Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

West has consumed future income and is now deleveraging.<br />

This de facto means the West will have to<br />

convert to net exports while China will have to move<br />

in the opposite direction. In the end, re-balancing will<br />

take place and the result of rebalancing will be<br />

deceleration in currency reserve growth.<br />

The implication for currency markets is<br />

straightforward. There will be less USD supply<br />

coming via reserve reallocation.<br />

Road map to sterling weakness<br />

According to our PPP models, sterling is fairly<br />

valued, but this should not lead to the misinterpretation<br />

that the GBP will rally in the medium<br />

term. If at all, sterling has only short-term upside,<br />

with the long-term outlook remaining heavily biased<br />

to the downside.<br />

The BoE will stop QE-related monetary expansion as<br />

its inflation rates have surprised to the upside. This<br />

means that there needs to be an alternative buyer for<br />

the Gilt market. Bear in mind, the GBP 178bln budget<br />

deficit forecast by the government for 2009 has been<br />

entirely funded by the BoE, which has absorbed GBP<br />

198bln in debt securities (mainly Gilts) from the open<br />

market (see Chart 9). This operation allowed yields<br />

to remain comparatively low despite the government<br />

borrowing record amounts. In the absence of the<br />

BoE extending its QE operations, the Gilt market<br />

must attract private funds. We doubt that these<br />

private savings can be secured from domestic<br />

sources. Ahead of the general election, the<br />

government will try to create a feel-good factor. Most<br />

of its support measures are aimed at supporting the<br />

demand side of the economy, including housing.<br />

Hence domestic savings are back in decline and, in<br />

the absence of domestic funds being invested in the<br />

Gilt market, the UK will have to import capital. This<br />

will work in favour of sterling for the next couple of<br />

weeks but will came at a high cost as Gilt yield<br />

differentials rise, moving domestic borrowing costs<br />

up.<br />

After the election there will be the reality check and<br />

that will be brutal. It will be Hobson’s choice: either<br />

cut deficits (which will weaken demand) or face rating<br />

downgrades (which will drive borrowing costs<br />

higher). But higher borrowing costs are obviously the<br />

worst option for an overleveraged economy. After all<br />

those years of exuberant consumer spending on<br />

future income expectations, it is clear that domestic<br />

demand can no longer be the main source of<br />

economic activity. The UK will need to become<br />

supply driven, but the chief thrust of the Brown<br />

government’s economic policy has been to create the<br />

aforementioned feel-good factor. Instead of<br />

promoting the supply side of the British economy,<br />

everything has been done to support private<br />

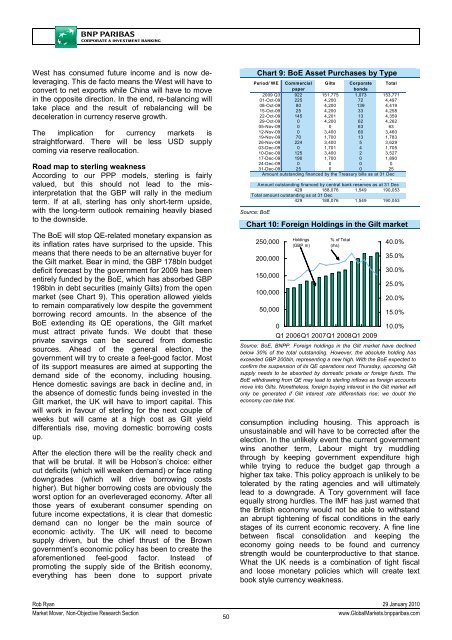

Chart 9: BoE Asset Purchases by Type<br />

Period/ WE Commercial Gilts Corporate Total<br />

paper<br />

bonds<br />

2009 Q3 922 151,775 1,073 153,771<br />

01-Oct-09 225 4,200 72 4,497<br />

08-Oct-09 80 4,200 139 4,419<br />

15-Oct-09 25 4,200 33 4,258<br />

22-Oct-09 145 4,201 13 4,359<br />

29-Oct-09 0 4,200 62 4,262<br />

05-Nov-09 0 0 63 63<br />

12-Nov-09 0 3,400 60 3,460<br />

19-Nov-09 70 1,700 13 1,783<br />

26-Nov-09 224 3,400 5 3,629<br />

03-Dec-09 0 1,701 4 1,705<br />

10-Dec-09 125 3,400 2 3,527<br />

17-Dec-09 190 1,700 0 1,890<br />

24-Dec-09 0 0 0 0<br />

31-Dec-09 25 0 0 25<br />

Amount outstanding financed by the Treasury bills as at 31 Dec<br />

- - - -<br />

Amount outstanding financed by central bank reserves as at 31 Dec<br />

429 188,076 1,549 190,053<br />

Total amount outstanding as at 31 Dec<br />

429 188,076 1,549 190,053<br />

Source: BoE<br />

Chart 10: Foreign Holdings in the Gilt market<br />

250,000<br />

200,000<br />

150,000<br />

100,000<br />

50,000<br />

0<br />

Holdings<br />

(GBP m)<br />

% of Total<br />

(rhs)<br />

40.0%<br />

35.0%<br />

30.0%<br />

25.0%<br />

20.0%<br />

15.0%<br />

10.0%<br />

Q1 2006Q1 2007Q1 2008Q1 2009<br />

Source: BoE, <strong>BNP</strong>P. Foreign holdings in the Gilt market have declined<br />

below 30% of the total outstanding. However, the absolute holding has<br />

exceeded GBP 200bln, representing a new high. With the BoE expected to<br />

confirm the suspension of its QE operations next Thursday, upcoming Gilt<br />

supply needs to be absorbed by domestic private or foreign funds. The<br />

BoE withdrawing from QE may lead to sterling inflows as foreign accounts<br />

move into Gilts. Nonetheless, foreign buying interest in the Gilt market will<br />

only be generated if Gilt interest rate differentials rise; we doubt the<br />

economy can take that.<br />

consumption including housing. This approach is<br />

unsustainable and will have to be corrected after the<br />

election. In the unlikely event the current government<br />

wins another term, Labour might try muddling<br />

through by keeping government expenditure high<br />

while trying to reduce the budget gap through a<br />

higher tax take. This policy approach is unlikely to be<br />

tolerated by the rating agencies and will ultimately<br />

lead to a downgrade. A Tory government will face<br />

equally strong hurdles. The IMF has just warned that<br />

the British economy would not be able to withstand<br />

an abrupt tightening of fiscal conditions in the early<br />

stages of its current economic recovery. A fine line<br />

between fiscal consolidation and keeping the<br />

economy going needs to be found and currency<br />

strength would be counterproductive to that stance.<br />

What the UK needs is a combination of tight fiscal<br />

and loose monetary policies which will create text<br />

book style currency weakness.<br />

Rob Ryan 29 January 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

50<br />

www.Global<strong>Market</strong>s.bnpparibas.com