Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Overview<br />

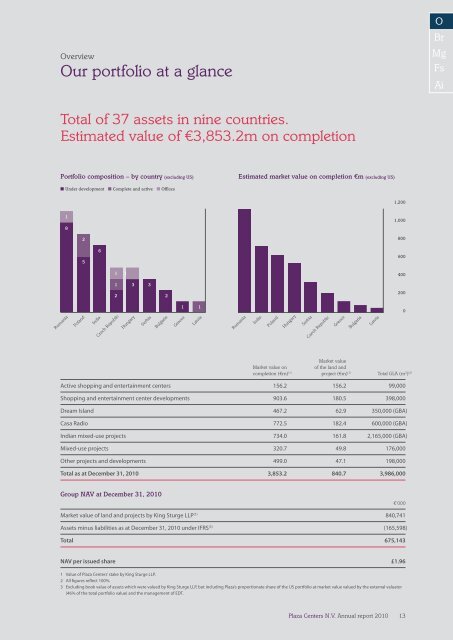

Our portfolio at a glance<br />

O<br />

Br<br />

Mg<br />

Fs<br />

Ai<br />

Total of 37 assets in nine countries.<br />

Estimated value of €3,853.2m on completion<br />

Portfolio composition – by country (excluding US)<br />

Estimated market value on completion €m (excluding US)<br />

■ Under development ■ Complete and active ■ Offices<br />

1,200<br />

1<br />

8<br />

1,000<br />

2<br />

5<br />

6<br />

800<br />

600<br />

1<br />

1<br />

400<br />

1<br />

3 3<br />

2<br />

2<br />

200<br />

Romania<br />

Poland<br />

India<br />

Czech Republic<br />

Hungary<br />

Serbia<br />

Bulgaria<br />

Greece<br />

1 1<br />

Latvia<br />

Romania<br />

India<br />

Poland<br />

Hungary<br />

Serbia<br />

Czech Republic<br />

Greece<br />

Bulgaria<br />

Latvia<br />

0<br />

Market value<br />

Market value on<br />

of the land and<br />

completion (€m) (1) project (€m) (1) Total GLA (m 2 ) (2)<br />

Active shopping and entertainment centers 156.2 156.2 99,000<br />

Shopping and entertainment center developments 903.6 180.5 398,000<br />

Dream Island 467.2 62.9 350,000 (GBA)<br />

Casa Radio 772.5 182.4 600,000 (GBA)<br />

Indian mixed-use projects 734.0 161.8 2,165,000 (GBA)<br />

Mixed-use projects 320.7 49.8 176,000<br />

Other projects and developments 499.0 47.1 198,000<br />

Total as at December 31, <strong>2010</strong> 3,853.2 840.7 3,986,000<br />

Group NAV at December 31, <strong>2010</strong><br />

€’000<br />

Market value of land and projects by King Sturge LLP (1) 840,741<br />

Assets minus liabilities as at December 31, <strong>2010</strong> under IFRS (3) (165,598)<br />

Total 675,143<br />

NAV per issued share £1.96<br />

1 Value of Plaza Centers’ stake by King Sturge LLP.<br />

2 All figures reflect 100%.<br />

3 Excluding book value of assets which were valued by King Sturge LLP, but including Plaza’s proportionate share of the US portfolio at market value valued by the external valuator<br />

(46% of the total portfolio value) and the management of EDT.<br />

<br />

Plaza Centers N.V. <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>13