2010 Catalog - Delaware County Community College

2010 Catalog - Delaware County Community College

2010 Catalog - Delaware County Community College

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

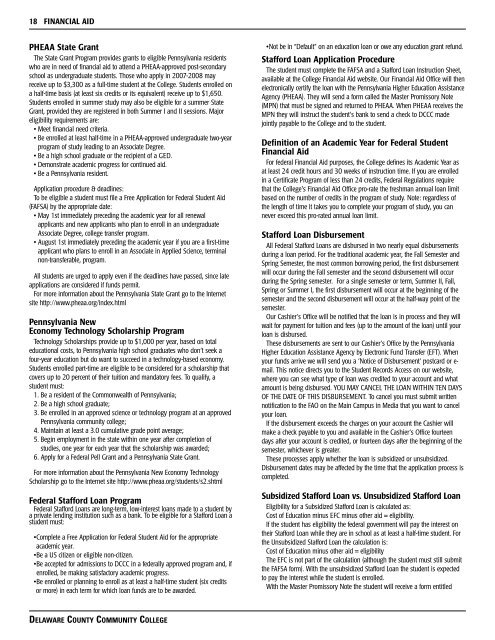

18 FINANCIAL AID<br />

PHEAA State Grant<br />

The State Grant Program provides grants to eligible Pennsylvania residents<br />

who are in need of financial aid to attend a PHEAA-approved post-secondary<br />

school as undergraduate students. Those who apply in 2007-2008 may<br />

receive up to $3,300 as a full-time student at the <strong>College</strong>. Students enrolled on<br />

a half-time basis (at least six credits or its equivalent) receive up to $1,650.<br />

Students enrolled in summer study may also be eligible for a summer State<br />

Grant, provided they are registered in both Summer I and II sessions. Major<br />

eligibility requirements are:<br />

• Meet financial need criteria.<br />

• Be enrolled at least half-time in a PHEAA-approved undergraduate two-year<br />

program of study leading to an Associate Degree.<br />

• Be a high school graduate or the recipient of a GED.<br />

• Demonstrate academic progress for continued aid.<br />

• Be a Pennsylvania resident.<br />

Application procedure & deadlines:<br />

To be eligible a student must file a Free Application for Federal Student Aid<br />

(FAFSA) by the appropriate date:<br />

• May 1st immediately preceding the academic year for all renewal<br />

applicants and new applicants who plan to enroll in an undergraduate<br />

Associate Degree, college transfer program.<br />

• August 1st immediately preceding the academic year if you are a first-time<br />

applicant who plans to enroll in an Associate in Applied Science, terminal<br />

non-transferable, program.<br />

All students are urged to apply even if the deadlines have passed, since late<br />

applications are considered if funds permit.<br />

For more information about the Pennsylvania State Grant go to the Internet<br />

site http://www.pheaa.org/index.html<br />

Pennsylvania New<br />

Economy Technology Scholarship Program<br />

Technology Scholarships provide up to $1,000 per year, based on total<br />

educational costs, to Pennsylvania high school graduates who don’t seek a<br />

four-year education but do want to succeed in a technology-based economy.<br />

Students enrolled part-time are eligible to be considered for a scholarship that<br />

covers up to 20 percent of their tuition and mandatory fees. To qualify, a<br />

student must:<br />

1. Be a resident of the Commonwealth of Pennsylvania;<br />

2. Be a high school graduate;<br />

3. Be enrolled in an approved science or technology program at an approved<br />

Pennsylvania community college;<br />

4. Maintain at least a 3.0 cumulative grade point average;<br />

5. Begin employment in the state within one year after completion of<br />

studies, one year for each year that the scholarship was awarded;<br />

6. Apply for a Federal Pell Grant and a Pennsylvania State Grant.<br />

For more information about the Pennsylvania New Economy Technology<br />

Scholarship go to the Internet site http://www.pheaa.org/students/s2.shtml<br />

Federal Stafford Loan Program<br />

Federal Stafford Loans are long-term, low-interest loans made to a student by<br />

a private lending institution such as a bank. To be eligible for a Stafford Loan a<br />

student must:<br />

•Complete a Free Application for Federal Student Aid for the appropriate<br />

academic year.<br />

•Be a US citizen or eligible non-citizen.<br />

•Be accepted for admissions to DCCC in a federally approved program and, if<br />

enrolled, be making satisfactory academic progress.<br />

•Be enrolled or planning to enroll as at least a half-time student (six credits<br />

or more) in each term for which loan funds are to be awarded.<br />

•Not be in “Default” on an education loan or owe any education grant refund.<br />

Stafford Loan Application Procedure<br />

The student must complete the FAFSA and a Stafford Loan Instruction Sheet,<br />

available at the <strong>College</strong> Financial Aid website. Our Financial Aid Office will then<br />

electronically certify the loan with the Pennsylvania Higher Education Assistance<br />

Agency (PHEAA). They will send a form called the Master Promissory Note<br />

(MPN) that must be signed and returned to PHEAA. When PHEAA receives the<br />

MPN they will instruct the student’s bank to send a check to DCCC made<br />

jointly payable to the <strong>College</strong> and to the student.<br />

Definition of an Academic Year for Federal Student<br />

Financial Aid<br />

For federal Financial Aid purposes, the <strong>College</strong> defines its Academic Year as<br />

at least 24 credit hours and 30 weeks of instruction time. If you are enrolled<br />

in a Certificate Program of less than 24 credits, Federal Regulations require<br />

that the <strong>College</strong>'s Financial Aid Office pro-rate the freshman annual loan limit<br />

based on the number of credits in the program of study. Note: regardless of<br />

the length of time it takes you to complete your program of study, you can<br />

never exceed this pro-rated annual loan limit.<br />

Stafford Loan Disbursement<br />

All Federal Stafford Loans are disbursed in two nearly equal disbursements<br />

during a loan period. For the traditional academic year, the Fall Semester and<br />

Spring Semester, the most common borrowing period, the first disbursement<br />

will occur during the Fall semester and the second disbursement will occur<br />

during the Spring semester. For a single semester or term, Summer II, Fall,<br />

Spring or Summer I, the first disbursement will occur at the beginning of the<br />

semester and the second disbursement will occur at the half-way point of the<br />

semester.<br />

Our Cashier’s Office will be notified that the loan is in process and they will<br />

wait for payment for tuition and fees (up to the amount of the loan) until your<br />

loan is disbursed.<br />

These disbursements are sent to our Cashier’s Office by the Pennsylvania<br />

Higher Education Assistance Agency by Electronic Fund Transfer (EFT). When<br />

your funds arrive we will send you a ‘Notice of Disbursement’ postcard or e-<br />

mail. This notice directs you to the Student Records Access on our website,<br />

where you can see what type of loan was credited to your account and what<br />

amount is being disbursed. YOU MAY CANCEL THE LOAN WITHIN TEN DAYS<br />

OF THE DATE OF THIS DISBURSEMENT. To cancel you must submit written<br />

notification to the FAO on the Main Campus in Media that you want to cancel<br />

your loan.<br />

If the disbursement exceeds the charges on your account the Cashier will<br />

make a check payable to you and available in the Cashier’s Office fourteen<br />

days after your account is credited, or fourteen days after the beginning of the<br />

semester, whichever is greater.<br />

These processes apply whether the loan is subsidized or unsubsidized.<br />

Disbursement dates may be affected by the time that the application process is<br />

completed.<br />

Subsidized Stafford Loan vs. Unsubsidized Stafford Loan<br />

Eligibility for a Subsidized Stafford Loan is calculated as:<br />

Cost of Education minus EFC minus other aid = eligibility.<br />

If the student has eligibility the federal government will pay the interest on<br />

their Stafford Loan while they are in school as at least a half-time student. For<br />

the Unsubsidized Stafford Loan the calculation is:<br />

Cost of Education minus other aid = eligibility<br />

The EFC is not part of the calculation (although the student must still submit<br />

the FAFSA form). With the unsubsidized Stafford Loan the student is expected<br />

to pay the interest while the student is enrolled.<br />

With the Master Promissory Note the student will receive a form entitled<br />

DELAWARE COUNTY COMMUNITY COLLEGE