Daimler Annual Report 2011 - Alle jaarverslagen

Daimler Annual Report 2011 - Alle jaarverslagen

Daimler Annual Report 2011 - Alle jaarverslagen

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

7 | Consolidated Financial Statements | Notes to the Consolidated Financial Statements<br />

16. Other financial assets<br />

The item “other financial assets” shown in the consolidated<br />

statement of financial position is comprised of the classes<br />

presented in table 7.34.<br />

In <strong>2011</strong>, equity instruments carried at cost with a carrying<br />

amount of €74 million (2010: €23 million) were sold. The realized<br />

gains from the sales were €16 million in <strong>2011</strong> (2010: gains<br />

of €23 million). As of December 31, <strong>2011</strong>, the Group principally<br />

did not intend to dispose of any reported equity instruments<br />

carried at cost.<br />

Financial liabilities recognized at fair value through profit<br />

or loss relate exclusively to derivative financial instruments<br />

which are not used in hedge accounting.<br />

As of December 31, <strong>2011</strong>, other receivables and financial<br />

assets include a loan and accumulated interest to Chrysler<br />

LLC of US$1.9 billion (December 31, 2010: US$1.8 billion).<br />

As in the previous year, the receivables were fully impaired.<br />

Further information on other financial assets is provided<br />

in Note 30.<br />

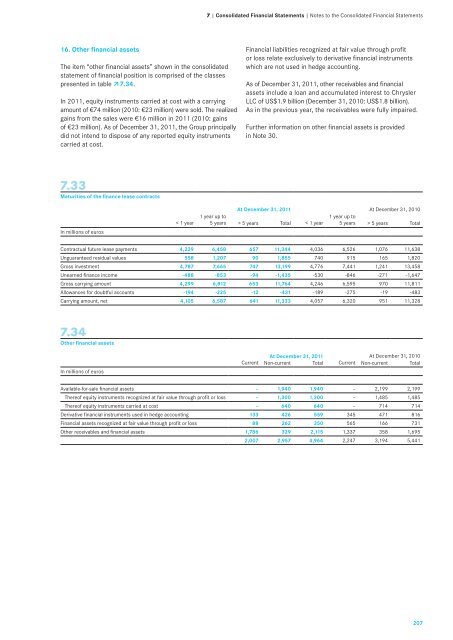

7.33<br />

Maturities of the finance lease contracts<br />

In millions of euros<br />

< 1 year<br />

1 year up to<br />

5 years<br />

At December 31, <strong>2011</strong><br />

At December 31, 2010<br />

> 5 years Total < 1 year<br />

1 year up to<br />

5 years > 5 years Total<br />

Contractual future lease payments 4,229 6,458 657 11,344 4,036 6,526 1,076 11,638<br />

Unguaranteed residual values 558 1,207 90 1,855 740 915 165 1,820<br />

Gross investment 4,787 7,665 747 13,199 4,776 7,441 1,241 13,458<br />

Unearned finance income -488 -853 -94 -1,435 -530 -846 -271 -1,647<br />

Gross carrying amount 4,299 6,812 653 11,764 4,246 6,595 970 11,811<br />

Allowances for doubtful accounts -194 -225 -12 -431 -189 -275 -19 -483<br />

Carrying amount, net 4,105 6,587 641 11,333 4,057 6,320 951 11,328<br />

7.34<br />

Other financial assets<br />

In millions of euros<br />

Current<br />

At December 31, <strong>2011</strong><br />

At December 31, 2010<br />

Non-current Total Current Non-current Total<br />

Available-for-sale financial assets – 1,940 1,940 – 2,199 2,199<br />

Thereof equity instruments recognized at fair value through profit or loss – 1,300 1,300 – 1,485 1,485<br />

Thereof equity instruments carried at cost – 640 640 – 714 714<br />

Derivative financial instruments used in hedge accounting 133 426 559 345 471 816<br />

Financial assets recognized at fair value through profit or loss 88 262 350 565 166 731<br />

Other receivables and financial assets 1,786 329 2,115 1,337 358 1,695<br />

2,007 2,957 4,964 2,247 3,194 5,441<br />

207