Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

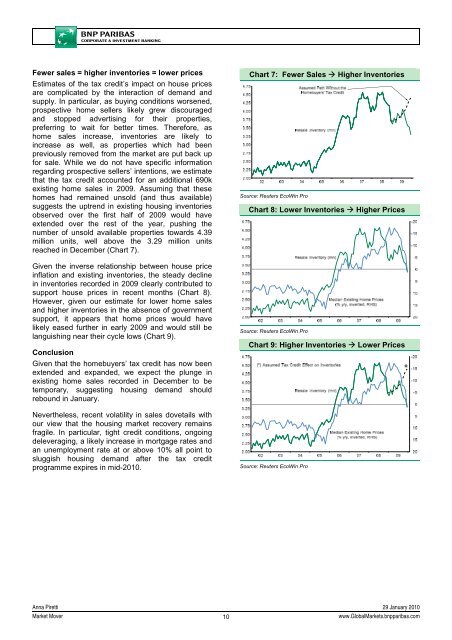

Fewer sales = higher inventories = lower prices<br />

Estimates of the tax credit’s impact on house prices<br />

are complicated by the interaction of demand and<br />

supply. In particular, as buying conditions worsened,<br />

prospective home sellers likely grew discouraged<br />

and stopped advertising for their properties,<br />

preferring to wait for better times. Therefore, as<br />

home sales increase, inventories are likely to<br />

increase as well, as properties which had been<br />

previously removed from the market are put back up<br />

for sale. While we do not have specific information<br />

regarding prospective sellers’ intentions, we estimate<br />

that the tax credit accounted for an additional 690k<br />

existing home sales in 2009. Assuming that these<br />

homes had remained unsold (and thus available)<br />

suggests the uptrend in existing housing inventories<br />

observed over the first half of 2009 would have<br />

extended over the rest of the year, pushing the<br />

number of unsold available properties towards 4.39<br />

million units, well above the 3.29 million units<br />

reached in December (Chart 7).<br />

Given the inverse relationship between house price<br />

inflation and existing inventories, the steady decline<br />

in inventories recorded in 2009 clearly contributed to<br />

support house prices in recent months (Chart 8).<br />

However, given our estimate for lower home sales<br />

and higher inventories in the absence of government<br />

support, it appears that home prices would have<br />

likely eased further in early 2009 and would still be<br />

languishing near their cycle lows (Chart 9).<br />

Conclusion<br />

Given that the homebuyers’ tax credit has now been<br />

extended and expanded, we expect the plunge in<br />

existing home sales recorded in December to be<br />

temporary, suggesting housing demand should<br />

rebound in January.<br />

Nevertheless, recent volatility in sales dovetails with<br />

our view that the housing market recovery remains<br />

fragile. In particular, tight credit conditions, ongoing<br />

deleveraging, a likely increase in mortgage rates and<br />

an unemployment rate at or above 10% all point to<br />

sluggish housing demand after the tax credit<br />

programme expires in mid-2010.<br />

Chart 7: Fewer Sales Higher Inventories<br />

Source: Reuters EcoWin Pro<br />

Chart 8: Lower Inventories Higher Prices<br />

Source: Reuters EcoWin Pro<br />

Chart 9: Higher Inventories Lower Prices<br />

Source: Reuters EcoWin Pro<br />

Anna Piretti 29 January 2010<br />

<strong>Market</strong> Mover<br />

10<br />

www.Global<strong>Market</strong>s.bnpparibas.com