Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Inflation: BEs Collapsing in Europe<br />

• GLOBAL: Weak but key data looming.<br />

• EUR: Bearish. 2/10y BE Steepener.<br />

• USD: Favour 10y TIPS (BE) into month-end.<br />

• GBP: Further BE curve post UKTi-40.<br />

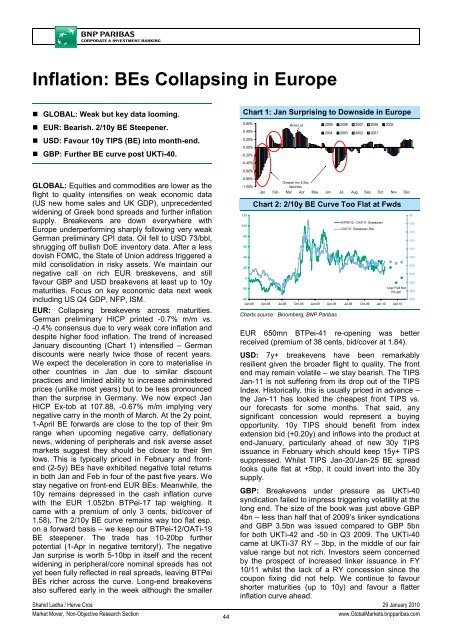

Chart 1: Jan Surprising to Downside in Europe<br />

0.60%<br />

Richen Jul<br />

2009 2008 2007 2006 2005<br />

0.40%<br />

2004 2003 2002 2001<br />

0.20%<br />

0.00%<br />

-0.20%<br />

-0.40%<br />

Cheapen Apr & Sep<br />

GLOBAL: Equities and commodities are lower as the<br />

-1.00%<br />

Maturities<br />

flight to quality intensifies on weak economic data<br />

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec<br />

(US new home sales and UK GDP), unprecedented<br />

Chart 2: 2/10y BE Curve Too Flat at Fwds<br />

widening of Greek bond spreads and further inflation<br />

120<br />

80<br />

supply. Breakevens are down everywhere with<br />

BTPEI12 / OATI17 Breakeven<br />

100<br />

100<br />

OATI17 Breakeven Rhs<br />

Europe underperforming sharply following very weak<br />

120<br />

80<br />

German preliminary CPI data. Oil fell to USD 73/bbl,<br />

140<br />

60<br />

shrugging off bullish DoE inventory data. After a less<br />

160<br />

dovish FOMC, the State of Union address triggered a<br />

40<br />

180<br />

mild consolidation in risky assets. We maintain our<br />

200<br />

20<br />

negative call on rich EUR breakevens, and still<br />

220<br />

0<br />

favour GBP and USD breakevens at least up to 10y<br />

240<br />

-20<br />

1-Apr Fwd Not<br />

maturities. Focus on key economic data next week<br />

Priced! 260<br />

including US Q4 GDP, NFP, ISM.<br />

-40<br />

280<br />

Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10<br />

EUR: Collapsing breakevens across maturities.<br />

German preliminary HICP printed -0.7% m/m vs.<br />

Charts source: Bloomberg, <strong>BNP</strong> Paribas<br />

-0.4% consensus due to very weak core inflation and<br />

despite higher food inflation. The trend of increased<br />

EUR 650mn BTPei-41 re-opening was better<br />

January discounting (Chart 1) intensified – German<br />

received (premium of 38 cents, bid/cover at 1.84).<br />

discounts were nearly twice those of recent years. USD: 7y+ breakevens have been remarkably<br />

We expect the deceleration in core to materialise in resilient given the broader flight to quality. The front<br />

other countries in Jan due to similar discount end may remain volatile – we stay bearish. The TIPS<br />

practices and limited ability to increase administered Jan-11 is not suffering from its drop out of the TIPS<br />

prices (unlike most years) but to be less pronounced Index. Historically, this is usually priced in advance –<br />

than the surprise in Germany. We now expect Jan the Jan-11 has looked the cheapest front TIPS vs.<br />

HICP Ex-tob at 107.88, -0.67% m/m implying very our forecasts for some months. That said, any<br />

negative carry in the month of March. At the 2y point, significant concession would represent a buying<br />

1-April BE forwards are close to the top of their 9m opportunity. 10y TIPS should benefit from index<br />

range when upcoming negative carry, deflationary extension bid (+0.20y) and inflows into the product at<br />

news, widening of peripherals and risk averse asset end-January, particularly ahead of new 30y TIPS<br />

markets suggest they should be closer to their 9m issuance in February which should keep 15y+ TIPS<br />

lows. This is typically priced in February and frontend<br />

suppressed. Whilst TIPS Jan-20/Jan-25 BE spread<br />

(2-5y) BEs have exhibited negative total returns looks quite flat at +5bp, it could invert into the 30y<br />

in both Jan and Feb in four of the past five years. We supply.<br />

stay negative on front-end EUR BEs. Meanwhile, the<br />

10y remains depressed in the cash inflation curve<br />

GBP: Breakevens under pressure as UKTi-40<br />

with the EUR 1.052bn BTPei-17 tap weighing. It<br />

syndication failed to impress triggering volatility at the<br />

came with a premium of only 3 cents, bid/cover of<br />

long end. The size of the book was just above GBP<br />

1.58). The 2/10y BE curve remains way too flat esp. 4bn – less than half that of 2009’s linker syndications<br />

on a forward basis – we keep our BTPei-12/OATi-19<br />

and GBP 3.5bn was issued compared to GBP 5bn<br />

BE steepener. The trade has 10-20bp further<br />

for both UKTi-42 and -50 in Q3 2009. The UKTi-40<br />

potential (1-Apr in negative territory!). The negative<br />

came at UKTi-37 RY – 3bp, in the middle of our fair<br />

Jan surprise is worth 5-10bp in itself and the recent<br />

value range but not rich. Investors seem concerned<br />

widening in peripheral/core nominal spreads has not<br />

by the prospect of increased linker issuance in FY<br />

yet been fully reflected in real spreads, leaving BTPei 10/11 whilst the lack of a RY concession since the<br />

BEs richer across the curve. Long-end breakevens<br />

coupon fixing did not help. We continue to favour<br />

also suffered early in the week although the smaller<br />

shorter maturities (up to 10y) and favour a flatter<br />

inflation curve ahead.<br />

Shahid Ladha / Herve Cros 29 January 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

44<br />

www.Global<strong>Market</strong>s.bnpparibas.com<br />

-0.60%<br />

-0.80%