Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial statements<br />

Notes to the consolidated financial statements<br />

continued<br />

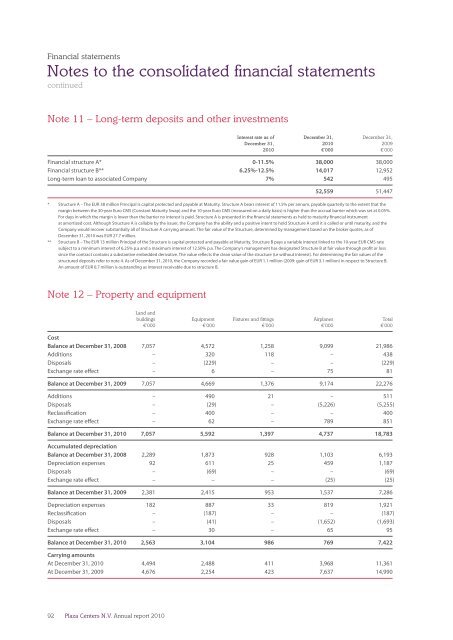

Note 11 – Long-term deposits and other investments<br />

Interest rate as of December 31, December 31,<br />

December 31, <strong>2010</strong> 2009<br />

<strong>2010</strong> €’000 €’000<br />

Financial structure A* 0-11.5% 38,000 38,000<br />

Financial structure B** 6.25%-12.5% 14,017 12,952<br />

Long-term loan to associated Company 7% 542 495<br />

52,559 51,447<br />

* Structure A – The EUR 38 million Principal is capital protected and payable at Maturity. Structure A bears interest of 11.5% per annum, payable quarterly to the extent that the<br />

margin between the 30-year Euro CMS (Constant Maturity Swap) and the 10-year Euro CMS (measured on a daily basis) is higher than the accrual barrier which was set at 0.05%.<br />

For days in which the margin is lower than the barrier no interest is paid. Structure A is presented in the financial statements as held to maturity financial instrument<br />

at amortized cost. Although Structure A is callable by the issuer, the Company has the ability and a positive intent to hold Structure A until it is called or until maturity, and the<br />

Company would recover substantially all of Structure A carrying amount. The fair value of the Structure, determined by management based on the broker quotes, as of<br />

December 31, <strong>2010</strong> was EUR 27.7 million.<br />

** Structure B – The EUR 13 million Principal of the Structure is capital protected and payable at Maturity. Structure B pays a variable interest linked to the 10-year EUR CMS rate<br />

subject to a minimum interest of 6.25% p.a and a maximum interest of 12.50% p.a. The Company’s management has designated Structure B at fair value through profit or loss<br />

since the contract contains a substantive embedded derivative. The value reflects the clean value of the structure (i.e without interest). For determining the fair values of the<br />

structured deposits refer to note 4. As of December 31, <strong>2010</strong>, the Company recorded a fair value gain of EUR 1.1 million (2009: gain of EUR 3.1 million) in respect to Structure B.<br />

An amount of EUR 0.7 million is outstanding as interest receivable due to structure B.<br />

Note 12 – Property and equipment<br />

Land and<br />

buildings Equipment Fixtures and fittings Airplanes Total<br />

€’000 €’000 €’000 €’000 €’000<br />

Cost<br />

Balance at December 31, 2008 7,057 4,572 1,258 9,099 21,986<br />

Additions – 320 118 – 438<br />

Disposals – (229) – – (229)<br />

Exchange rate effect – 6 – 75 81<br />

Balance at December 31, 2009 7,057 4,669 1,376 9,174 22,276<br />

Additions – 490 21 – 511<br />

Disposals – (29) – (5,226) (5,255)<br />

Reclassification – 400 – – 400<br />

Exchange rate effect – 62 – 789 851<br />

Balance at December 31, <strong>2010</strong> 7,057 5,592 1,397 4,737 18,783<br />

Accumulated depreciation<br />

Balance at December 31, 2008 2,289 1,873 928 1,103 6,193<br />

Depreciation expenses 92 611 25 459 1,187<br />

Disposals – (69) – – (69)<br />

Exchange rate effect – – – (25) (25)<br />

Balance at December 31, 2009 2,381 2,415 953 1,537 7,286<br />

Depreciation expenses 182 887 33 819 1,921<br />

Reclassification – (187) – – (187)<br />

Disposals – (41) – (1,652) (1,693)<br />

Exchange rate effect – 30 – 65 95<br />

Balance at December 31, <strong>2010</strong> 2,563 3,104 986 769 7,422<br />

Carrying amounts<br />

At December 31, <strong>2010</strong> 4,494 2,488 411 3,968 11,361<br />

At December 31, 2009 4,676 2,254 423 7,637 14,990<br />

92<br />

Plaza Centers N.V. <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>