Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial statements<br />

Notes to the consolidated financial statements<br />

continued<br />

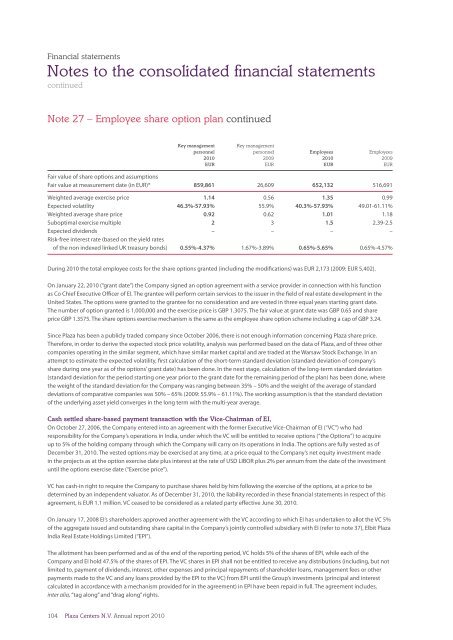

Note 27 – Employee share option plan continued<br />

Key management Key management<br />

personnel personnel Employees Employees<br />

<strong>2010</strong> 2009 <strong>2010</strong> 2009<br />

EUR EUR EUR EUR<br />

Fair value of share options and assumptions<br />

Fair value at measurement date (in EUR)* 859,861 26,609 652,132 516,691<br />

Weighted average exercise price 1.14 0.56 1.35 0.99<br />

Expected volatility 46.3%-57.93% 55.9% 40.3%-57.93% 49.01-61.11%<br />

Weighted average share price 0.92 0.62 1.01 1.18<br />

Suboptimal exercise multiple 2 3 1.5 2.39-2.5<br />

Expected dividends – – – –<br />

Risk-free interest rate (based on the yield rates<br />

of the non indexed linked UK treasury bonds) 0.55%-4.37% 1.67%-3.89% 0.65%-5.65% 0.65%-4.57%<br />

During <strong>2010</strong> the total employee costs for the share options granted (including the modifications) was EUR 2,173 (2009: EUR 5,402).<br />

On January 22, <strong>2010</strong> (“grant date”) the Company signed an option agreement with a service provider in connection with his function<br />

as Co Chief Executive Officer of EI. The grantee will perform certain services to the issuer in the field of real estate development in the<br />

United States. The options were granted to the grantee for no consideration and are vested in three equal years starting grant date.<br />

The number of option granted is 1,000,000 and the exercise price is GBP 1.3075. The fair value at grant date was GBP 0.65 and share<br />

price GBP 1.3575. The share options exercise mechanism is the same as the employee share option scheme including a cap of GBP 3.24.<br />

Since Plaza has been a publicly traded company since October 2006, there is not enough information concerning Plaza share price.<br />

Therefore, in order to derive the expected stock price volatility, analysis was performed based on the data of Plaza, and of three other<br />

companies operating in the similar segment, which have similar market capital and are traded at the Warsaw Stock Exchange. In an<br />

attempt to estimate the expected volatility, first calculation of the short-term standard deviation (standard deviation of company’s<br />

share during one year as of the options’ grant date) has been done. In the next stage, calculation of the long-term standard deviation<br />

(standard deviation for the period starting one year prior to the grant date for the remaining period of the plan) has been done, where<br />

the weight of the standard deviation for the Company was ranging between 35% – 50% and the weight of the average of standard<br />

deviations of comparative companies was 50% – 65% (2009: 55.9% – 61.11%). The working assumption is that the standard deviation<br />

of the underlying asset yield converges in the long term with the multi-year average.<br />

Cash settled share-based payment transaction with the Vice-Chairman of EI,<br />

On October 27, 2006, the Company entered into an agreement with the former Executive Vice-Chairman of EI (“VC”) who had<br />

responsibility for the Company’s operations in India, under which the VC will be entitled to receive options (“the Options”) to acquire<br />

up to 5% of the holding company through which the Company will carry on its operations in India. The options are fully vested as of<br />

December 31, <strong>2010</strong>. The vested options may be exercised at any time, at a price equal to the Company’s net equity investment made<br />

in the projects as at the option exercise date plus interest at the rate of USD LIBOR plus 2% per annum from the date of the investment<br />

until the options exercise date (“Exercise price”).<br />

VC has cash-in right to require the Company to purchase shares held by him following the exercise of the options, at a price to be<br />

determined by an independent valuator. As of December 31, <strong>2010</strong>, the liability recorded in these financial statements in respect of this<br />

agreement, is EUR 1.1 million. VC ceased to be considered as a related party effective June 30, <strong>2010</strong>.<br />

On January 17, 2008 EI’s shareholders approved another agreement with the VC according to which EI has undertaken to allot the VC 5%<br />

of the aggregate issued and outstanding share capital in the Company’s jointly controlled subsidiary with EI (refer to note 37), Elbit Plaza<br />

India Real Estate Holdings Limited (“EPI”).<br />

The allotment has been performed and as of the end of the <strong>report</strong>ing period, VC holds 5% of the shares of EPI, while each of the<br />

Company and EI hold 47.5% of the shares of EPI. The VC shares in EPI shall not be entitled to receive any distributions (including, but not<br />

limited to, payment of dividends, interest, other expenses and principal repayments of shareholder loans, management fees or other<br />

payments made to the VC and any loans provided by the EPI to the VC) from EPI until the Group’s investments (principal and interest<br />

calculated in accordance with a mechanism provided for in the agreement) in EPI have been repaid in full. The agreement includes,<br />

inter alia, “tag along” and “drag along” rights.<br />

104<br />

Plaza Centers N.V. <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>