Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial statements<br />

Notes to the consolidated financial statements<br />

continued<br />

Note 13 – Investment property continued<br />

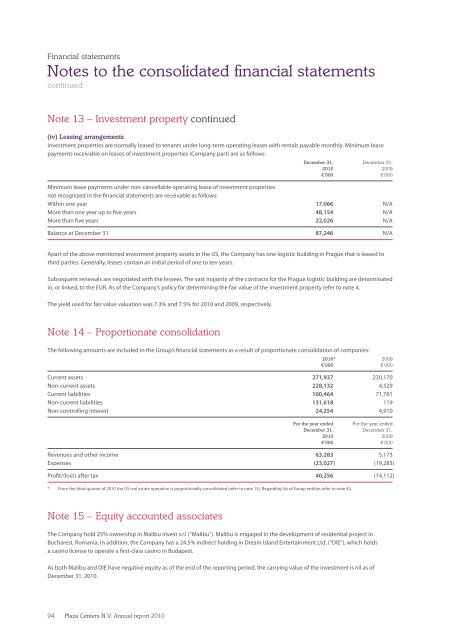

(iv) Leasing arrangements<br />

Investment properties are normally leased to tenants under long-term operating leases with rentals payable monthly. Minimum lease<br />

payments receivable on leases of investment properties (Company part) are as follows:<br />

December 31, December 31,<br />

<strong>2010</strong> 2009<br />

€’000 €’000<br />

Minimum lease payments under non-cancellable operating lease of investment properties<br />

not recognized in the financial statements are receivable as follows:<br />

Within one year 17,066 N/A<br />

More than one year up to five years 48,154 N/A<br />

More than five years 22,026 N/A<br />

Balance at December 31 87,246 N/A<br />

Apart of the above mentioned investment property assets in the US, the Company has one logistic building in Prague that is leased to<br />

third parties. Generally, leases contain an initial period of one to ten years.<br />

Subsequent renewals are negotiated with the lessees. The vast majority of the contracts for the Prague logistic building are denominated<br />

in, or linked, to the EUR. As of the Company’s policy for determining the fair value of the investment property refer to note 4.<br />

The yield used for fair value valuation was 7.3% and 7.5% for <strong>2010</strong> and 2009, respectively.<br />

Note 14 – Proportionate consolidation<br />

The following amounts are included in the Group’s financial statements as a result of proportionate consolidation of companies:<br />

<strong>2010</strong>* 2009<br />

€’000 €’000<br />

Current assets 271,937 230,170<br />

Non-current assets 228,132 4,529<br />

Current liabilities 100,464 71,761<br />

Non-current liabilities 131,618 119<br />

Non-controlling interest 24,254 4,910<br />

For the year ended For the year ended<br />

December 31, December 31,<br />

<strong>2010</strong> 2009<br />

€’000 €’000<br />

Revenues and other income 63,283 5,173<br />

Expenses (23,027) (19,285)<br />

Profit/(loss) after tax 40,256 (14,112)<br />

* From the third quarter of <strong>2010</strong> the US real estate operation is proportionally consolidated (refer to note 15). Regarding list of Group entities refer to note 42.<br />

Note 15 – Equity accounted associates<br />

The Company hold 25% ownership in Malibu invest s.r.l (“Malibu”). Malibu is engaged in the development of residential project in<br />

Bucharest, Romania. In addition, the Company has a 24.5% indirect holding in Dream Island Entertainment Ltd. (“DIE”), which holds<br />

a casino license to operate a first-class casino in Budapest.<br />

As both Malibu and DIE have negative equity as of the end of the <strong>report</strong>ing period, the carrying value of the investment is nil as of<br />

December 31, <strong>2010</strong>.<br />

94<br />

Plaza Centers N.V. <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>