Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial statements<br />

Notes to the consolidated financial statements<br />

continued<br />

Note 35 – Financial instruments continued<br />

The Company’s Board of Directors’ seeks to maintain a balance between the higher returns that might be possible with higher levels<br />

of borrowings and the advantages and security afforded by a sound capital position.<br />

From time to time the Group purchases its own shares on the market; the timing of these purchases depends on market prices. No<br />

purchase is made unless the expected effect will be to increase earnings per share. The purchase of shares by the Company under this<br />

authority would be effected by a purchase in the market. It should not be confused with any share dealing facilities that may be offered<br />

to shareholders by the Company from time to time.<br />

At present employees hold 0% of ordinary shares, but with future potential of about 6.5% assuming that all outstanding employee share<br />

options vest and are exercised at maximum price of 324 pence.<br />

The Company’s Board of Directors was authorized by the general meeting of the shareholders to allot equity securities (including<br />

rights to acquire equity securities) in the Company up to an aggregate nominal value of approximately EUR 978 thousands, being<br />

approximately 33% of the Company’s issued ordinary share capital as at May 25, <strong>2010</strong>. Such authorization shall expire on the conclusion<br />

of the <strong>Annual</strong> General Meeting which will be held in May 2011. There were no changes in the Group’s approach to capital management<br />

during the year.<br />

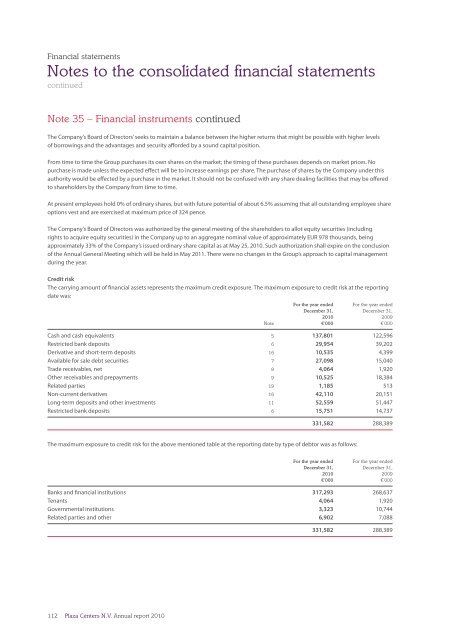

Credit risk<br />

The carrying amount of financial assets represents the maximum credit exposure. The maximum exposure to credit risk at the <strong>report</strong>ing<br />

date was:<br />

For the year ended For the year ended<br />

December 31, December 31,<br />

<strong>2010</strong> 2009<br />

Note €’000 €’000<br />

Cash and cash equivalents 5 137,801 122,596<br />

Restricted bank deposits 6 29,954 39,202<br />

Derivative and short-term deposits 16 10,535 4,399<br />

Available for sale debt securities 7 27,098 15,040<br />

Trade receivables, net 8 4,064 1,920<br />

Other receivables and prepayments 9 10,525 18,384<br />

Related parties 19 1,185 513<br />

Non-current derivatives 16 42,110 20,151<br />

Long-term deposits and other investments 11 52,559 51,447<br />

Restricted bank deposits 6 15,751 14,737<br />

331,582 288,389<br />

The maximum exposure to credit risk for the above mentioned table at the <strong>report</strong>ing date by type of debtor was as follows:<br />

For the year ended For the year ended<br />

December 31, December 31,<br />

<strong>2010</strong> 2009<br />

€’000 €’000<br />

Banks and financial institutions 317,293 268,637<br />

Tenants 4,064 1,920<br />

Governmental institutions 3,323 10,744<br />

Related parties and other 6,902 7,088<br />

331,582 288,389<br />

112<br />

Plaza Centers N.V. <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>