Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial statements<br />

Notes to the consolidated financial statements<br />

continued<br />

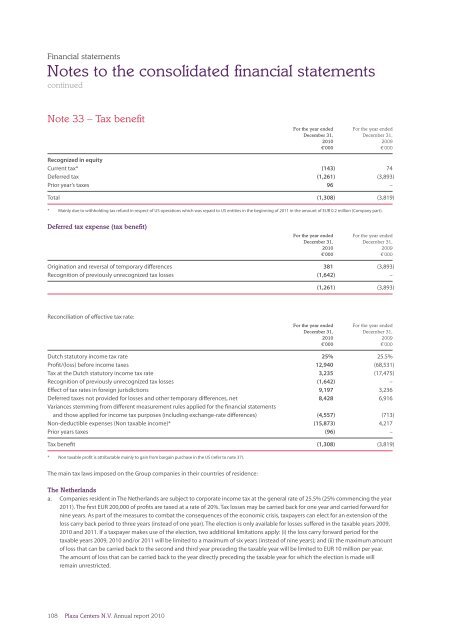

Note 33 – Tax benefit<br />

For the year ended For the year ended<br />

December 31, December 31,<br />

<strong>2010</strong> 2009<br />

€’000 €’000<br />

Recognized in equity<br />

Current tax* (143) 74<br />

Deferred tax (1,261) (3,893)<br />

Prior year’s taxes 96 –<br />

Total (1,308) (3,819)<br />

* Mainly due to withholding tax refund in respect of US operations which was repaid to US entities in the beginning of 2011 in the amount of EUR 0.2 million (Company part).<br />

Deferred tax expense (tax benefit)<br />

For the year ended For the year ended<br />

December 31, December 31,<br />

<strong>2010</strong> 2009<br />

€’000 €’000<br />

Origination and reversal of temporary differences 381 (3,893)<br />

Recognition of previously unrecognized tax losses (1,642) –<br />

(1,261) (3,893)<br />

Reconciliation of effective tax rate:<br />

For the year ended For the year ended<br />

December 31, December 31,<br />

<strong>2010</strong> 2009<br />

€’000 €’000<br />

Dutch statutory income tax rate 25% 25.5%<br />

Profit/(loss) before income taxes 12,940 (68,531)<br />

Tax at the Dutch statutory income tax rate 3,235 (17,475)<br />

Recognition of previously unrecognized tax losses (1,642) –<br />

Effect of tax rates in foreign jurisdictions 9,197 3,236<br />

Deferred taxes not provided for losses and other temporary differences, net 8,428 6,916<br />

Variances stemming from different measurement rules applied for the financial statements<br />

and those applied for income tax purposes (including exchange-rate differences) (4,557) (713)<br />

Non-deductible expenses (Non taxable income)* (15,873) 4,217<br />

Prior years taxes (96) –<br />

Tax benefit (1,308) (3,819)<br />

* Non taxable profit is attributable mainly to gain from bargain purchase in the US (refer to note 37).<br />

The main tax laws imposed on the Group companies in their countries of residence:<br />

The Netherlands<br />

a. Companies resident in The Netherlands are subject to corporate income tax at the general rate of 25.5% (25% commencing the year<br />

2011). The first EUR 200,000 of profits are taxed at a rate of 20%. Tax losses may be carried back for one year and carried forward for<br />

nine years. As part of the measures to combat the consequences of the economic crisis, taxpayers can elect for an extension of the<br />

loss carry back period to three years (instead of one year). The election is only available for losses suffered in the taxable years 2009,<br />

<strong>2010</strong> and 2011. If a taxpayer makes use of the election, two additional limitations apply: (i) the loss carry forward period for the<br />

taxable years 2009, <strong>2010</strong> and/or 2011 will be limited to a maximum of six years (instead of nine years); and (ii) the maximum amount<br />

of loss that can be carried back to the second and third year preceding the taxable year will be limited to EUR 10 million per year.<br />

The amount of loss that can be carried back to the year directly preceding the taxable year for which the election is made will<br />

remain unrestricted.<br />

108<br />

Plaza Centers N.V. <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>