Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EUR: Peripheral EGBs Under Pressure<br />

• The EUR 8bn syndication of the new 5y GGB<br />

was not enough to change the climate for Greek<br />

spreads, which are continuing to hit new highs.<br />

The Greek PDMA announced a second<br />

syndication to take place in February (new 10y)<br />

for EUR 3-5bn…<br />

• …thereby leaving no breathing space for<br />

GGBs after the heavy supply of this week. The<br />

Greek MinFin also announced a roadshow to the<br />

US and Asia next month in order to drum up<br />

foreign investors’ interest in GGBs.<br />

• Contagion to other eurozone countries,<br />

especially Portugal, is growing fast, thus making<br />

a default scenario even more unlikely. Ireland<br />

has been outperforming so far, and we believe<br />

that this cannot be sustained. Underweight<br />

Ireland and Portugal.<br />

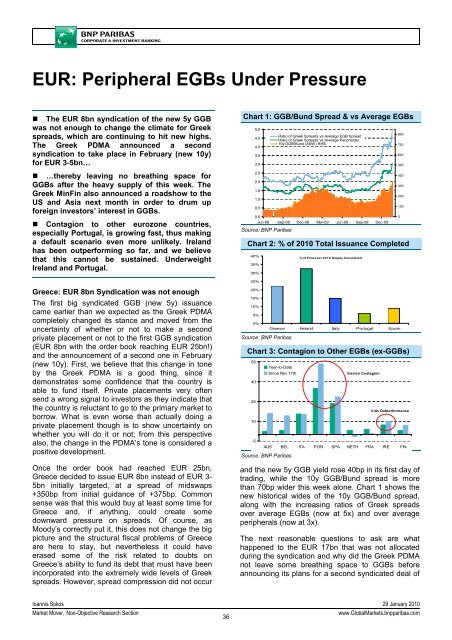

Chart 1: GGB/Bund Spread & vs Average EGBs<br />

5.0<br />

4.5<br />

4.0<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

Jun-08 Sep-08 Dec-08 Mar-09 Jun-09 Sep-09 Dec-09<br />

Source: <strong>BNP</strong> Paribas<br />

Ratio of Greek Spreads vs Average EGB Spread<br />

Ratio of Greek Spreads vs Average Peripherals<br />

10y GGB/Bund (ASW) RHS<br />

Chart 2: % of 2010 Total Issuance Completed<br />

40%<br />

35%<br />

30%<br />

% of Forecast 2010 Supply Completed<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

25%<br />

Greece: EUR 8bn Syndication was not enough<br />

The first big syndicated GGB (new 5y) issuance<br />

came earlier than we expected as the Greek PDMA<br />

completely changed its stance and moved from the<br />

uncertainty of whether or not to make a second<br />

private placement or not to the first GGB syndication<br />

(EUR 8bn with the order book reaching EUR 25bn!)<br />

and the announcement of a second one in February<br />

(new 10y). First, we believe that this change in tone<br />

by the Greek PDMA is a good thing, since it<br />

demonstrates some confidence that the country is<br />

able to fund itself. Private placements very often<br />

send a wrong signal to investors as they indicate that<br />

the country is reluctant to go to the primary market to<br />

borrow. What is even worse than actually doing a<br />

private placement though is to show uncertainty on<br />

whether you will do it or not; from this perspective<br />

also, the change in the PDMA’s tone is considered a<br />

positive development.<br />

Once the order book had reached EUR 25bn,<br />

Greece decided to issue EUR 8bn instead of EUR 3-<br />

5bn initially targeted, at a spread of midswaps<br />

+350bp from initial guidance of +375bp. Common<br />

sense was that this would buy at least some time for<br />

Greece and, if anything, could create some<br />

downward pressure on spreads. Of course, as<br />

Moody’s correctly put it, this does not change the big<br />

picture and the structural fiscal problems of Greece<br />

are here to stay, but nevertheless it could have<br />

erased some of the risk related to doubts on<br />

Greece’s ability to fund its debt that must have been<br />

incorporated into the extremely wide levels of Greek<br />

spreads. However, spread compression did not occur<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

Source: <strong>BNP</strong> Paribas<br />

Greece Ireland Italy Portugal Spain<br />

Chart 3: Contagion to Other EGBs (ex-GGBs)<br />

55<br />

40<br />

25<br />

10<br />

-5<br />

Year-to-Date<br />

Since Nov 17th<br />

AUS BEL ITA POR SPA NETH FRA IRE FIN<br />

Source: <strong>BNP</strong> Paribas<br />

Iberian Contagion<br />

Irish Outperformance<br />

and the new 5y GGB yield rose 40bp in its first day of<br />

trading, while the 10y GGB/Bund spread is more<br />

than 70bp wider this week alone. Chart 1 shows the<br />

new historical wides of the 10y GGB/Bund spread,<br />

along with the increasing ratios of Greek spreads<br />

over average EGBs (now at 5x) and over average<br />

peripherals (now at 3x).<br />

The next reasonable questions to ask are what<br />

happened to the EUR 17bn that was not allocated<br />

during the syndication and why did the Greek PDMA<br />

not leave some breathing space to GGBs before<br />

announcing its plans for a second syndicated deal of<br />

Ioannis Sokos 29 January 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

36<br />

www.Global<strong>Market</strong>s.bnpparibas.com