Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

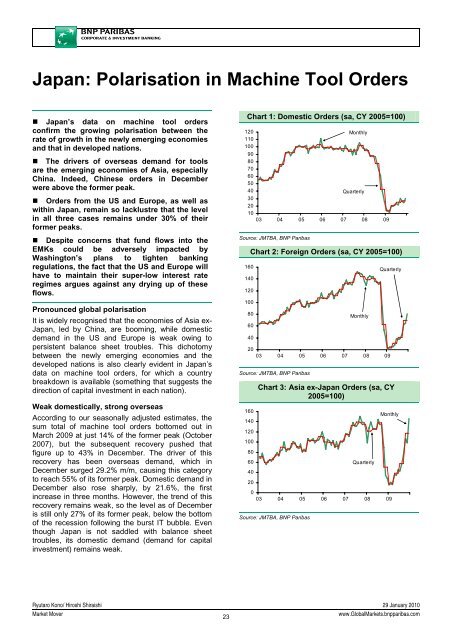

Japan: Polarisation in Machine Tool Orders<br />

• Japan’s data on machine tool orders<br />

confirm the growing polarisation between the<br />

rate of growth in the newly emerging economies<br />

and that in developed nations.<br />

• The drivers of overseas demand for tools<br />

are the emerging economies of Asia, especially<br />

China. Indeed, Chinese orders in December<br />

were above the former peak.<br />

• Orders from the US and Europe, as well as<br />

within Japan, remain so lacklustre that the level<br />

in all three cases remains under 30% of their<br />

former peaks.<br />

• Despite concerns that fund flows into the<br />

EMKs could be adversely impacted by<br />

Washington’s plans to tighten banking<br />

regulations, the fact that the US and Europe will<br />

have to maintain their super-low interest rate<br />

regimes argues against any drying up of these<br />

flows.<br />

Pronounced global polarisation<br />

It is widely recognised that the economies of Asia ex-<br />

Japan, led by China, are booming, while domestic<br />

demand in the US and Europe is weak owing to<br />

persistent balance sheet troubles. This dichotomy<br />

between the newly emerging economies and the<br />

developed nations is also clearly evident in Japan’s<br />

data on machine tool orders, for which a country<br />

breakdown is available (something that suggests the<br />

direction of capital investment in each nation).<br />

Weak domestically, strong overseas<br />

According to our seasonally adjusted estimates, the<br />

sum total of machine tool orders bottomed out in<br />

March 2009 at just 14% of the former peak (October<br />

2007), but the subsequent recovery pushed that<br />

figure up to 43% in December. The driver of this<br />

recovery has been overseas demand, which in<br />

December surged 29.2% m/m, causing this category<br />

to reach 55% of its former peak. Domestic demand in<br />

December also rose sharply, by 21.6%, the first<br />

increase in three months. However, the trend of this<br />

recovery remains weak, so the level as of December<br />

is still only 27% of its former peak, below the bottom<br />

of the recession following the burst IT bubble. Even<br />

though Japan is not saddled with balance sheet<br />

troubles, its domestic demand (demand for capital<br />

investment) remains weak.<br />

Chart 1: Domestic Orders (sa, CY 2005=100)<br />

120<br />

Monthly<br />

110<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

Quarterly<br />

30<br />

20<br />

10<br />

03 04 05 06 07 08 09<br />

Source: JMTBA, <strong>BNP</strong> Paribas<br />

160<br />

140<br />

120<br />

100<br />

Chart 2: Foreign Orders (sa, CY 2005=100)<br />

80<br />

60<br />

40<br />

Monthly<br />

Quarterly<br />

20<br />

03 04 05 06 07 08 09<br />

Source: JMTBA, <strong>BNP</strong> Paribas<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

Chart 3: Asia ex-Japan Orders (sa, CY<br />

2005=100)<br />

Quarterly<br />

Monthly<br />

0<br />

03 04 05 06 07 08 09<br />

Source: JMTBA, <strong>BNP</strong> Paribas<br />

Ryutaro Kono/ Hiroshi Shiraishi 29 January 2010<br />

<strong>Market</strong> Mover<br />

23<br />

www.Global<strong>Market</strong>s.bnpparibas.com