Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

O<br />

Br<br />

Mg<br />

Fs<br />

Ai<br />

• As a result of that transaction, EPN gained control (48%) in EDT<br />

and purchased 50% in the management company partnering<br />

with DDR (shopping malls management company that<br />

manages approximately 570 properties in the US, Brazil and<br />

Puerto Rico) for approximately US$120 million.<br />

• EDT currently holds and manages 48 active commercial centers<br />

in 20 states in the US with an aggregate property value of<br />

approximately US$1.4 billion.<br />

• The properties generate annual net operating income of over<br />

US$100 million.<br />

• These centers are 90% occupied where approximately 80%<br />

of annual revenues from rental derive from retail anchors with<br />

nationwide locations who are signed on long-term leases.<br />

• The properties have rentable areas spanning over<br />

1.02 million m 2 which are leased to hundreds of diverse tenants.<br />

Progress to date<br />

Since the acquisition of EDT, the Company has made good<br />

progress, among others, by securing additional long-term<br />

credit, leasing of vacant spaces and reorganizing the<br />

management’s structure.<br />

Financing<br />

• A debt in the headquarters’ level was repaid in the amount<br />

of approximately US$108 million that was due for immediate<br />

repayment and currently the Company is not indebted at<br />

this level.<br />

• In September <strong>2010</strong>, a refinancing of approximately US$380<br />

million was carried out in two different property portfolios in<br />

attractive (and mainly fixed) interest rates for long term and<br />

that is based on the Company’s estimate that in the coming<br />

years interest may increase.<br />

• In March 2011, the Trust closed another US$115 million<br />

non-recourse refinancing for five years. Proceeds from the<br />

refinance will be used to repay current debt of US$103.2 million<br />

and the rest will be used for the Trust’s long-term capital goal<br />

to fund its business and provide future operational flexibility.<br />

Leasing<br />

• The Company increased the occupancy rates by leasing vacant<br />

spaces and renewing leases with existing tenants. Since the<br />

acquisition leasing activity was robust and the trust successfully<br />

leased more than 1.3 million ft 2 or 12.2% of the portfolio.<br />

Changing the management’s structure<br />

• The management’s focus was pushed to the US from Australia<br />

while focusing on proactive management of the properties.<br />

• In March 2011 EPN announced an off-market takeover bid to<br />

acquire all of the outstanding units of EDT that its affiliates do<br />

not already own (“Bid”). EPN’s unconditional offer is to buy<br />

all outstanding units of EDT that EPN does not already own<br />

(approximately 52%) for AUS$0.078 cash per EDT unit.<br />

Charter Hall transaction<br />

• In December <strong>2010</strong>, the Company entered into an agreement<br />

with the Australian company Charter Hall to purchase seven<br />

commercial centers of grocery anchored shopping centers type<br />

in the US at property value of US$75 million.<br />

The acquired centers are located in three different states<br />

in the US<br />

650,000 ft 2 (60,000 m 2 ) of gross rentable area<br />

91% shopping center occupancy<br />

US$7 million net operating income per annum<br />

9.2% return on the purchase price<br />

The Company’s strategy in new transactions<br />

and purchases<br />

We intend to carry out additional purchases of quality property<br />

and individual property portfolios. Furthermore, purchase of<br />

Mall type properties will be considered. The EDT and Charter Hall<br />

transactions shall constitute a platform to purchase additional<br />

properties which will be in line with our investment profile.<br />

Once exit yields decline sufficiently, the Company intends<br />

to realize the properties while generating capital gains.<br />

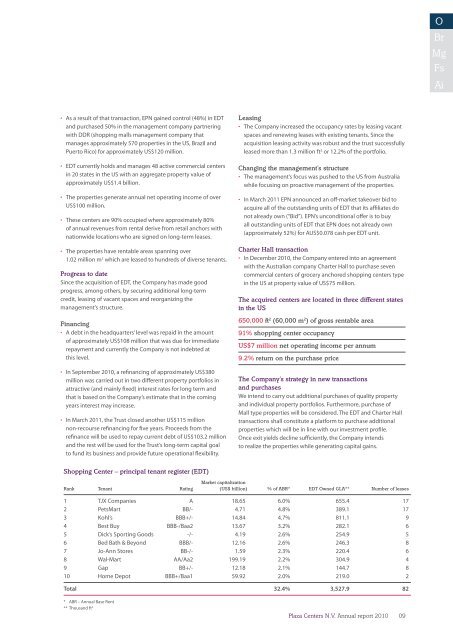

Shopping Center – principal tenant register (EDT)<br />

Market capitalization<br />

Rank Tenant Rating (US$ billion) % of ABR* EDT Owned GLA** Number of leases<br />

1 TJX Companies A 18.65 6.0% 655.4 17<br />

2 PetsMart BB/- 4.71 4.8% 389.1 17<br />

3 Kohl’s BBB+/- 14.84 4.7% 811.1 9<br />

4 Best Buy BBB-/Baa2 13.67 3.2% 282.1 6<br />

5 Dick’s Sporting Goods -/- 4.19 2.6% 254.9 5<br />

6 Bed Bath & Beyond BBB/- 12.16 2.6% 246.3 8<br />

7 Jo-Ann Stores BB-/- 1.59 2.3% 220.4 6<br />

8 Wal-Mart AA/Aa2 199.19 2.2% 304.9 4<br />

9 Gap BB+/- 12.18 2.1% 144.7 8<br />

10 Home Depot BBB+/Baa1 59.92 2.0% 219.0 2<br />

Total 32.4% 3,527.9 82<br />

* ABR – <strong>Annual</strong> Base Rent<br />

** Thousand ft 2<br />

<br />

Plaza Centers N.V. <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>09