Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Global Inflation Watch<br />

Very Weak German CPI Data<br />

Wednesday’s large downward surprise to German<br />

inflation constituted the latest piece of evidence that<br />

policymakers should be far more worried about<br />

deflation rather than inflation in the euro area. The<br />

national headline CPI fell by 0.6% m/m in January,<br />

double the -0.3% m/m print expected by the market<br />

and weaker than our own -0.5% m/m estimate. That<br />

left the y/y rate flat at 0.8% y/y after three straight<br />

months of big gains. The HICP numbers were even<br />

weaker at -0.7% m/m, 0.7% y/y.<br />

There were two key drivers of the downward surprise<br />

relative to consensus. First, the increase in energy<br />

prices in January was weaker than the country’s fuel<br />

data had implied. Second, and much more<br />

importantly, there was a very weak core inflation<br />

print. Based on the five states’ data, we estimate<br />

core inflation decelerated to 0.8% y/y in January from<br />

1.1% in December at the national level – its lowest<br />

level since October 2006.<br />

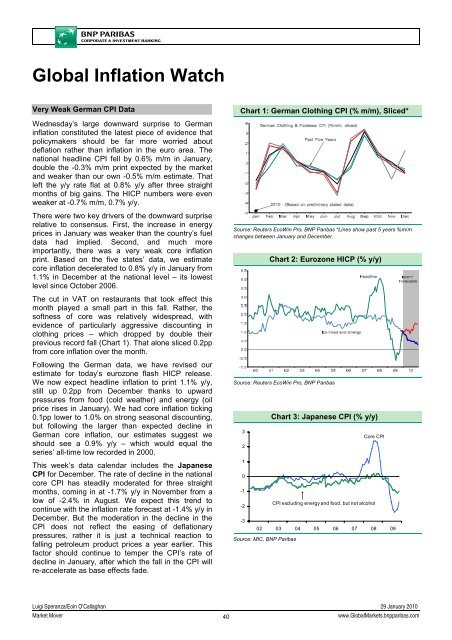

Chart 1: German Clothing CPI (% m/m), Sliced*<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas *Lines show past 5 years %m/m<br />

changes between January and December.<br />

Chart 2: Eurozone HICP (% y/y)<br />

The cut in VAT on restaurants that took effect this<br />

month played a small part in this fall. Rather, the<br />

softness of core was relatively widespread, with<br />

evidence of particularly aggressive discounting in<br />

clothing prices – which dropped by double their<br />

previous record fall (Chart 1). That alone sliced 0.2pp<br />

from core inflation over the month.<br />

Following the German data, we have revised our<br />

estimate for today’s eurozone flash HICP release.<br />

We now expect headline inflation to print 1.1% y/y,<br />

still up 0.2pp from December thanks to upward<br />

pressures from food (cold weather) and energy (oil<br />

price rises in January). We had core inflation ticking<br />

0.1pp lower to 1.0% on strong seasonal discounting,<br />

but following the larger than expected decline in<br />

German core inflation, our estimates suggest we<br />

should see a 0.9% y/y – which would equal the<br />

series’ all-time low recorded in 2000.<br />

This week’s data calendar includes the Japanese<br />

CPI for December. The rate of decline in the national<br />

core CPI has steadily moderated for three straight<br />

months, coming in at -1.7% y/y in November from a<br />

low of -2.4% in August. We expect this trend to<br />

continue with the inflation rate forecast at -1.4% y/y in<br />

December. But the moderation in the decline in the<br />

CPI does not reflect the easing of deflationary<br />

pressures, rather it is just a technical reaction to<br />

falling petroleum product prices a year earlier. This<br />

factor should continue to temper the CPI’s rate of<br />

decline in January, after which the fall in the CPI will<br />

re-accelerate as base effects fade.<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

Chart 3: Japanese CPI (% y/y)<br />

3<br />

Core CPI<br />

2<br />

1<br />

0<br />

-1<br />

CPI excluding energy and food, but not alcohol<br />

-2<br />

-3<br />

02 03 04 05 06 07 08 09<br />

Source: MIC, <strong>BNP</strong> Paribas<br />

Luigi Speranza/Eoin O’Callaghan 29 January 2010<br />

<strong>Market</strong> Mover<br />

40<br />

www.Global<strong>Market</strong>s.bnpparibas.com