Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

O<br />

Br<br />

Mg<br />

Fs<br />

Ai<br />

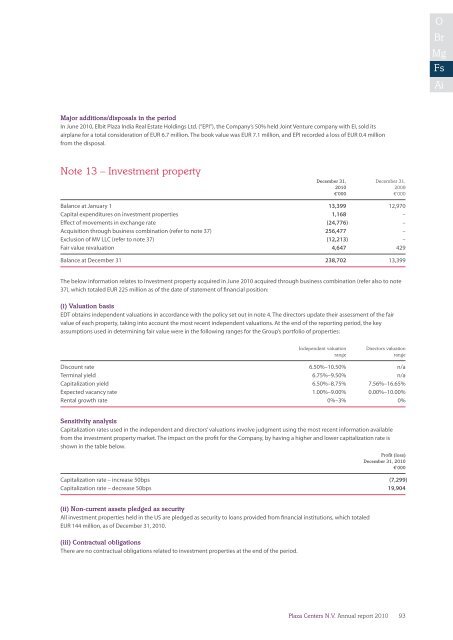

Major additions/disposals in the period<br />

In June <strong>2010</strong>, Elbit Plaza India Real Estate Holdings Ltd. (“EPI”), the Company’s 50% held Joint Venture company with EI, sold its<br />

airplane for a total consideration of EUR 6.7 million. The book value was EUR 7.1 million, and EPI recorded a loss of EUR 0.4 million<br />

from the disposal.<br />

Note 13 – Investment property<br />

December 31, December 31,<br />

<strong>2010</strong> 2009<br />

€’000 €’000<br />

Balance at January 1 13,399 12,970<br />

Capital expenditures on investment properties 1,168 –<br />

Effect of movements in exchange rate (24,776) –<br />

Acquisition through business combination (refer to note 37) 256,477 –<br />

Exclusion of MV LLC (refer to note 37) (12,213) –<br />

Fair value revaluation 4,647 429<br />

Balance at December 31 238,702 13,399<br />

The below information relates to Investment property acquired in June <strong>2010</strong> acquired through business combination (refer also to note<br />

37), which totaled EUR 225 million as of the date of statement of financial position:<br />

(i) Valuation basis<br />

EDT obtains independent valuations in accordance with the policy set out in note 4. The directors update their assessment of the fair<br />

value of each property, taking into account the most recent independent valuations. At the end of the <strong>report</strong>ing period, the key<br />

assumptions used in determining fair value were in the following ranges for the Group’s portfolio of properties:<br />

Independent valuation<br />

range<br />

Directors valuation<br />

range<br />

Discount rate 6.50%–10.50% n/a<br />

Terminal yield 6.75%–9.50% n/a<br />

Capitalization yield 6.50%–8.75% 7.56%–16.65%<br />

Expected vacancy rate 1.00%–9.00% 0.00%–10.00%<br />

Rental growth rate 0%–3% 0%<br />

Sensitivity analysis<br />

Capitalization rates used in the independent and directors’ valuations involve judgment using the most recent information available<br />

from the investment property market. The impact on the profit for the Company, by having a higher and lower capitalization rate is<br />

shown in the table below.<br />

Profit (loss)<br />

December 31, <strong>2010</strong><br />

€’000<br />

Capitalization rate – increase 50bps (7,299)<br />

Capitalization rate – decrease 50bps 19,904<br />

(ii) Non-current assets pledged as security<br />

All investment properties held in the US are pledged as security to loans provided from financial institutions, which totaled<br />

EUR 144 million, as of December 31, <strong>2010</strong>.<br />

(iii) Contractual obligations<br />

There are no contractual obligations related to investment properties at the end of the period.<br />

<br />

Plaza Centers N.V. <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>93