Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Annual report 2010 - plazacenters

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial statements<br />

Notes to the consolidated financial statements<br />

continued<br />

Note 35 – Financial instruments continued<br />

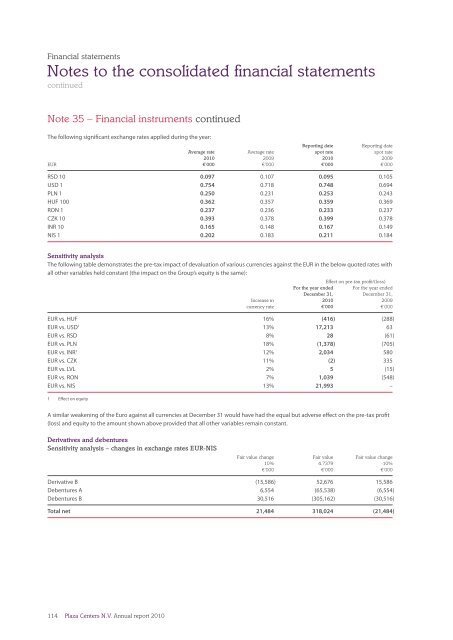

The following significant exchange rates applied during the year:<br />

Reporting date<br />

Reporting date<br />

Average rate Average rate spot rate spot rate<br />

<strong>2010</strong> 2009 <strong>2010</strong> 2009<br />

EUR €’000 €’000 €’000 €’000<br />

RSD 10 0.097 0.107 0.095 0.105<br />

USD 1 0.754 0.718 0.748 0.694<br />

PLN 1 0.250 0.231 0.253 0.243<br />

HUF 100 0.362 0.357 0.359 0.369<br />

RON 1 0.237 0.236 0.233 0.237<br />

CZK 10 0.393 0.378 0.399 0.378<br />

INR 10 0.165 0.148 0.167 0.149<br />

NIS 1 0.202 0.183 0.211 0.184<br />

Sensitivity analysis<br />

The following table demonstrates the pre-tax impact of devaluation of various currencies against the EUR in the below quoted rates with<br />

all other variables held constant (the impact on the Group’s equity is the same):<br />

Effect on pre-tax profit/(loss)<br />

For the year ended For the year ended<br />

December 31, December 31,<br />

Increase in <strong>2010</strong> 2009<br />

currency rate €’000 €’000<br />

EUR vs. HUF 16% (416) (288)<br />

EUR vs. USD 1 13% 17,213 63<br />

EUR vs. RSD 8% 28 (61)<br />

EUR vs. PLN 18% (1,378) (705)<br />

EUR vs. INR 1 12% 2,034 580<br />

EUR vs. CZK 11% (2) 335<br />

EUR vs. LVL 2% 5 (15)<br />

EUR vs. RON 7% 1,039 (548)<br />

EUR vs. NIS 13% 21,993 –<br />

1 Effect on equity<br />

A similar weakening of the Euro against all currencies at December 31 would have had the equal but adverse effect on the pre-tax profit<br />

(loss) and equity to the amount shown above provided that all other variables remain constant.<br />

Derivatives and debentures<br />

Sensitivity analysis – changes in exchange rates EUR-NIS<br />

Fair value change Fair value Fair value change<br />

10% 4.7379 -10%<br />

€’000 €’000 €’000<br />

Derivative B (15,586) 52,676 15,586<br />

Debentures A 6,554 (65,538) (6,554)<br />

Debentures B 30,516 (305,162) (30,516)<br />

Total net 21,484 318,024 (21,484)<br />

114<br />

Plaza Centers N.V. <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>