FY 2013 Operating and Capital Budget - Metro Transit

FY 2013 Operating and Capital Budget - Metro Transit

FY 2013 Operating and Capital Budget - Metro Transit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

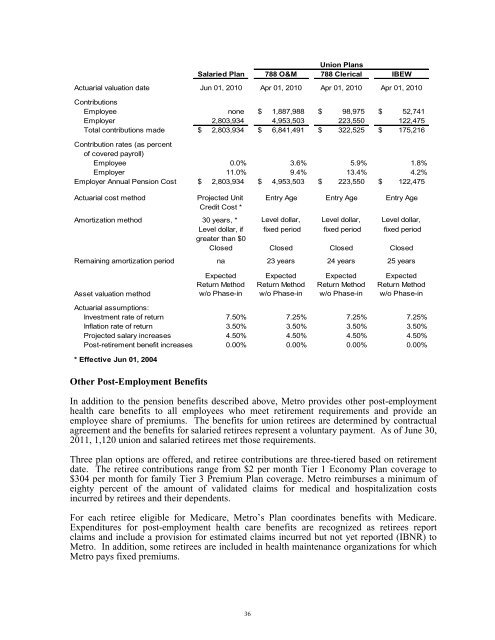

Union Plans<br />

Salaried Plan 788 O&M 788 Clerical IBEW<br />

Actuarial valuation date Jun 01, 2010 Apr 01, 2010 Apr 01, 2010 Apr 01, 2010<br />

Contributions<br />

Employee none $ 1,887,988 $ 98,975 $ 52,741<br />

Employer 2,803,934 4,953,503 223,550 122,475<br />

Total contributions made $ 2,803,934 $ 6,841,491 $ 322,525 $ 175,216<br />

Contribution rates (as percent<br />

of covered payroll)<br />

Employee 0.0% 3.6% 5.9% 1.8%<br />

Employer 11.0% 9.4% 13.4% 4.2%<br />

Employer Annual Pension Cost $ 2,803,934 $ 4,953,503 $ 223,550 $ 122,475<br />

Actuarial cost method Projected Unit Entry Age Entry Age Entry Age<br />

Credit Cost *<br />

Amortization method 30 years, * Level dollar, Level dollar, Level dollar,<br />

Level dollar, if fixed period fixed period fixed period<br />

greater than $0<br />

Closed Closed Closed Closed<br />

Remaining amortization period na 23 years 24 years 25 years<br />

Asset valuation method<br />

Expected<br />

Return Method<br />

w/o Phase-in<br />

Expected<br />

Return Method<br />

w/o Phase-in<br />

Expected<br />

Return Method<br />

w/o Phase-in<br />

Expected<br />

Return Method<br />

w/o Phase-in<br />

Actuarial assumptions:<br />

Investment rate of return 7.50% 7.25% 7.25% 7.25%<br />

Inflation rate of return 3.50% 3.50% 3.50% 3.50%<br />

Projected salary increases 4.50% 4.50% 4.50% 4.50%<br />

Post-retirement benefit increases 0.00% 0.00% 0.00% 0.00%<br />

* Effective Jun 01, 2004<br />

Other Post-Employment Benefits<br />

In addition to the pension benefits described above, <strong>Metro</strong> provides other post-employment<br />

health care benefits to all employees who meet retirement requirements <strong>and</strong> provide an<br />

employee share of premiums. The benefits for union retirees are determined by contractual<br />

agreement <strong>and</strong> the benefits for salaried retirees represent a voluntary payment. As of June 30,<br />

2011, 1,120 union <strong>and</strong> salaried retirees met those requirements.<br />

Three plan options are offered, <strong>and</strong> retiree contributions are three-tiered based on retirement<br />

date. The retiree contributions range from $2 per month Tier 1 Economy Plan coverage to<br />

$304 per month for family Tier 3 Premium Plan coverage. <strong>Metro</strong> reimburses a minimum of<br />

eighty percent of the amount of validated claims for medical <strong>and</strong> hospitalization costs<br />

incurred by retirees <strong>and</strong> their dependents.<br />

For each retiree eligible for Medicare, <strong>Metro</strong>’s Plan coordinates benefits with Medicare.<br />

Expenditures for post-employment health care benefits are recognized as retirees report<br />

claims <strong>and</strong> include a provision for estimated claims incurred but not yet reported (IBNR) to<br />

<strong>Metro</strong>. In addition, some retirees are included in health maintenance organizations for which<br />

<strong>Metro</strong> pays fixed premiums.<br />

36