Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements<br />

Notes to the consolidated financial statements<br />

continued<br />

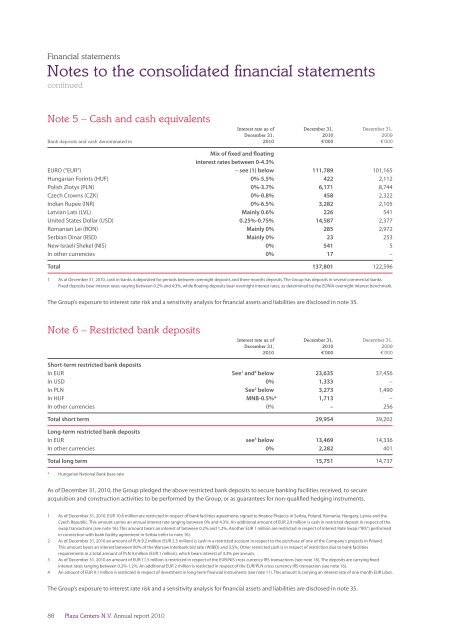

Note 5 – Cash and cash equivalents<br />

Interest rate as of December 31, December 31,<br />

December 31, <strong>2010</strong> 2009<br />

Bank deposits and cash denominated in <strong>2010</strong> €’000 €’000<br />

Mix of fixed and floating<br />

interest rates between 0-4.3%<br />

EURO (“EUR”) – see (1) below 111,789 101,165<br />

Hungarian Forints (HUF) 0%-5.5% 422 2,112<br />

Polish Zlotys (PLN) 0%-3.7% 6,171 8,744<br />

Czech Crowns (CZK) 0%-0.8% 458 2,322<br />

Indian Rupee (INR) 0%-6.5% 3,282 2,105<br />

Latvian Lats (LVL) Mainly 0.6% 226 541<br />

United States Dollar (USD) 0.25%-0.75% 14,587 2,377<br />

Romanian Lei (RON) Mainly 0% 285 2,972<br />

Serbian Dinar (RSD) Mainly 0% 23 253<br />

New Israeli Shekel (NIS) 0% 541 5<br />

In other currencies 0% 17 –<br />

Total 137,801 122,596<br />

1 As at December 31, <strong>2010</strong>, cash in banks is deposited for periods between overnight deposits and three months deposits. The Group has deposits in several commercial banks.<br />

Fixed deposits bear interest rates varying between 0.2% and 4.3%, while floating deposits bear overnight interest rates, as determined by the EONIA overnight interest benchmark.<br />

The Group’s exposure to interest rate risk and a sensitivity analysis for financial assets and liabilities are disclosed in note 35.<br />

Note 6 – Restricted bank deposits<br />

Interest rate as of December 31, December 31,<br />

December 31, <strong>2010</strong> 2009<br />

<strong>2010</strong> €’000 €’000<br />

Short-term restricted bank deposits<br />

In EUR See 1 and 4 below 23,635 37,456<br />

In USD 0% 1,333 –<br />

In PLN See 2 below 3,273 1,490<br />

In HUF MNB-0.5%* 1,713 –<br />

In other currencies 0% – 256<br />

Total short term 29,954 39,202<br />

Long-term restricted bank deposits<br />

In EUR see 3 below 13,469 14,336<br />

In other currencies 0% 2,282 401<br />

Total long term 15,751 14,737<br />

* Hungarian National Bank base rate<br />

As of December 31, <strong>2010</strong>, the Group pledged the above restricted bank deposits to secure banking facilities received, to secure<br />

acquisition and construction activities to be performed by the Group, or as guarantees for non-qualified hedging instruments.<br />

1 As of December 31, <strong>2010</strong>, EUR 10.6 million are restricted in respect of bank facilities agreements signed to finance Projects in Serbia, Poland, Romania, Hungary, Latvia and the<br />

Czech Republic. This amount carries an annual interest rate ranging between 0% and 4.3%. An additional amount of EUR 2.9 million is cash in restricted deposit in respect of the<br />

swap transactions (see note 16). This amount bears an interest of between 0.2% and 1.2%. Another EUR 1 million are restricted in respect of Interest Rate Swap (“IRS”) performed<br />

in connection with bank facility agreement in Serbia (refer to note 16).<br />

2 As of December 31, <strong>2010</strong> an amount of PLN 9.2 million (EUR 2.3 million) is cash in a restricted account in respect to the purchase of one of the Company’s projects in Poland.<br />

This amount bears an interest between 80% of the Warsaw Interbank bid rate (WIBID) and 3.5%. Other restricted cash is in respect of restriction due to bank facilities<br />

requirements in a total amount of PLN 4 million (EUR 1 million), which bears interest of 3.3% per annum.<br />

3 As of December 31, <strong>2010</strong> an amount of EUR 11.5 million is restricted in respect of the EUR/NIS cross currency IRS transactions (see note 16). The deposits are carrying fixed<br />

interest rates ranging between 0.2%-1.2%. An additional EUR 2 million is restricted in respect of the EUR/PLN cross currency IRS transaction (see note 16).<br />

4 An amount of EUR 9.1 million is restricted in respect of investment in long-term financial instruments (see note 11). This amount is carrying an interest rate of one month EUR Libor.<br />

The Group’s exposure to interest rate risk and a sensitivity analysis for financial assets and liabilities are disclosed in note 35.<br />

88<br />

Plaza Centers N.V. <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>