FY 2013 Operating and Capital Budget - Metro Transit

FY 2013 Operating and Capital Budget - Metro Transit

FY 2013 Operating and Capital Budget - Metro Transit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

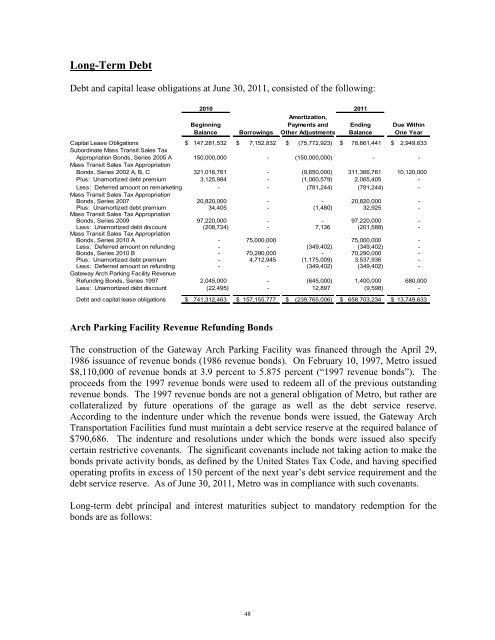

Long-Term Debt<br />

Debt <strong>and</strong> capital lease obligations at June 30, 2011, consisted of the following:<br />

2010 2011<br />

Amortization,<br />

Beginning Payments <strong>and</strong> Ending Due Within<br />

Balance Borrowings Other Adjustments Balance One Year<br />

<strong>Capital</strong> Lease Obligations $ 147,281,532 $ 7,152,832 $ (75,772,923) $ 78,661,441 $ 2,949,633<br />

Subordinate Mass <strong>Transit</strong> Sales Tax<br />

Appropriation Bonds, Series 2005 A 150,000,000 - (150,000,000) - -<br />

Mass <strong>Transit</strong> Sales Tax Appropriation<br />

Bonds, Series 2002 A, B, C 321,016,761 - (9,650,000) 311,366,761 10,120,000<br />

Plus: Unamortized debt premium 3,125,984 - (1,060,579) 2,065,405 -<br />

Less: Deferred amount on remarketing - - (781,244) (781,244) -<br />

Mass <strong>Transit</strong> Sales Tax Appropriation<br />

Bonds, Series 2007 20,820,000 - - 20,820,000 -<br />

Plus: Unamortized debt premium 34,405 - (1,480) 32,925 -<br />

Mass <strong>Transit</strong> Sales Tax Appropriation<br />

Bonds, Series 2009 97,220,000 - - 97,220,000 -<br />

Less: Unamortized debt discount (208,724) - 7,136 (201,588) -<br />

Mass <strong>Transit</strong> Sales Tax Appropriation<br />

Bonds, Series 2010 A - 75,000,000 75,000,000 -<br />

Less: Deferred amount on refunding - - (349,402) (349,402) -<br />

Bonds, Series 2010 B - 70,290,000 - 70,290,000 -<br />

Plus: Unamortized debt premium - 4,712,945 (1,175,009) 3,537,936 -<br />

Less: Deferred amount on refunding - - (349,402) (349,402) -<br />

Gateway Arch Parking Facility Revenue<br />

Refunding Bonds, Series 1997 2,045,000 - (645,000) 1,400,000 680,000<br />

Less: Unamortized debt discount (22,495) - 12,897 (9,598) -<br />

Debt <strong>and</strong> capital lease obligations $ 741,312,463 $ 157,155,777 $ (239,765,006) $ 658,703,234 $ 13,749,633<br />

Arch Parking Facility Revenue Refunding Bonds<br />

The construction of the Gateway Arch Parking Facility was financed through the April 29,<br />

1986 issuance of revenue bonds (1986 revenue bonds). On February 10, 1997, <strong>Metro</strong> issued<br />

$8,110,000 of revenue bonds at 3.9 percent to 5.875 percent (“1997 revenue bonds”). The<br />

proceeds from the 1997 revenue bonds were used to redeem all of the previous outst<strong>and</strong>ing<br />

revenue bonds. The 1997 revenue bonds are not a general obligation of <strong>Metro</strong>, but rather are<br />

collateralized by future operations of the garage as well as the debt service reserve.<br />

According to the indenture under which the revenue bonds were issued, the Gateway Arch<br />

Transportation Facilities fund must maintain a debt service reserve at the required balance of<br />

$790,686. The indenture <strong>and</strong> resolutions under which the bonds were issued also specify<br />

certain restrictive covenants. The significant covenants include not taking action to make the<br />

bonds private activity bonds, as defined by the United States Tax Code, <strong>and</strong> having specified<br />

operating profits in excess of 150 percent of the next year’s debt service requirement <strong>and</strong> the<br />

debt service reserve. As of June 30, 2011, <strong>Metro</strong> was in compliance with such covenants.<br />

Long-term debt principal <strong>and</strong> interest maturities subject to m<strong>and</strong>atory redemption for the<br />

bonds are as follows:<br />

48