Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

US: After FOMC, Favour Calls on Front End<br />

• In light of the FOMC statement, outright<br />

front-end carry positions no longer look as<br />

attractive since the market could be spooked<br />

by strong data and aggressively push frontend<br />

rates higher.<br />

• We still feel the Fed won’t hike any time<br />

soon and have long recommended playing the<br />

base-case scenario of a Fed on hold using<br />

options. This takes advantage of the outsized<br />

rolldown in the short end.<br />

• STRATEGY: Buy 6m1y and sell 6m10y<br />

receivers in a costless structure to take<br />

advantage of a highly attractive entry point due<br />

to the flatter forward curve and historically<br />

cheap vol ratio.<br />

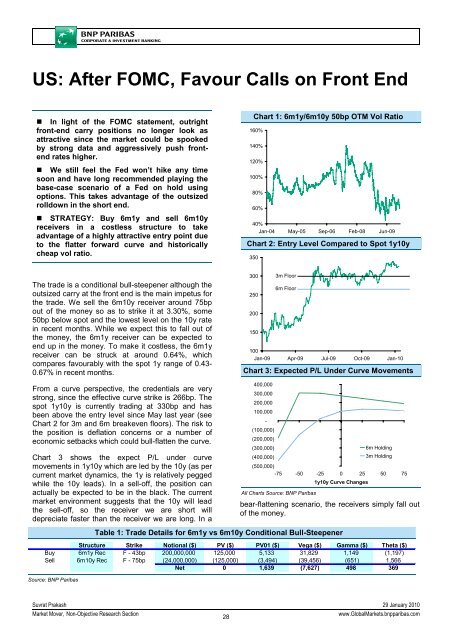

Chart 1: 6m1y/6m10y 50bp OTM Vol Ratio<br />

160%<br />

140%<br />

120%<br />

100%<br />

80%<br />

60%<br />

40%<br />

Jan-04 May-05 Sep-06 Feb-08 Jun-09<br />

Chart 2: Entry Level Compared to Spot 1y10y<br />

350<br />

The trade is a conditional bull-steepener although the<br />

outsized carry at the front end is the main impetus for<br />

the trade. We sell the 6m10y receiver around 75bp<br />

out of the money so as to strike it at 3.30%, some<br />

50bp below spot and the lowest level on the 10y rate<br />

in recent months. While we expect this to fall out of<br />

the money, the 6m1y receiver can be expected to<br />

end up in the money. To make it costless, the 6m1y<br />

receiver can be struck at around 0.64%, which<br />

compares favourably with the spot 1y range of 0.43-<br />

0.67% in recent months.<br />

From a curve perspective, the credentials are very<br />

strong, since the effective curve strike is 266bp. The<br />

spot 1y10y is currently trading at 330bp and has<br />

been above the entry level since May last year (see<br />

Chart 2 for 3m and 6m breakeven floors). The risk to<br />

the position is deflation concerns or a number of<br />

economic setbacks which could bull-flatten the curve.<br />

Chart 3 shows the expect P/L under curve<br />

movements in 1y10y which are led by the 10y (as per<br />

current market dynamics, the 1y is relatively pegged<br />

while the 10y leads). In a sell-off, the position can<br />

actually be expected to be in the black. The current<br />

market environment suggests that the 10y will lead<br />

the sell-off, so the receiver we are short will<br />

depreciate faster than the receiver we are long. In a<br />

300<br />

250<br />

200<br />

150<br />

3m Floor<br />

6m Floor<br />

100<br />

Jan-09 Apr-09 Jul-09 Oct-09 Jan-10<br />

Chart 3: Expected P/L Under Curve Movements<br />

400,000<br />

300,000<br />

200,000<br />

100,000<br />

-<br />

(100,000)<br />

(200,000)<br />

(300,000)<br />

6m Holding<br />

(400,000)<br />

3m Holding<br />

(500,000)<br />

-75 -50 -25 0 25 50 75<br />

All Charts Source: <strong>BNP</strong> Paribas<br />

1y10y Curve Changes<br />

bear-flattening scenario, the receivers simply fall out<br />

of the money.<br />

Table 1: Trade Details for 6m1y vs 6m10y Conditional Bull-Steepener<br />

Structure Strike Notional ($) PV ($) PV01 ($) Vega ($) Gamma ($) Theta ($)<br />

Buy 6m1y Rec F - 43bp 200,000,000 125,000 5,133 31,829 1,149 (1,197)<br />

Sell 6m10y Rec F - 75bp (24,000,000) (125,000) (3,494) (39,456) (651) 1,566<br />

Net 0 1,639 (7,627) 498 369<br />

Source: <strong>BNP</strong> Paribas<br />

Suvrat Prakash 29 January 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

28<br />

www.Global<strong>Market</strong>s.bnpparibas.com