FY 2013 Operating and Capital Budget - Metro Transit

FY 2013 Operating and Capital Budget - Metro Transit

FY 2013 Operating and Capital Budget - Metro Transit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Self-insurance Liability<br />

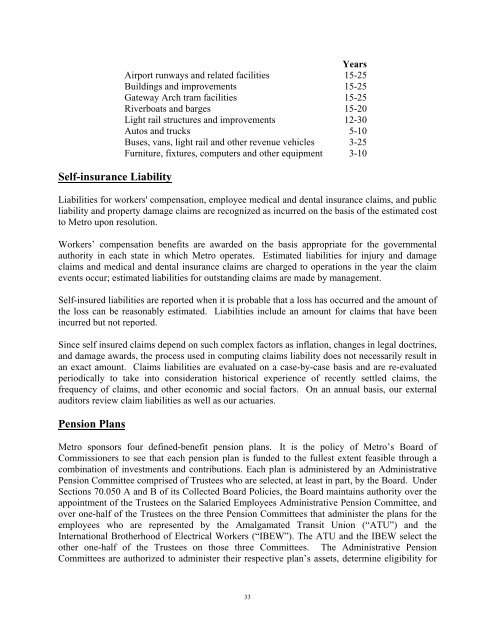

Years<br />

Airport runways <strong>and</strong> related facilities 15-25<br />

Buildings <strong>and</strong> improvements 15-25<br />

Gateway Arch tram facilities 15-25<br />

Riverboats <strong>and</strong> barges 15-20<br />

Light rail structures <strong>and</strong> improvements 12-30<br />

Autos <strong>and</strong> trucks 5-10<br />

Buses, vans, light rail <strong>and</strong> other revenue vehicles 3-25<br />

Furniture, fixtures, computers <strong>and</strong> other equipment 3-10<br />

Liabilities for workers' compensation, employee medical <strong>and</strong> dental insurance claims, <strong>and</strong> public<br />

liability <strong>and</strong> property damage claims are recognized as incurred on the basis of the estimated cost<br />

to <strong>Metro</strong> upon resolution.<br />

Workers’ compensation benefits are awarded on the basis appropriate for the governmental<br />

authority in each state in which <strong>Metro</strong> operates. Estimated liabilities for injury <strong>and</strong> damage<br />

claims <strong>and</strong> medical <strong>and</strong> dental insurance claims are charged to operations in the year the claim<br />

events occur; estimated liabilities for outst<strong>and</strong>ing claims are made by management.<br />

Self-insured liabilities are reported when it is probable that a loss has occurred <strong>and</strong> the amount of<br />

the loss can be reasonably estimated. Liabilities include an amount for claims that have been<br />

incurred but not reported.<br />

Since self insured claims depend on such complex factors as inflation, changes in legal doctrines,<br />

<strong>and</strong> damage awards, the process used in computing claims liability does not necessarily result in<br />

an exact amount. Claims liabilities are evaluated on a case-by-case basis <strong>and</strong> are re-evaluated<br />

periodically to take into consideration historical experience of recently settled claims, the<br />

frequency of claims, <strong>and</strong> other economic <strong>and</strong> social factors. On an annual basis, our external<br />

auditors review claim liabilities as well as our actuaries.<br />

Pension Plans<br />

<strong>Metro</strong> sponsors four defined-benefit pension plans. It is the policy of <strong>Metro</strong>’s Board of<br />

Commissioners to see that each pension plan is funded to the fullest extent feasible through a<br />

combination of investments <strong>and</strong> contributions. Each plan is administered by an Administrative<br />

Pension Committee comprised of Trustees who are selected, at least in part, by the Board. Under<br />

Sections 70.050 A <strong>and</strong> B of its Collected Board Policies, the Board maintains authority over the<br />

appointment of the Trustees on the Salaried Employees Administrative Pension Committee, <strong>and</strong><br />

over one-half of the Trustees on the three Pension Committees that administer the plans for the<br />

employees who are represented by the Amalgamated <strong>Transit</strong> Union (“ATU”) <strong>and</strong> the<br />

International Brotherhood of Electrical Workers (“IBEW”). The ATU <strong>and</strong> the IBEW select the<br />

other one-half of the Trustees on those three Committees. The Administrative Pension<br />

Committees are authorized to administer their respective plan’s assets, determine eligibility for<br />

33