Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial statements<br />

Notes to the consolidated financial statements<br />

continued<br />

Note 41 – Critical accounting judgments and key sources<br />

of estimation uncertainty continued<br />

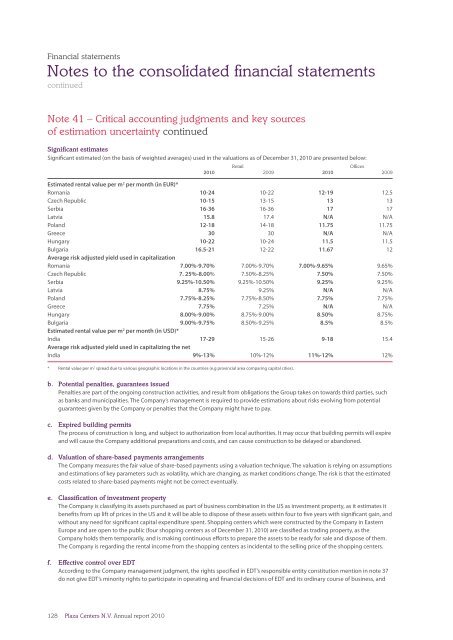

Significant estimates<br />

Significant estimated (on the basis of weighted averages) used in the valuations as of December 31, <strong>2010</strong> are presented below:<br />

Retail<br />

Offices<br />

<strong>2010</strong> 2009 <strong>2010</strong> 2009<br />

Estimated rental value per m 2 per month (in EUR)*<br />

Romania 10-24 10-22 12-19 12.5<br />

Czech Republic 10-15 13-15 13 13<br />

Serbia 16-36 16-36 17 17<br />

Latvia 15.8 17.4 N/A N/A<br />

Poland 12-18 14-18 11.75 11.75<br />

Greece 30 30 N/A N/A<br />

Hungary 10-22 10-24 11.5 11.5<br />

Bulgaria 16.5-21 12-22 11.67 12<br />

Average risk adjusted yield used in capitalization<br />

Romania 7.00%-9.70% 7.00%-9.70% 7.00%-9.65% 9.65%<br />

Czech Republic 7. 25%-8.00% 7.50%-8.25% 7.50% 7.50%<br />

Serbia 9.25%-10.50% 9.25%-10.50% 9.25% 9.25%<br />

Latvia 8.75% 9.25% N/A N/A<br />

Poland 7.75%-8.25% 7.75%-8.50% 7.75% 7.75%<br />

Greece 7.75% 7.25% N/A N/A<br />

Hungary 8.00%-9.00% 8.75%-9.00% 8.50% 8.75%<br />

Bulgaria 9.00%-9.75% 8.50%-9.25% 8.5% 8.5%<br />

Estimated rental value per m 2 per month (in USD)*<br />

India 17-29 15-26 9-18 15.4<br />

Average risk adjusted yield used in capitalizing the net<br />

India 9%-13% 10%-12% 11%-12% 12%<br />

* Rental value per m 2 spread due to various geographic locations in the countries (e.g provincial area comparing capital cities).<br />

b. Potential penalties, guarantees issued<br />

Penalties are part of the ongoing construction activities, and result from obligations the Group takes on towards third parties, such<br />

as banks and municipalities. The Company’s management is required to provide estimations about risks evolving from potential<br />

guarantees given by the Company or penalties that the Company might have to pay.<br />

c. Expired building permits<br />

The process of construction is long, and subject to authorization from local authorities. It may occur that building permits will expire<br />

and will cause the Company additional preparations and costs, and can cause construction to be delayed or abandoned.<br />

d. Valuation of share-based payments arrangements<br />

The Company measures the fair value of share-based payments using a valuation technique. The valuation is relying on assumptions<br />

and estimations of key parameters such as volatility, which are changing, as market conditions change. The risk is that the estimated<br />

costs related to share-based payments might not be correct eventually.<br />

e. Classification of investment property<br />

The Company is classifying its assets purchased as part of business combination in the US as investment property, as it estimates it<br />

benefits from up lift of prices in the US and it will be able to dispose of these assets within four to five years with significant gain, and<br />

without any need for significant capital expenditure spent. Shopping centers which were constructed by the Company in Eastern<br />

Europe and are open to the public (four shopping centers as of December 31, <strong>2010</strong>) are classified as trading property, as the<br />

Company holds them temporarily, and is making continuous efforts to prepare the assets to be ready for sale and dispose of them.<br />

The Company is regarding the rental income from the shopping centers as incidental to the selling price of the shopping centers.<br />

f. Effective control over EDT<br />

According to the Company management judgment, the rights specified in EDT’s responsible entity constitution mention in note 37<br />

do not give EDT’s minority rights to participate in operating and financial decisions of EDT and its ordinary course of business, and<br />

128<br />

Plaza Centers N.V. <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>