FY 2013 Operating and Capital Budget - Metro Transit

FY 2013 Operating and Capital Budget - Metro Transit

FY 2013 Operating and Capital Budget - Metro Transit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

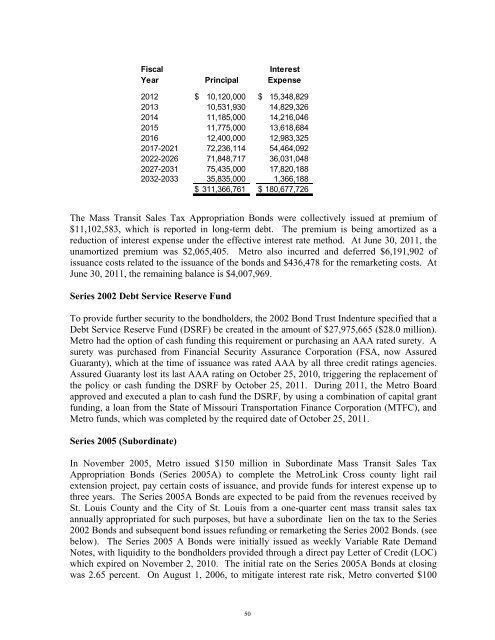

Fiscal<br />

Interest<br />

Year Principal Expense<br />

2012 $ 10,120,000 $ 15,348,829<br />

<strong>2013</strong> 10,531,930 14,829,326<br />

2014 11,185,000 14,216,046<br />

2015 11,775,000 13,618,684<br />

2016 12,400,000 12,983,325<br />

2017-2021 72,236,114 54,464,092<br />

2022-2026 71,848,717 36,031,048<br />

2027-2031 75,435,000 17,820,188<br />

2032-2033 35,835,000 1,366,188<br />

$ 311,366,761 $ 180,677,726<br />

The Mass <strong>Transit</strong> Sales Tax Appropriation Bonds were collectively issued at premium of<br />

$11,102,583, which is reported in long-term debt. The premium is being amortized as a<br />

reduction of interest expense under the effective interest rate method. At June 30, 2011, the<br />

unamortized premium was $2,065,405. <strong>Metro</strong> also incurred <strong>and</strong> deferred $6,191,902 of<br />

issuance costs related to the issuance of the bonds <strong>and</strong> $436,478 for the remarketing costs. At<br />

June 30, 2011, the remaining balance is $4,007,969.<br />

Series 2002 Debt Service Reserve Fund<br />

To provide further security to the bondholders, the 2002 Bond Trust Indenture specified that a<br />

Debt Service Reserve Fund (DSRF) be created in the amount of $27,975,665 ($28.0 million).<br />

<strong>Metro</strong> had the option of cash funding this requirement or purchasing an AAA rated surety. A<br />

surety was purchased from Financial Security Assurance Corporation (FSA, now Assured<br />

Guaranty), which at the time of issuance was rated AAA by all three credit ratings agencies.<br />

Assured Guaranty lost its last AAA rating on October 25, 2010, triggering the replacement of<br />

the policy or cash funding the DSRF by October 25, 2011. During 2011, the <strong>Metro</strong> Board<br />

approved <strong>and</strong> executed a plan to cash fund the DSRF, by using a combination of capital grant<br />

funding, a loan from the State of Missouri Transportation Finance Corporation (MTFC), <strong>and</strong><br />

<strong>Metro</strong> funds, which was completed by the required date of October 25, 2011.<br />

Series 2005 (Subordinate)<br />

In November 2005, <strong>Metro</strong> issued $150 million in Subordinate Mass <strong>Transit</strong> Sales Tax<br />

Appropriation Bonds (Series 2005A) to complete the <strong>Metro</strong>Link Cross county light rail<br />

extension project, pay certain costs of issuance, <strong>and</strong> provide funds for interest expense up to<br />

three years. The Series 2005A Bonds are expected to be paid from the revenues received by<br />

St. Louis County <strong>and</strong> the City of St. Louis from a one-quarter cent mass transit sales tax<br />

annually appropriated for such purposes, but have a subordinate lien on the tax to the Series<br />

2002 Bonds <strong>and</strong> subsequent bond issues refunding or remarketing the Series 2002 Bonds. (see<br />

below). The Series 2005 A Bonds were initially issued as weekly Variable Rate Dem<strong>and</strong><br />

Notes, with liquidity to the bondholders provided through a direct pay Letter of Credit (LOC)<br />

which expired on November 2, 2010. The initial rate on the Series 2005A Bonds at closing<br />

was 2.65 percent. On August 1, 2006, to mitigate interest rate risk, <strong>Metro</strong> converted $100<br />

50