FY 2013 Operating and Capital Budget - Metro Transit

FY 2013 Operating and Capital Budget - Metro Transit

FY 2013 Operating and Capital Budget - Metro Transit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

million of the Series 2005A Bonds to a rate of 3.95% for a 38-month period ending October 1,<br />

2009. On October 1, 2009, the $100 million Series 2005 thus converted were remarketed as<br />

weekly Variable Rate Dem<strong>and</strong> Notes. The Series 2005 Bonds were refunded with the Series<br />

2010 Bonds (see below).<br />

Series 2007<br />

In December 2007, <strong>Metro</strong> issued $20.82 million in Mass <strong>Transit</strong> Sales Tax Appropriation<br />

Refunding Bonds (Series 2007) to advance refund the 2009 <strong>and</strong> 2010 principal payments of<br />

the Series 2002B Bonds, totaling $18.1 million. A Debt Service Reserve in the amount of<br />

$2.08 million was established at the time of the bond sale. The net proceeds of $18.49 million<br />

were deposited in an irrevocable trust with an escrow agent to provide for the payment of<br />

principal <strong>and</strong> interest of the aforementioned Series 2002B bonds. The Series 2007 Bonds are<br />

expected to be paid from the revenues received by St. Louis County <strong>and</strong> the City of St. Louis<br />

from a one-quarter cent mass transit sales tax annually appropriated for such purposes. The<br />

bonds bear interest at rates of 5.00 percent to 5.25 percent <strong>and</strong> mature in fiscal year 2034.<br />

As a result of the refunding, <strong>Metro</strong> increased its total debt service requirements by $29.31<br />

million, which resulted in an economic loss of $3.21 million. As of June 30, 2011, all of the<br />

defeased debt had been retired.<br />

The bonds were collectively issued at a premium of $38,224 that is recorded in long-term<br />

debt. The premium is being amortized as a reduction of interest expense. At June 30, 2011<br />

the unamortized premium was $32,925. <strong>Metro</strong> incurred <strong>and</strong> deferred $276,296 of costs<br />

related to the issuance of the bonds. At June 30, 2011, the remaining balance is $237,997.<br />

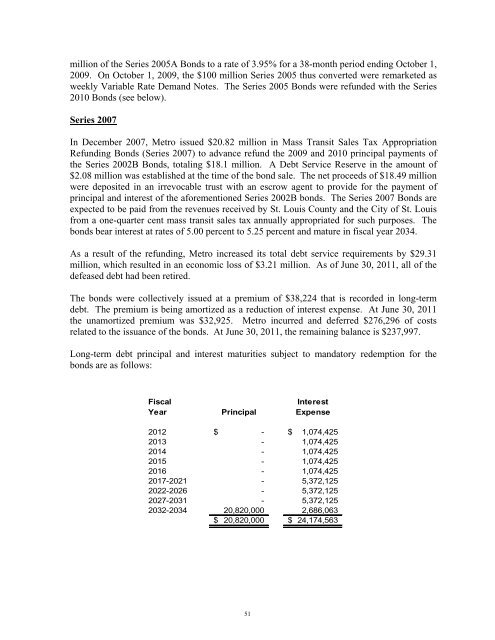

Long-term debt principal <strong>and</strong> interest maturities subject to m<strong>and</strong>atory redemption for the<br />

bonds are as follows:<br />

Fiscal<br />

Interest<br />

Year Principal Expense<br />

2012 $ - $ 1,074,425<br />

<strong>2013</strong> - 1,074,425<br />

2014 - 1,074,425<br />

2015 - 1,074,425<br />

2016 - 1,074,425<br />

2017-2021 - 5,372,125<br />

2022-2026 - 5,372,125<br />

2027-2031 - 5,372,125<br />

2032-2034 20,820,000 2,686,063<br />

$ 20,820,000 $ 24,174,563<br />

51