Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

O<br />

Br<br />

Mg<br />

Fs<br />

Ai<br />

The net proceeds of the Placement and Entitlement Offer were used for the repayment of the amounts outstanding under EDT’s<br />

unsecured debt and derivative liabilities.<br />

Following the completion of the above transactions, EPN is fully consolidating the financial statements of the Trust with non-controlling<br />

interest of 52.2%, as of June 18 <strong>2010</strong>.<br />

The June 30, <strong>2010</strong> effective date was modified to June 18, <strong>2010</strong> to adequately reflect the business combination performed.<br />

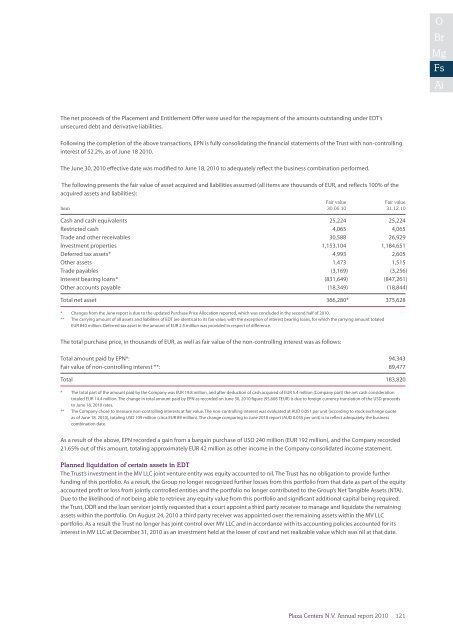

The following presents the fair value of asset acquired and liabilities assumed (all items are thousands of EUR, and reflects 100% of the<br />

acquired assets and liabilities):<br />

Fair value<br />

Fair value<br />

Item 30.06.10 31.12.10<br />

Cash and cash equivalents 25,224 25,224<br />

Restricted cash 4,065 4,065<br />

Trade and other receivables 30,588 26,929<br />

Investment properties 1,153,104 1,184,651<br />

Deferred tax assets* 4,993 2,605<br />

Other assets 1,473 1,515<br />

Trade payables (3,169) (3,256)<br />

Interest bearing loans* (831,649) (847,261)<br />

Other accounts payable (18,349) (18,844)<br />

Total net asset 366,280* 375,628<br />

* Changes from the June <strong>report</strong> is due to the updated Purchase Price Allocation <strong>report</strong>ed, which was concluded in the second half of <strong>2010</strong>.<br />

** The carrying amount of all assets and liabilities of EDT are identical to its fair value, with the exception of interest bearing loans, for which the carrying amount totaled<br />

EUR 840 million. Deferred tax asset in the amount of EUR 2.5 million was provided in respect of difference.<br />

The total purchase price, in thousands of EUR, as well as fair value of the non-controlling interest was as follows:<br />

Total amount paid by EPN*: 94,343<br />

Fair value of non-controlling interest **: 89,477<br />

Total 183,820<br />

* The total part of the amount paid by the Company was EUR 19.8 million, and after deduction of cash acquired of EUR 5.4 million (Company part) the net cash consideration<br />

totaled EUR 14.4 million. The change in total amount paid by EPN as recorded on June 30, <strong>2010</strong> figure (95,608 TEUR) is due to foreign currency translation of the USD proceeds<br />

to June 18, <strong>2010</strong> rates.<br />

** The Company chose to measure non-controlling interests at fair value. The non-controlling interest was evaluated at AUD 0.051 per unit (according to stock exchange quote<br />

as of June 18, <strong>2010</strong>), totaling USD 109 million (circa EUR 89 million). The change comparing to June <strong>2010</strong> <strong>report</strong> (AUD 0.055 per unit) is to reflect adequately the business<br />

combination date.<br />

As a result of the above, EPN recorded a gain from a bargain purchase of USD 240 million (EUR 192 million), and the Company recorded<br />

21.65% out of this amount, totaling approximately EUR 42 million as other income in the Company consolidated income statement.<br />

Planned liquidation of certain assets in EDT<br />

The Trust’s investment in the MV LLC joint venture entity was equity accounted to nil. The Trust has no obligation to provide further<br />

funding of this portfolio. As a result, the Group no longer recognized further losses from this portfolio from that date as part of the equity<br />

accounted profit or loss from jointly controlled entities and the portfolio no longer contributed to the Group’s Net Tangible Assets (NTA).<br />

Due to the likelihood of not being able to retrieve any equity value from this portfolio and significant additional capital being required,<br />

the Trust, DDR and the loan servicer jointly requested that a court appoint a third party receiver to manage and liquidate the remaining<br />

assets within the portfolio. On August 24, <strong>2010</strong> a third party receiver was appointed over the remaining assets within the MV LLC<br />

portfolio. As a result the Trust no longer has joint control over MV LLC and in accordance with its accounting policies accounted for its<br />

interest in MV LLC at December 31, <strong>2010</strong> as an investment held at the lower of cost and net realizable value which was nil at that date.<br />

<br />

Plaza Centers N.V. <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>121