Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

1.2% m/m in November, partly offsetting an increase<br />

in October. On a 3m/3m basis, sales are now up<br />

0.7%, a deceleration from 1.0% in October and<br />

below the recent peak of 1.8% in July. Manufacturing<br />

production, on the other hand, is on an upward trend.<br />

The 3m/3m rate has risen consistently over the past<br />

five months. In November, production was up 2.3%<br />

from 2.2% in October, well above the trough of<br />

-3.4% in February. In terms of surveys,<br />

manufacturing PMI in December nudged up into<br />

expansion territory, the first time it had been above<br />

50 since July. However, the index was revised down<br />

recently from 50.4 to 47.2, back to signalling<br />

contraction in the sector.<br />

Overall, as economic data since the last policy<br />

meeting have not been stronger than the market and<br />

the Norges Bank were expecting, they should not,<br />

alone, warrant a change in the Norges Bank’s initial<br />

intention to deliver rate hikes gradually. Also, the<br />

import weighted NOK has strengthened somewhat<br />

since the last policy meeting. It was up as much as<br />

2% in mid-January, while on Wednesday it closed<br />

around 0.4% higher than its level in mid-December<br />

(Chart 4).<br />

Lending rates, credit growth and house prices<br />

Since December, there has been survey evidence<br />

that bank lending rates have increased further. In<br />

particular, the country’s biggest lender said in mid-<br />

January that it will raise interest rates on home loans<br />

by 25bp, effective March 10. Given this move comes<br />

from the biggest lender, the smaller lenders are likely<br />

to raise their lending rates accordingly. We believe<br />

this gives a reason to the Norges Bank to pause in<br />

February, as the increase in rates shows that the<br />

policy rate hikes are having an impact.<br />

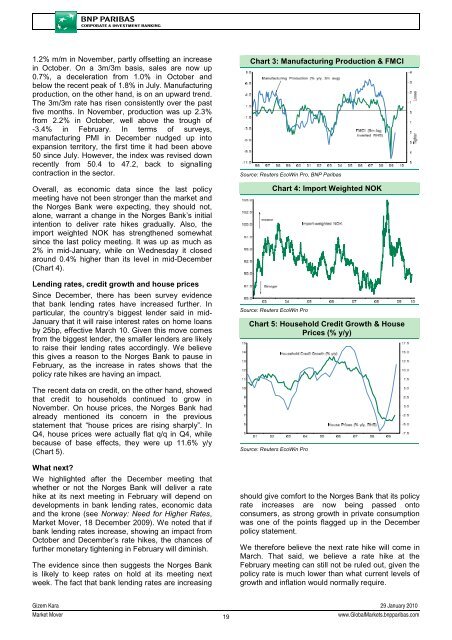

The recent data on credit, on the other hand, showed<br />

that credit to households continued to grow in<br />

November. On house prices, the Norges Bank had<br />

already mentioned its concern in the previous<br />

statement that “house prices are rising sharply”. In<br />

Q4, house prices were actually flat q/q in Q4, while<br />

because of base effects, they were up 11.6% y/y<br />

(Chart 5).<br />

What next?<br />

We highlighted after the December meeting that<br />

whether or not the Norges Bank will deliver a rate<br />

hike at its next meeting in February will depend on<br />

developments in bank lending rates, economic data<br />

and the krone (see Norway: Need for Higher Rates,<br />

<strong>Market</strong> Mover, 18 December 2009). We noted that if<br />

bank lending rates increase, showing an impact from<br />

October and December’s rate hikes, the chances of<br />

further monetary tightening in February will diminish.<br />

The evidence since then suggests the Norges Bank<br />

is likely to keep rates on hold at its meeting next<br />

week. The fact that bank lending rates are increasing<br />

Chart 3: Manufacturing Production & FMCI<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

Chart 4: Import Weighted NOK<br />

Source: Reuters EcoWin Pro<br />

Chart 5: Household Credit Growth & House<br />

Prices (% y/y)<br />

Source: Reuters EcoWin Pro<br />

should give comfort to the Norges Bank that its policy<br />

rate increases are now being passed onto<br />

consumers, as strong growth in private consumption<br />

was one of the points flagged up in the December<br />

policy statement.<br />

We therefore believe the next rate hike will come in<br />

March. That said, we believe a rate hike at the<br />

February meeting can still not be ruled out, given the<br />

policy rate is much lower than what current levels of<br />

growth and inflation would normally require.<br />

Gizem Kara 29 January 2010<br />

<strong>Market</strong> Mover<br />

19<br />

www.Global<strong>Market</strong>s.bnpparibas.com