br />

Number of shares Number of shares<br />

Ordinary shares of par value EUR 0.01 each 1,000,000,000 1,000,000,000<br />

Issued and fully paid:<br />

At the beginning of the year 294,195,700 292,431,381<br />

Exercise of share options 1 2,526,429 1,764,319<br />

At the end of the year 296,722,129 294,195,700<br />

1 In the course of 2009, 2,970,976 vested options were exercised into 1,764,319 shares of EUR 0.01. In the course of <strong>2010</strong>, 3,954,541 vested options were exercised into 2,526,429<br />

shares of EUR 0.01.<br />

Capital reserve due to share option plan<br />

Capital reserve is in respect of Employee Share Option Plan (“ESOP”) in the total amount of EUR 31,029 as of December 31, <strong>2010</strong><br />

(2009: EUR 28,467). Regarding the amendment of ESOP and its effect on the capital reserve refer to note 27.<br />

Translation reserve<br />

The translation reserve comprises all foreign exchange differences arising from the translation of the financial statements of foreign<br />

operations in India and in the US.<br />

Dividend policy<br />

The payment of dividends is dependent on the financial performance and condition of the Group, the Company’s financial position and<br />

the capital and anticipated working capital requirements of the Group. The distribution of dividend is based upon the statutory <strong>report</strong>’s<br />

distributable results and retained earnings of the Company itself.<br />

Subject to mandatory provisions of Dutch laws, the dividend policy will reflect the long-term earnings and cash flow potential of the<br />

Group, taking into account the Group’s capital requirements, while at the same time maintaining an appropriate level of dividend cover.<br />

Treasury shares<br />

The buyback program announced in October 2008 was fully utilized within three months and the 14,500,000 purchased shares were<br />

held in treasury.<br />

On October 9, 2009 the Company placed the 14,500,000 ordinary shares mentioned above with a number of Polish institutional<br />

investors. The shares were sold at a price of 6.5 Polish Zlotys (“PLN”) per share (circa 141 pence), compared to the Warsaw Stock Exchange<br />

closing price on October 9, 2009 of 6.6 PLN per share (circa 143 pence).<br />

The Company received a total gross consideration of circa GBP 20.5 million (EUR 21.9 million) on disposal, representing a gross economic<br />

(not accounting) gain of circa GBP 12.8 million (circa EUR 13.8 million). For accounting purposes the excess of amount paid over the<br />

value of treasury shares was recorded as share premium.<br />

<br />

Plaza Centers N.V. <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>101