Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements<br />

Notes to the consolidated financial statements<br />

continued<br />

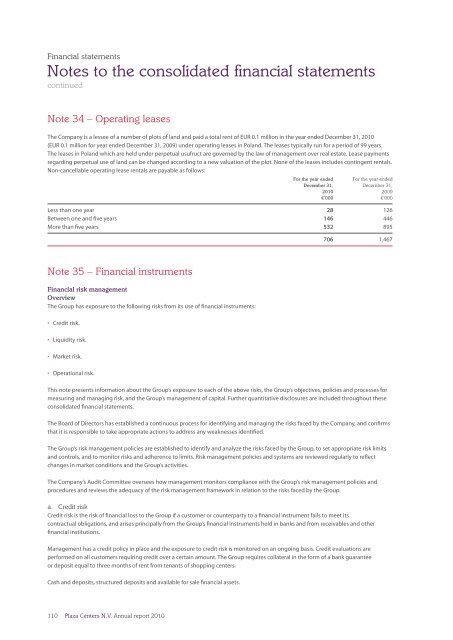

Note 34 – Operating leases<br />

The Company is a lessee of a number of plots of land and paid a total rent of EUR 0.1 million in the year ended December 31, <strong>2010</strong><br />

(EUR 0.1 million for year ended December 31, 2009) under operating leases in Poland. The leases typically run for a period of 99 years.<br />

The leases in Poland which are held under perpetual usufruct are governed by the law of management over real estate. Lease payments<br />

regarding perpetual use of land can be changed according to a new valuation of the plot. None of the leases includes contingent rentals.<br />

Non-cancellable operating lease rentals are payable as follows:<br />

For the year ended For the year ended<br />

December 31, December 31,<br />

<strong>2010</strong> 2009<br />

€’000 €’000<br />

Less than one year 28 126<br />

Between one and five years 146 446<br />

More than five years 532 895<br />

706 1,467<br />

Note 35 – Financial instruments<br />

Financial risk management<br />

Overview<br />

The Group has exposure to the following risks from its use of financial instruments:<br />

• Credit risk.<br />

• Liquidity risk.<br />

• Market risk.<br />

• Operational risk.<br />

This note presents information about the Group’s exposure to each of the above risks, the Group’s objectives, policies and processes for<br />

measuring and managing risk, and the Group’s management of capital. Further quantitative disclosures are included throughout these<br />

consolidated financial statements.<br />

The Board of Directors has established a continuous process for identifying and managing the risks faced by the Company, and confirms<br />

that it is responsible to take appropriate actions to address any weaknesses identified.<br />

The Group’s risk management policies are established to identify and analyze the risks faced by the Group, to set appropriate risk limits<br />

and controls, and to monitor risks and adherence to limits. Risk management policies and systems are reviewed regularly to reflect<br />

changes in market conditions and the Group’s activities.<br />

The Company’s Audit Committee oversees how management monitors compliance with the Group’s risk management policies and<br />

procedures and reviews the adequacy of the risk management framework in relation to the risks faced by the Group.<br />

a. Credit risk<br />

Credit risk is the risk of financial loss to the Group if a customer or counterparty to a financial instrument fails to meet its<br />

contractual obligations, and arises principally from the Group’s financial instruments held in banks and from receivables and other<br />

financial institutions.<br />

Management has a credit policy in place and the exposure to credit risk is monitored on an ongoing basis. Credit evaluations are<br />

performed on all customers requiring credit over a certain amount. The Group requires collateral in the form of a bank guarantee<br />

or deposit equal to three months of rent from tenants of shopping centers.<br />

Cash and deposits, structured deposits and available for sale financial assets.<br />

110<br />

Plaza Centers N.V. <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>